AI & Expense Efficiency in the Insurance Industry

Join the conversation on LinkedIn

Insurance workflows are notoriously rife with unstructured data, regulatory requirements, complexity, multi-stakeholder collaboration/bottlenecks, and high-stakes decisions. Each of these attributes makes the $1T insurance industry a highly compelling use case for vertical AI. Up to 80% of data used across the industry is unstructured/unorganized, and processing this data takes upwards of 40% of employee time. No surprise then that digital transformation and AI enablement is viewed as a “main driver” of insurance industry value creation and M&A.

The conversation in insurance board rooms is no longer about whether they should invest in AI, but instead about how quickly and to what extent. EY reports that “virtually every large insurer is already investing in, or making plans to invest in, gen AI.” As development and transformation teams kick into action, it is increasingly clear that the prize is quite large for those who can pull it off. More than half of surveyed insurer leaders responded that gen AI deployment could lead to productivity gains of 10-20%, premium growth of up to 3%, and substantial improvement in technical/underwriting results.

There are myriad use cases for automation and AI across the insurance value chain, from increasing the performance of a producing broker to more effectively leveraging underwriting data to reducing loss and leakage in administrative workflows. Outlining prospective use cases (decidedly not the topic of this post!) could easily fill a much larger article or white paper, but it’s instructive to look at where carriers are focusing today. 82% of large insurers point to “productivity gains” as the primary objective of AI initiatives. AI agents and higher efficiency generally can help support insurers and BPOs across administrative and claims teams, where recruiting/retention is most acutely challenging. 95% of carriers are said to be prioritizing back-office and internal use cases first, above client-facing use cases.

The case for prioritizing expense efficiency

The data suggests that the impact of vertical AI to admin expenses can be substantial and strategically valuable.

Expenses are one natural prospective starting point where digital transformation can lead to operating leverage. For insurers, profitability comes down to two key levers: reducing losses (i.e., “bending the risk curve” to realize lower underwriting losses) and controlling expenses. Looking strictly at the expense side of that equation shows significant opportunities for improvement.

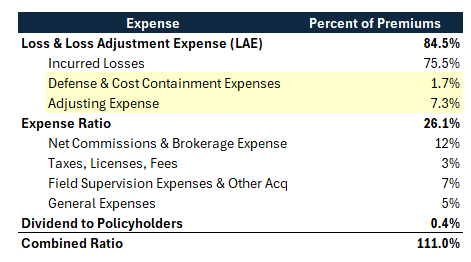

Below we show the breakdown of 2023 homeowners insurance combined ratios as reported by the Insurance Information Institute. Homeowners in that year had a particularly high combined ratio driven mostly by the staggering incurred loss ratios, but if we ignore the massive 111% CR, we can use the various line items in the chart to simplify and explain pathways to increasing carrier profitability.

Carriers typically focus on improving underwriting profitability via better selection and risk management, driving down incurred loss (this refers to the 75% line item in the chart, by far the largest component in the ratio). Alternatively or additionally, carriers can focus on efficiency to drive down their expenses irrespective of underwriting performance. Some of this spend gets categorized as misc operating expenses (e.g., the 26%), including brokerage commissions, licensing, fees, general expenses, etc. Other expenses are associated directly with the cost of administering claims for losses, referred to as Loss Adjustment Expenses (LAE), and highlighted here in yellow. Net of actual incurred losses in this example, the loss-related expenses contribute upwards of 9 percentage points to the combined ratio. In other words: of the high 84.5% total loss-related expense, ~10% of it goes towards operations or services and not to the actual claims payout to an insured. This means that both within claims workflows, and well beyond claims workflows, there is significant operating fat (and therefore leverage for carriers who can optimize their expenses via technology).

If, say, the carrier above leveraged automation to reduce loss adjustment expenses (and *nothing* else) by 25%, that alone would subtract >2 points from their combined ratio! We believe there is a growing opportunity to do exactly this across large claims orgs. Adjusting and claims workflows remain highly manual, despite the documented importance of more/earlier analytics and the clear cost impact of automation. Along with a high degree of outsourcing, multiple stakeholders, and significant regulatory complexity – this points to meaningful applicability for emerging vertical AI solutions that can automate and streamline such processes.

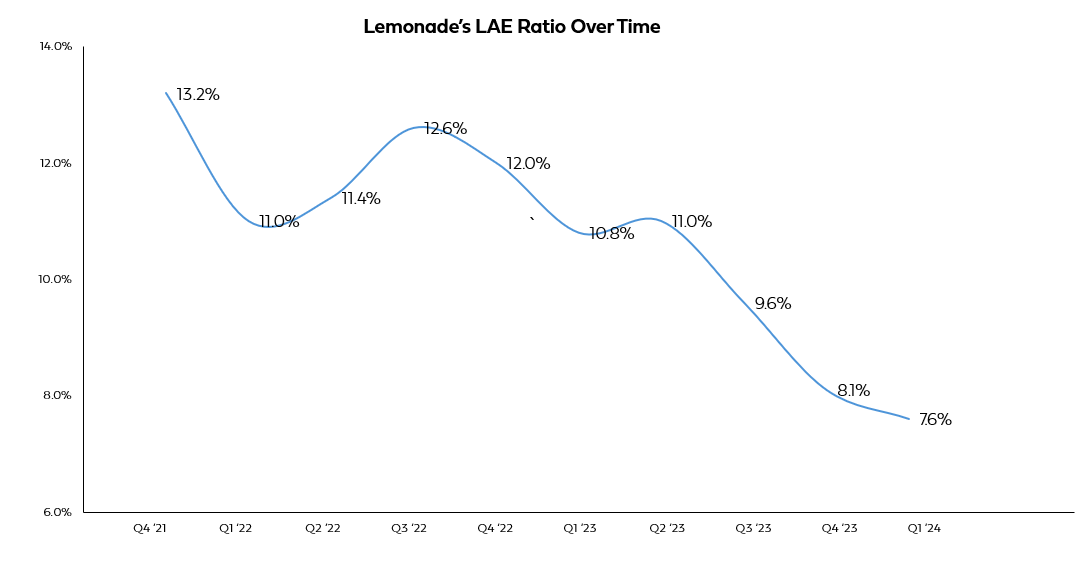

There is growing evidence of real-world successes as well. Take a look, for example, at Lemonade’s LAE stats reported in 2024, which broadly shows the company driving down its claims admin costs via increased automation. Over a period of two years, the company reported that opex (ex-growth spend) remained roughly flat, despite in-force premium increasing by 45%. It is not straightforward to attribute this increasing efficiency across technology, training, scale, etc, though Lemonade specifically said it is the “direct result of our ability to leverage technology, including generative AI…to automate systems and processes…”

Going forward, LAE and claims efficiency is likely to be a priority for carriers that increasingly shapes their technology/AI strategies. However, it is also important to note that claims processes represent only a fraction of the addressable surface area for automation and efficiency. In conversations with prospective insurance industry customers and experts, when we ask about the workflows they are most eager to address within their respective organizations, we’ve heard about dozens of distinct use cases – including managing human-intensive regulatory filings, COIs, compliance requirements, client onboarding, and data enrichment, among many others. In other words: the overall efficiency and automation opportunity extends far beyond claims and TPA spend. In some ways, because claims spend is often disproportionately outsourced, the growing demand to modernize these other internal workflows could be even more interesting for technology and service providers to tackle.

Increasingly, carriers are seeing the criticality of digital transformation to deliver superior efficiency (in claims, and across their orgs more broadly). In their 2025 Global Insurance Report, McKinsey notes that the top-quartile of carriers achieve admin expenses ~2ppts lower than their peers, and also that globally insurers need to eliminate ~$10B in expenses just to get [adjusted] expenses back to their 2018 level before the hard market (after normalizing for inflation and premium growth). Both the outperformance of leading carriers on expenses, as well as the massive scale of administrative expenses that must be cut from the system, highlights how ripe the ecosystem is becoming for vertical AI solutions.

To build or to buy?

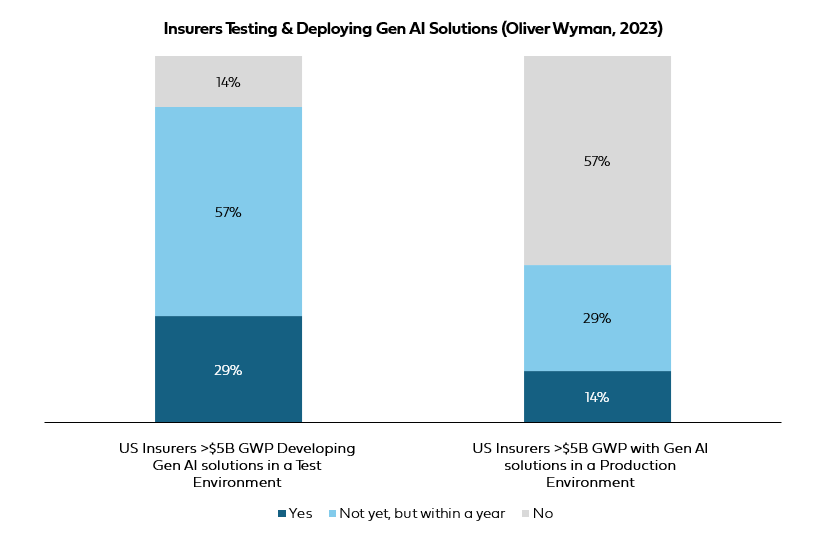

Large carriers today are experimenting with home-grown solutions, but the writing is on the wall that they will have more success with customizable, scalable third-party platforms compared to internal developments. Already, >50% of decision makers surveyed at large carriers cite accuracy/reliability and implementation costs as top barriers to pursuing more/faster GenAI investments. Moreover, there is already a large lag between testing solutions and actually implementing them in production, which speaks to the challenges in AI deployment and the need for specialized software and service providers.

In a 2023 survey conducted by Oliver Wyman, whereas 86% of respondents had already developed Gen AI applications in staging (or planned to by the end of the year), <15% had pushed these solutions to production, and >50% had no plans to do so. Although many carriers will inevitably experiment with AI internally, it is clear that third-party providers are needed to deliver high performing and scalable solutions. The real question then is whether this is the domain for venture-backed vertical AI startups or for leading transformation/implementation consultancies: will it be the best engineers who win, or blue chip firms that know how to navigate large carriers? To date, revenues are pouring into the latter; Accenture has been eating most other firms’ lunch, with a whopping $3B in gen AI related bookings last year. Our view, though, is that best-in-class technical solutions do not have to be mutually exclusive from enterprise reliability. We believe the winning formula here is the player that can provide leading vertical AI innovation alongside the stability of a consulting firm, and we believe that company is overwhelmingly likely to be a new entrant.

At Equal, we’re excited about the potential for vertical AI to reinvent complex insurance workflows. Platforms that support carriers and service providers to more thoughtfully leverage troves of unstructured data have the power to improve operational efficiency and increase profitability. Carriers that can quickly adopt AI and transform their internal processes stand to benefit from material strategic advantages over those that do not. And although enterprise insurance cycles are challenging, leading vertical AI providers that can tap into carrier demand across administrative use cases will be in a position to address tens of billions in recurring revenues.