An Energy Dilemma

Effective rhetoric often follows a three-step process: establish a status quo, destabilize it, and propose a solution to a now-unstable world.

If you've been researching "energy demand" in the past few months, you've likely come across a series of articles from national outlets like the New York Times, Wall Street Journal, and Washington Post discussing the recent surge in energy demand and the expected surge to come. These outlets have picked up on the news because this surge represents one of the most significant disruptions to the status quo of the United States’ energy system since Edison. Notably, however, these articles stop right before offering solutions. That’s not because the journalists at the New York Times don’t know how to round out a good story – they took that rhetoric class, too. So why is it?

1. Status Quo: Energy demand has been flat for nearly two decades even as significant innovation has been made on the supply side of the equation. Solar and wind are forecasted to lead growth in US power generation for the next 2 years. In many ways, it has felt like "energy is abundant.”

2. Destabilization: But an energy storm has been brewing. Booming data centers – and the use of AI – coupled with increased nearshoring of manufacturing have scooped energy demand right off its post-millennial plateau and shot it back into orbit, doubling in the next few years – and those macroeconomic trends show no sign of stalling out.

As an example of the impact of those trends: compared to forecasts from just last year, PJM is now expecting an additional 10,000 MW of demand by 2030. That’s like plopping down a second New York City in the Midwest in 6 years or tripling the size of Chicago. The plain fact of the matter cannot be overstated: this represents a monumental disruption, unprecedented and unpredictable, particularly for regions prone to siting data centers and manufacturing plans. And although it might only take one year to build a data center, it would take another 5 years to connect that center to sufficient renewable energy sources or another 10 to rebuild the requisite transmission lines.

3. Solution: Energy was abundant . . . but now demand is surging, and what once seemed abundant is entirely insufficient – and we’re in the midst of a supposed energy transition. So, what should we do? These articles have helpfully sounded the alarm to a broader audience, but their narrative seems to stop short. Unfortunately, that’s because there isn't one clear-cut solution – only a series of them, a set of parallel paths and aggregations. And the median New York Times reader isn’t looking to dive into the weeds – that’s what this is for:

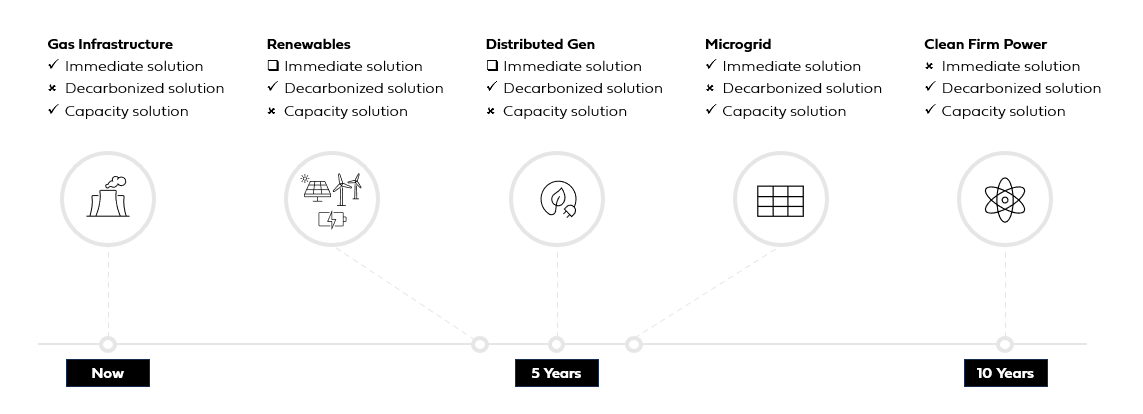

In effect, we're facing an energy dilemma - we need energy now, we need energy that supports a clean energy economy, and we need energy round-the-clock. More precisely, we have to ask ourselves how to meet our energy needs with immediate, decarbonized capacity. Below we explore several potential options, though none are likely to solve the problem alone.

Gas Infrastructure – In light of imminent energy challenges, utility companies are now reconsidering their plans to decommission gas power plants and even starting to explore the development of new infrastructure for gas. With the goal of satisfying energy demand immediately and securing round-the-clock availability, prioritizing gas investments for the next few years is a straightforward approach. While gas is considered a relatively cleaner fossil fuel compared to others, this shift feels like taking a step back – a regression from the tremendous progress made towards renewable energy buildout. Does it effectively address our immediate energy capacity needs? Yes. Investment in gas means leveraging a familiar, mature technology that is known to be a reliable energy source. Does it propel us forward towards a clean energy future? No.

Clean Firm Power – On the opposite side of the tech maturity spectrum, large corporate companies are exploring new frontiers with clean firm power. Google and Microsoft have even established requests for information (RFIs) for nuclear, geothermal, and clean hydrogen sources. While it's exciting that they're pursuing new options, it's difficult to see the viability of these solutions in the short-term, since these models are focused on developing first-of-a-kind projects. From logistical challenges to the slow pace of development, there are plenty of hurdles to clear.

Renewables – Large-scale renewable energy sources have undeniably become an integral part of our energy landscape, with Power Purchase Agreements (PPAs) serving as a familiar tool in facilitating their adoption. However, it's crucial to recognize that many renewables, such as solar and wind, are inherently variable in nature, leading to intermittent energy supply. This intermittency poses a significant challenge, particularly in meeting consistent demand for electricity throughout the day. Without being paired with storage, solar and wind are not able to provide consistent “capacity.” On top of this, renewables also come up against deployment obstacles, specifically interconnection. Unfortunately, fewer than 25% of solar and wind projects successfully get through the interconnection bottleneck.

Distributed Generation – Simultaneously, the grid is becoming remarkably more distributed at the local level. Distributed energy resources are numerous pockets of energy spread throughout the grid - from a distributed generation standpoint, think rooftop solar. In the United States, the DER market is expected to nearly double in capacity by 2027. To put this into context, DER capacity is being added at similar levels to large-scale resources. Opportunistically, this means the ability to unlock larger revenue opportunities if they can “meaningfully” satisfy grid capacity needs. However, there are near-term challenges - especially in coordinating electricity, data, and dollars across these energy silos, allowing these resources to behave in unison.

Microgrid – What else can the grid use? Well, why not choose Option (D) – all of the above. Microgrids are an orchestration of distributed resources, local electricity grids that typically consist of a controller system attached to a variety of assets such as generator, storage, and renewables. A significant advantage of these solutions is that they can effectively bypass interconnection bottlenecks by lowering interconnection requirements. Additionally, since microgrids consist of a portfolio of assets, financing can be fairly simple. Using a Microgrid Service Agreement (MSA), customers pay a flat monthly fee for the microgrid, ensuring they hit a guaranteed minimum. On top of this, microgrid systems can avoid complications with transmitted power. They can generate power on-site or in close proximity to their customers, providing reliable power while eliminating the time and costs associated with interconnection and power delivery. However, to support data center load profiles, a fully renewable microgrid might not be quite viable today. Some elements of fossil fuel mix might be needed to support capacity needs (unless battery sizes increase).

Now why am I writing all this? We have an energy dilemma. There’s a version of the world that is bleak. We focus investments on the short-term and we prioritize gas, or we focus investments too long-term and we are halted by a crisis. Ultimately, this is a call to action for innovation. We need immediate, decarbonized capacity. We need batteries. All energy is equal, but some types of energy are more equal than others. As we push forward a renewable energy agenda, we will need batteries to transform this generation into more valuable capacity. Just in the past few months, storage assets have undergone a remarkable transformation. For some companies, the average size of battery capacity has skyrocketed from 0.5 MW to 300 MW (60,000%) in just a few months. However, batteries / storage come with their own specific challenges, impacting how easily they can be originated and financed – tech risk, operating risk, interconnection risk. Technology advancements are constantly being iterated on, casting a shadow on long-term investment decisions. The inability to reliably guarantee battery performance over extended periods of time can be a barrier. Despite value-stacking, batteries are still in their infancy in how the market monetarily values them.

At Equal, we think batteries will play a big role and that their timeline will be pulled forward dramatically (in turn pulling other energy resources’ timelines forward). With a stronger need for batteries and a stronger payback for batteries, we need innovation that improves how we finance, deploy, and access revenue for these resources.