Energy’s Next Frontier: Knowing Your Customer

Follow the discussion on X.com | Follow the discussion on LinkedIn

Traditionally, energy companies were just in the business of powering homes. They had a set of customers in their region with a relatively defined need for power. Their job was simply to build enough generation to meet customer demand and to deliver it to their customers. Their generation power was largely controllable (firing up power plants), making the process of mapping supply and demand relatively straightforward.

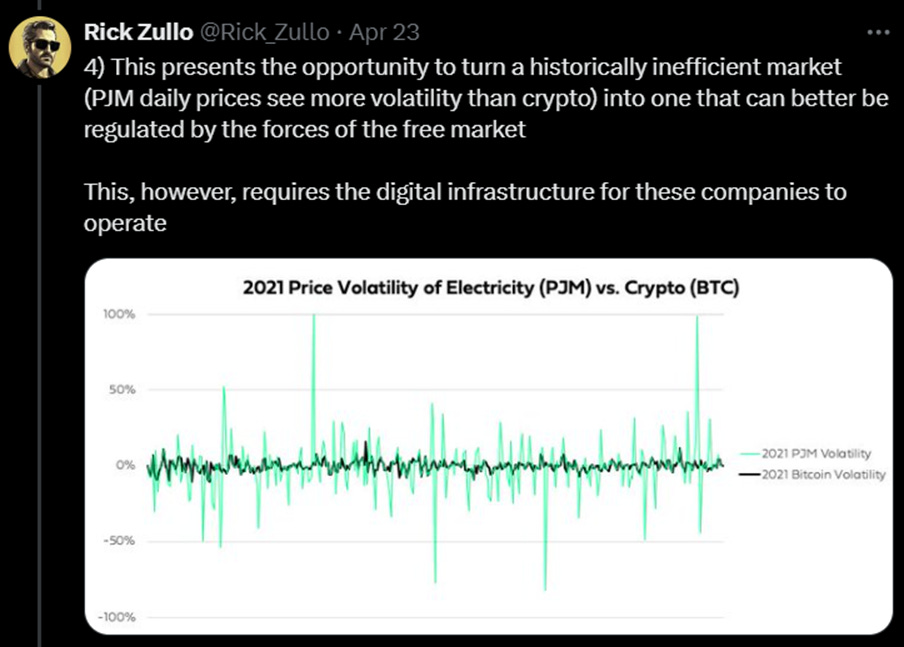

Today, energy companies operate very differently. Markets have been deregulated, creating more choice for the consumer and numerous retailers/suppliers operating within a given market. Simultaneously, demand and supply curves have been complicated with the addition of large-scale renewables (that produce volatile energy supply) and small-scale DERs (that have equally volatile demand given consumption patterns). This has resulted in remarkably volatile energy pricing. On top of this, weather events (another driver of volatility) have catalyzed pricing spikes that have driven both retailers and customers to bankruptcy.

This volatility now requires energy providers to understand their customers in new ways — a capability that wasn’t required for utilities operating with captive customers in a monopolized market. Rick and I started our careers working for electric utilities and the concept of customer intelligence certainly isn’t as mature here as some of the other industries we invest in. We’d frequently see utilities connect multiple Customer Information Systems together (CIS for billing, energy consumption, contact information, etc.), without a unified POV of the customer, their profitability, and/or what would motivate their behaviors. Companies like Opower were early movers in attempting to advance customer connectivity and intelligence; However, 17 years after its founding (and with the resources of Oracle behind it), it only serves 175 of the 3,000 electricity utilities in the US.

As the grid dynamics discussed above become more volatile and energy markets become more competitive, these legacy technology systems simply can't keep up. For energy providers to win in today’s customer landscape, they need to not only attract and retain customers, but to better understand which customers attribute to profitability, rather than weigh down on their earnings.

It’s not just about customer retention

As we speak to many energy providers, there is emerging awareness on the importance of retention and deservedly so. Retail energy has been an incredibly high churn market (as much as 40%), making retention essential to payback their efforts. This leaves energy retailers needing to solve a plethora of operational questions:

Will the customer continue to pay?

Can you get a customer to extend from being a 12-month customer to an 18-month customer?

What’s the minimum amount of interaction needed to avoid customer churn?

The greatest focus, at least for today, is how to avoid “sticker shock” for customers, especially given pricing volatility that poses the risk for both churn and potential payment. Some electricity providers, particularly in Texas, have offered flat monthly prices to prevent customers from bill shock; However, frequency and severity of weather events has largely made that untenable. Take Brazos — a financially robust electric co-op with an A+ credit rating that went bankrupt after Winter Storm Uri. Unfortunately, Brazos received excessively high electricity invoices, totaling $2.1B, to then be passed on to its 1.5M retail customers in a matter of days. And this isn’t just a one time occurrence. Before going bankrupt, Griddy was sued multiple times for charging massive bills to customers. Customers on $10 monthly plans were getting hit with $9k bills. What these occurrences mean is that energy companies need to think about customers differently. It cannot just be about customer retention and mapping customers to payment plans…

It’s about customer profitability

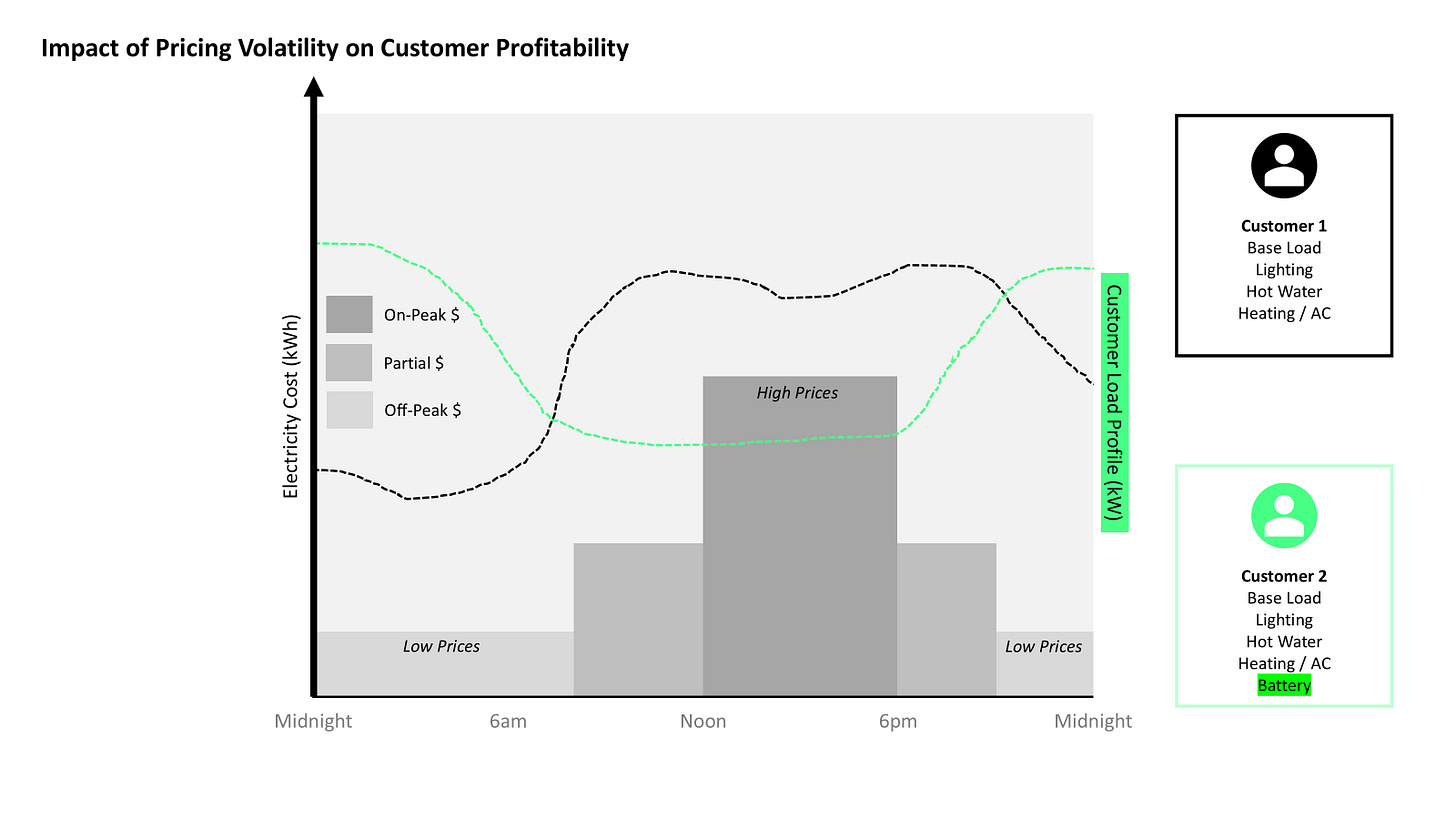

…It needs to be about customer profitability and mapping customers to demand. With different types of DERs added to homes, energy companies should not think of customers as a “one size fits all” category, especially since load curves are becoming more distinctive across residents. This is because the load curve for one customer can be vastly different than another (and align to electricity prices differently), thus greatly impacting their risk and profitability. With this degree of pricing volatility, it’s essential for energy companies to understand how distributed energy resources contribute to their customers' load profiles to not only mitigate pricing spikes but also to create DER programs to incentivize the customer load profiles they need more of.

One of our portfolio companies, Texture, is working with several of these large energy companies on better customer site visibility. What we’ve learned is that some customers (depending on their DER profile) can be up to “200 times more” profitable (mostly through distributed batteries). Rather than thinking about the total breadth of households in their customer base and the length of that relationship like the way providers traditionally have, providers need to think about customer profitability and their LTV with the same mindset that an ecommerce company would think of its customer base.

Is it time for a Veeva for Energy?

Today, the energy industry is surprisingly devoid of tools to help energy companies understand and optimize their customer relationships. If you look at other spaces like healthcare, these industries are already leveraging verticalized CRMs to think about profitability and lifetime customer value. Even the largest CRM providers such as Salesforce have achieved woeful adoption in relation to the total dollars transacted — Salesforce doesn’t even share its energy & utilities breakdown amongst its other industries.

In spite of this, it’s becoming increasingly more clear that the energy industry needs to know their customers and we believe this provides an incredible opportunity for innovation. If you're thinking about energy companies and improving their ability to know their customers — we’d love to chat!