Equal Ventures’ “State of the Economy”

Follow the discussion on LinkedIn and X.com

Last month we presented to our LPAC and shared our “State of the Venture Economy”, alongside the usual general updates that we do for such meetings.

Unsurprising to many that I speak with frequently, I’m pretty concerned about the state of the overall economy and capital markets. Even since last month, we’ve seen fairly unprecedented events (the Japanese bond market…) making me worry further about the state of markets.

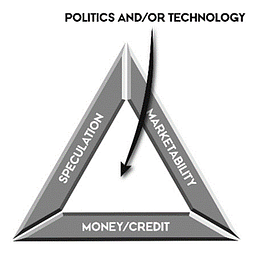

I often return to this graphic from Boom and Bust: A global history of financial bubbles, highlighting the 3 core ingredients for bubbles to exist – speculation, marketability and money/credit. It’s safe to say that AI has incited each of these and as I see the state of the economy, valuations, wealth concentration, leverage and actual execution, it seems that we’re tempting the fate of a pullback yet again.

Amidst this, there are two major dynamics at play – a grossly over-priced seed market and an increasingly concentrated of venture players. I outline in the deck the data supporting these factors, but also some of the practical implications of this that could make life for emerging managers and certain companies very difficult.

My desire is not to be the wet blanket, but to be prepared for the fight ahead. I believe showing restraint when others are “all-in” is a prudent act of risk management to ensure our companies can achieve full maturity and our firm can continue to compound in the years to come. As I wrote about in the Fortune of Failure (initially shared with LPs back in Nov. of 2021 and later published in 2022), I think there is a lot that fund managers and founders can do to build resiliency against market swings like this. Information is the strongest defense mechanism for market volatility and I want to do my best to make sure that everyone is armed with as much information as possible, regardless of whether they choose to utilize it or not.

Plenty of folks have come to different conclusions on the state of the market (including A16Z, which coincidentally released a similar report today that is chalked full of amazing insights) and that’s completely fine. They could be right and I hope they are. The benefit of being a bear in a bull market as a venture capitalist is that when you are wrong, you know that you’ve left money on the table, but ultimately you have done very well. If you are a VC bull as the market turns bearish, however, that’s when things can get dangerous very quickly. For me, I’d personally rather take my risk on partnering with the best companies, rather than the movement of market cycles.

We don’t quite have the research or production team of A16Z, but I’m hopeful you find value in some of the data and insights from our “State of the Venture Economy” report. As always, we welcome feedback and encourage you to engage with us via our posts on Linkedin and Twitter if you can.

With that, please take a look at our full report here.