False Positives of Pedigrees and “Pattern Recognition”

The number #1 job of an early-stage VC is to invest in people. If you get the people part wrong, nothing else can go right. As an investor, it can be terrifying that something that can seem so qualitative represents the lion’s share of influence in investment performance, but it’s the truth. This is what places such a significant premium on repeat founders with demonstrated success and sky high valuations for founders that seemed “de-risked”.

As fundraising processes move faster and faster our industry has oriented to spending less and less time with founders as part of the process. With that, many VCs increasingly look for founder archetypes and signs of external validation, rather than using their own independent judgment. Looking for external validating factors to “de-risk” a founder profile without truly understanding the founder seems fraught with problems.

A few of these problems include:

“Pattern Recognition” = Bias: Firstly, it reinforces bias under the guise of “pattern recognition”. Simply put, the pattern of our industry is deplorable and needs to be broken if we want a more equitable POV of the world. We need to BREAK that pattern, not reinforce it. Pattern recognition is resulting in founders force-fitting themselves to these archetypes (becoming hyper-obsessed with accolades and social media acknowledgement), rather than being the best versions of themselves and focusing on their business. I invest in individuals, not archetypes.

Untangling Luck from Skill: Secondly, it’s extremely difficult to untangle luck from skill for many of these past accolades. Did the individual skate into a prestigious school because their dad was an alumnus/donor or did they work their ass off to put themselves through college on their own dime? Did they play a role in making a company successful or did they happen to just jump on the right rocketship? Are they connected to startup influencers and VCs because they happened to run in the right social circles or because they are objectively talented? If you don’t look under the surface of the individual, you won’t be able to tell whether their success is a byproduct of circumstance or a function of their talent. I invest in talent, not circumstance.

Founder-Market Fit is NOT One Size Fits All: There is no single profile addressable to all startups. Each company requires different skills, experiences and networks. A founder in DevOps can and should have a different profile from one building a company in the trucking space or another in childcare. Founders need earned expertise in the domains of their business. That can come from professional or personal experiences, but it’s imperative to have a true understanding of the user and market dynamics to succeed. Ultimately, there are lots of best practices and skill sets that can be recruited into a company or learned along the way, but you can’t learn empathy for the user without having experienced it for yourself. Personally, I invest in earned > learned.

Kahneman established two systems for making decisions in his book “Thinking, Fast and Slow” (for a quick primer on the book, see here). When forced to make fast decisions (System 1), we tend to make fast judgements based on bias. This is hard-wired into our brains as a fight or flight survival mechanism and is incredibly difficult to unlearn. Given the DEI issues in our industry and the rotation we are experiencing in our industry (from technology development to technology deployment), the biases that we’ve seen from the past NEED to be broken. Perez establishes in her seminal work that as society enters “deployment” phases, we see the surface area of entrepreneurship grow. We see it become more dispersed, more diverse and more equitable. We are seeing that in real-time and it requires a different lens for evaluating founders. We need to reject “pattern recognition” and retrain our minds to evaluate the individual.

As I evaluate founders, I do NOT care about your pedigree, where you went to school, whether you had a killer score on a test or if you are connected to other VCs. I care about YOU.

Below are a few of the things I look for in founders:

Founder-Market Fit: Do you have founder-market fit? What experiences drove you to pursue this? I want to understand what makes you uniquely suited for this business. What experiences gave you unique insights or leverage in the market. Similarly, leading a startup is more than a job, it’s a mission. I want to know what led you to THIS mission over all others.

Grit & Resiliency: What drives you to go the extra mile? Have you experienced failure and come back from it? When you’ve had success, did you pat yourself on the pack or push forward? Understanding how you react in situations like that will tell me more about how you are going to handle yourself amongst the piercing highs and lows of startups. The resilience to handle that isn’t for the faint of heart and requires an immense amount of grit. As they say, “chips on shoulders puts chips in pockets”.

Decision Making Robustness: Similarly, do you make good decisions that drive toward effective results? Do you have a bias toward betting on yourself and your people? Do you have a quality process for consistently making good decisions? Ultimately, a CEO’s job becomes about making LOTS of decisions (effectively AND efficiently) and I want to better understand how you make them to evaluate your process, not just the results.

Gravitational Pull for Talent: Are you a vacuum for highly quality talent? ALL great founders develop gravitational pull for talent. They know how to recruit/evaluate hires and how to get the most out of their people. Startups are talent machines and you aren’t assessing just one person, but rather the future employees that will work with them.

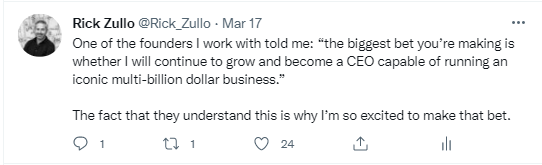

Continuous Self-Improvement: Are you relentless in self-improvement? Is the CEO I see 5 years from now going to be noticeably better than the one I am meeting today? I care less about where you are today and more about that CEO of tomorrow. The best CEOs I meet are self-aware of their capabilities AND their gaps. They hire to fill the areas they can’t address and they work tirelessly to improve others and to develop super powers out of their strengths. They recognize that we are betting on their trajectory more than who they are today, and they focus on continuous self-improvement to become the leader the company will need.

This process takes time. It’s hard to evaluate the nuances of each of these and apply them in a bespoke nature to your business in a single meeting. These are System 2 functions, but this is the most important decision we can make as startup investors. If you’re a founder and I’m taking longer than you hope for in getting to know you, I hope you can appreciate that this is the reason why. Partnering with a founder can be a decade long relationship with thousands of hours of time collectively spent with each other. As part of that process, I want to understand you, not just your resume. Our job is to bet on people. When founders embrace that and view us as partners, it gives us the best chance to not only evaluate their strengths and weaknesses, but to support them in their growth. Nothing is more exciting than that.

*Read this on Medium here

**Read more on Twitter here