Going Global is the Real Frontier for Climate

*Engage with this post on Twitter here

In our 2023 Research POV, we highlighted our focus on “going global” with our climate practice. In this post, we’d like to share more context on what we believe is one of the biggest opportunities in climate tech: the energy transition in emerging markets.

While it may seem hard to believe, we see conditions for climate tech in emerging markets as even more favorable than here in the US. The fact that many of these regions lack centralized grid infrastructure (or have major reliance and intermittency issues) makes decentralized clean energy resources like solar and storage a superior solution in terms of cost, time-to-market and environmental performance. As we dive into the business case for the clean energy transition abroad, we see a welcoming environment for climate tech startups.

Great Economic and Environmental Business Case Abroad

As we examine the cost structure of energy in these markets, many run on intermittent power supplanted by diesel fuel sources that are both extremely expensive AND hazardous to the environment. These nations lack the supply of coal and/or nuclear baseload power we have in the US, making the cost of non-distributed energy significantly higher (given the need to build transmission AND generation infrastructure). Sub-Saharan Africa, for example, spends more on fuel for diesel generators than on grid infrastructure. In these countries, solar + storage systems are largely displacing fossil fuel sources with an inferior cost profile, regardless of the environmental implications - especially for those who need to import oil from other countries. As we look at the economic replacement cost of an incremental MWh of solar capacity in emerging markets in comparison to the full lifecycle total cost of ownership (TCO) for fossil-based methods, solar is significantly cheaper. When we compare this to the US (where cheap sources of energy like coal, nuclear, hydro, natural gas and renewables are widely available and centralized grid infrastructure enables the economies of scale of large scale generation), the business case is not as stark. Despite the immense progress we have seen in clean energy cost curves and adoption in the US, the business case is simply better in emerging markets.

Levelized Cost of Electricity in Africa, 2020-2030

There are further unaddressed practicalities of the centralized vs. decentralized infrastructure dynamic between these two markets. Many industrialized countries like the US already have centralized grid transmission and distribution infrastructure. That’s an inherent sunk cost advantage to centralized baseload solutions like coal and nuclear. In all likelihood, that infrastructure could never be developed today in emerging markets (and if it could, it would be significantly more expensive). These tracks haven’t been laid and it’s uncertain whether they can be given the risk of displacing local people, the environmental considerations impacting land and the red tape associated with attempting these projects, let alone the credit risk of these nations and risk of shifting geopolitical influences. This creates an added layer of complexity, making the cost and risk of centralized grid solutions extremely high in these markets. 800M people still don’t have access to electricity because baseload resources haven’t been able to fill that gap. These economies need power today and any large scale infrastructure project would take decades to put in place with little certainty of accomplishing its end goal. And for those who believe nuclear presents the cure-all to our clean energy woes, we would urge you to consider the complications of expanding the number of countries (currently 32) that have nuclear capabilities and the surrounding political and defense concerns around that. As we look to emerging markets, it’s not just the most economical source of power, but it's the most practical. Leapfrogging the grid isn’t an option, it is the only option.

Lastly, as we look at this from an impact perspective, we are pursuing incredibly expensive environmental mitigation methods here in the US, such as direct air capture and sequestration, whereas we can achieve a comparable impact of our objectives abroad at half the cost. Reducing unfiltered fossil fuel generation and/or deforestation (which is often a victim of the local need for low cost sources of fuel) would have far greater impact at far lower cost. If we want to impact our environment with the greatest speed and force, emerging markets are where we need to focus.

As we examine the opportunity set for the clean energy transition in emerging markets, its economic and environmental business case is as strong as any developed market. Even better, the capacity for that opportunity set is far larger.

Going Global, Better AND Bigger

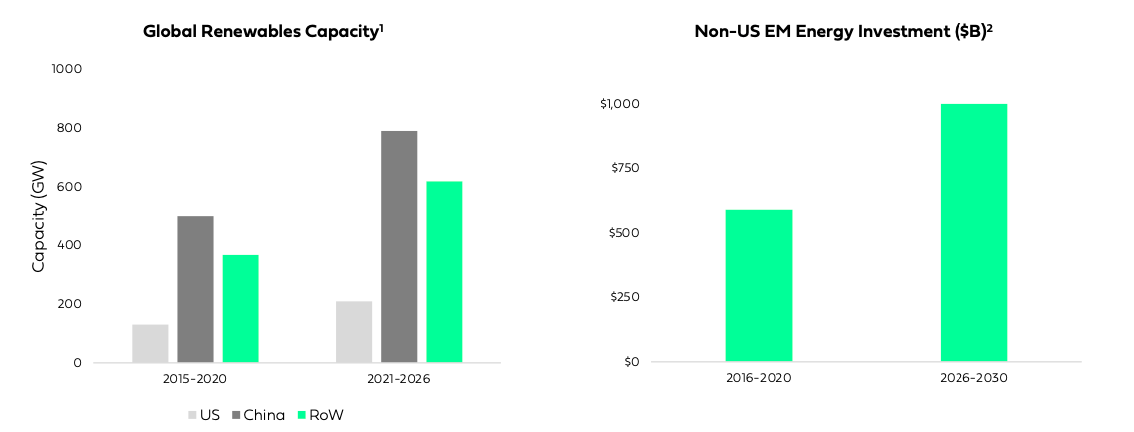

Between the superior project profiles and boundless economic potential, we see a tremendous opportunity for the clean energy transition in emerging markets. Demand for power in emerging markets is expected to grow 3x faster than in the US. Given the economics and environmental implications cited, experts see renewables capacity increasing at a far greater rate than other sources, with emerging markets’ capacity developed in the next 10 years projected to be almost 6-7x that of the US. The WEF expects over $1T of investment into emerging markets by 2030 to fund these projects.

Nations in these markets are joining forces to pool funding for renewables projects as a dedicated pact for a clean energy future, whereas we are still fighting clean energy progress at home despite superior resources. We’re seeing these coalitions pop up across all markets, from Africa with the African Renewable Energy Initiative, to Southeast Asia and the Association of Southeast Asian Nations’ 5-Year Plan of Action for Energy Cooperation and LatAm with the governments of Uruguay, Mexico and Colombia. Even the American government is taking part – President Biden pledged $11B towards international climate finance by 2024, USAID pledged $150B towards climate finance by 2030 and OPIC has committed and deployed hundreds of millions of dollars into renewables projects since its inception. These resources are incredibly helpful, but ensuring the supply of capital is sufficient enough to meet the scope of this opportunity will prove to be the pivotal test.

Bridging the Divide to Leapfrog Grid 1.0

As some folks know, before I was a tech investor, I worked in the clean energy sector for the first half of my career. What fewer know is that I spent the last 2 years of my career at Deloitte, working in its Emerging Markets group (focused particularly on Energy and Infrastructure). I could see the leapfrogging taking place as we worked on micro-grids more than a decade ago, something that hasn’t entered the western narrative until very recently. We’re seeing the early data points of this progress in larger, more developed markets like India, where renewables represent 42.5% of its grid capacity, compared to only 20% for the US. The economics of these projects have only gotten better, the capital more available and the developers more sophisticated.

Where these markets have lagged is in digital technology and access to capital. Having seen this opportunity unfold over the last 15 years, the economic gains possible through better digital solutions, better access to information and better access to working capital seem to be simply tremendous. As we seek to “bridge the divide,” our hope is that we bring the capabilities that we have in the developed world (digital solutions, innovative business models and robust capital markets) to the rest of the world, where these capabilities can have an even greater impact than they can on our home turf.

We’ve seen this firsthand through our investment in Odyssey Energy Solutions, a platform for distributed renewable energy developers and investors in emerging markets. Despite the perceived “risk” of these projects, emerging markets renewables projects see IRRs that are, on average, 33.5% higher than traditional infrastructure projects in advanced economies. By providing a freemium SaaS solution to clean energy developers, Odyssey has amassed thousands of customers representing billions of dollars in projects. By putting all stakeholders (developers, financiers and suppliers) on a single system, the company vastly accelerates the development of projects, improves risk alignment and financial integrity and compresses cost structures to enhance project economics - all without costing local stakeholders in emerging markets a dime.

At Equal Ventures, we believe the clean energy transition in emerging markets will leapfrog the legacy grid, creating an incredible opportunity for climate tech companies. Finding ways to unify and align incentives of historically at-odds stakeholders across the public and private sectors will be critical and we see digital solutions as an incredible way to achieve this goal (as Odyssey is doing). We believe there is immense need for digital solutions to accelerate this leapfrogging by creating more transparency in information flow across developers, investors (concessionary and commercial) and projects so capital can be more efficiently allocated. If you are building or investing in the emerging markets energy transition, please reach out to us!

Terrific post, thank you for writing it! Couldn’t agree more. Just shared it on LinkedIn.