Inflation Sparks the Off-Price Boom

The $300B+ off-price retail sector is rapidly transforming as it sheds old associations with bargain bins, outdated styles, and low-quality / damaged goods. Once seen as the last resort for picked-through, leftover inventory and liquidation prices at the expense of quality, today’s top off-price players are ushering in a new era of premium off-price shopping aided by challenged market dynamics. As record high credit card debt and looming concerns of stagflation continue to pressure the consumer and brands and retailers continue to grapple with excess inventory, off-price is emerging as the obvious answer for brands eager to offload unwanted inventory and cash-tight consumers looking for a great deal.

A Tale of Two Households

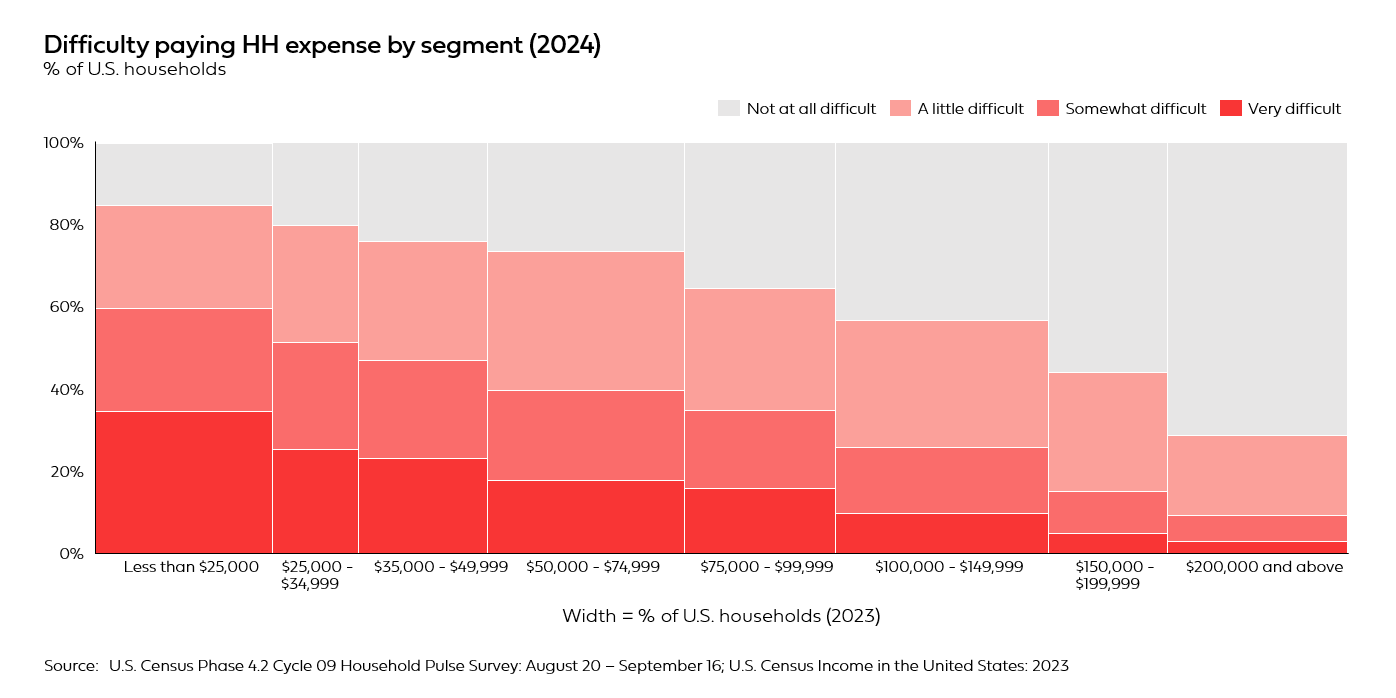

Despite the normalization from the historic highs of 2022, inflationary concerns continue to affect consumer spending and sentiments across all income levels and are particularly acute for low-income households. Per Census data, more than a third of households with annual incomes less than $100k still found it very difficult or somewhat difficult to pay for basic household expenses, with the percentage feeling under pressure hitting almost 60% for the lowest income households.

From the Minneapolis Federal Reserve, lower income households have “less flexibility to adjust their spending as prices rise… they are probably already buying low-cost brands.” While dollar stores historically have been buoyed by inflation, low income households are so under pressure that prominent chains like Family Tree and Dollar General are being decimated (DLTR and DG are down 56% and 47% YTD respectively).

At the other end of the spectrum, full-price luxury was also a bloodbath this year - HSBC analysts revised sector outlook to 2.8% growth for 2024, down from a previous forecast of 5.5% in a report called Cruel Summer. Aside from the slowdown in Chinese demand, “American consumers and particularly aspirational ones, ‘seemed to be priced out or at least impacted by inflationary pressures and a high interest rate environment’” per FashionDive. Japan was the only luxury market that remained strong, boosted by tourism, particularly from Americans leveraging the weak yen arbitrage to save hundreds, sometimes thousands, of dollars on luxury products. These consumers are not exiting the market, but rather are trading down to focus on “value” consumption. The signal is clear - though the high income consumer is tightening their belts, they’re still willing to spend! They will open their wallets if the value is there.

This dynamic is reflected in the broader market. Walmart’s Every Day Low Prices strategy and Costco’s premium Kirkland Signature private label strategy are both significantly outperforming Target. In response, the ‘cheap chic’ retailer greatly expanded its private label portfolio and cut prices this summer to stem “the growing issue of value” per GlobalData. Though TJ Maxx and Target both target a higher income HH than Walmart, TJ Maxx’s proposition is resonating more strongly as the wealthy consumer looks to trade down and the stock is soaring. Costco actually has the richest average consumer with a reported $128k in HH income per year but their customers are (literally) buying what they’re selling - premium, high quality private label bulk products at a great (but definitely not the cheapest) price.

The Consumer Pendulum Swings Toward Off-Price

The rising importance of value for consumers coupled with brands’ ubiquitous need to liquidate products is driving a premiumization of the off-price channel. Today’s off-price sector features a range of high-end brands trickling into retailers like TJ Maxx, where you can find everything from Glossier beauty products to designer pieces priced at ~$300+. At an AOV of ~$98, TJ Maxx is optimizing for “aspiration,” not “access.” This creates a win-win-win scenario for the brand to recover MSRP, TJ Maxx to increase AOV, and the consumer to aspire to purchasing a higher quality brand at a more approachable price point. Premium outlet stores are also booming, with some brands making the majority of their revenue through these channels. High end sample sales hosted by companies like 260SampleSale are integrating off-price shopping with a deal-frenzied, like minded local community, creating an engaging and scarce environment that fosters consumer excitement. Consumer perception of off-price channels is shifting, particularly among the younger generation - per an ICSC study, 48% of U.S. Gen Z consumers say they most frequently shop at off-price and discount retailers.

This new off-price environment shows no signs of slowing down. At Equal Ventures, we believe the future of retail lies in these next-generation off-price platforms to create value for consumers and brands alike and we’re incredibly excited about companies that are seeking to redefine what off-price retail can be. Off-price is no longer taboo — it’s the future of premium retail. If you are building in this segment, please don’t hesitate to reach out to sophia@equal.vc & chelsea@equal.vc!