Insurance Capacity & Innovation

The convergence of specialty insurance and non-traditional reinsurance capital

Follow the conversation on LinkedIn

Alternative capital in reinsurance reached $121B in the year ended June 2025, a record high, and roughly 60% higher compared to a decade earlier. Reinsurance industry ROE was north of 14% last year (and higher in 2023), and for institutional investors, reinsurance can provide attractive, uncorrelated returns. Today, non-traditional capital (i.e., from outside the reinsurance industry) constitutes roughly 15% of total reinsurance capital.

This is good news for a host of reasons. More capital, from a broader base of diversified sources, helps to improve the availability and affordability of reinsurance. It also reduces volatility and capacity crunches – for example, McKinsey reported that spikes in reinsurance pricing after catastrophe events have generally become less severe as alternative capital’s share of the total reinsurance capital increased over the past two decades. Growth in alternative reinsurance capital therefore directly impacts the price and availability of P&C coverage.

The influx of alternative capital also supports innovation across the insurance value chain. Newer investors seeking high returns may be particularly drawn to non-traditional and tech-enabled approaches across specialty insurance, areas startups are increasingly gravitating towards. More capital begets more underwriting and product innovation, which can boost profitability, and in turn drive more capital and capacity into the industry.

We wrote about growth in (and our interest in) the specialty insurance space in our recent post introducing Bluefields to the Equal portfolio. Insurable risks are trending more complex, forcing underwriters to adapt how they evaluate and manage risks to construct profitable programs. You don’t need to look far beyond major news headlines to see examples of the many catalysts for specialty underwriting: climate change and worsening natural catastrophes; more risk accumulation in high-risk areas; volatile inflation data; social inflation and a trend toward “nuclear” verdicts in some casualty lines…the list goes on. A decade of insurtech innovation enables new approaches that can dramatically improve profitability, and accelerating AI adoption is only increasing that impact.

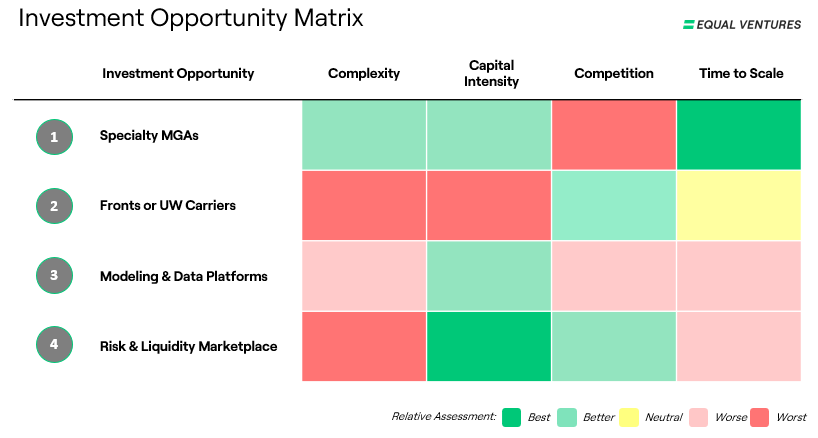

Both traditional reinsurers and non-traditional investors are pushing capacity towards these new approaches, creating opportunities for early stage companies. We outlined some of the various approaches founders may take at the intersection of non-traditional capacity and specialty insurance, and evaluated them across a high-level matrix of investment considerations. The goal is not to recommend any specific approach, but instead to highlight some of the pros and cons of each for those exploring this space.

Probably the most pure-play way to build in this category is to launch a specialty MGA. US MGA premiums more than doubled over the past five years. The rapid growth has been funded in part by fronts, captives, and other structures that provide capacity for novel underwriters. Because of their popularity in the market, there is a playbook for launching MGAs that has evolved (and improved) significantly with more technology and a more robust ecosystem. Companies like Stand in Equal’s portfolio demonstrate that AI-assisted underwriting and risk management can get to market efficiently and take share rapidly.

Another approach is to start at a different spot in the value chain, and instead build a front or underwriting carrier that backs new underwriters and programs. This approach might quickly scale across multiple different types of insurance products, compared to the more focused approach of a single MGA. There are fewer venture-backed companies taking this approach relative to starting MGAs, but it likely requires substantially more complexity and capital to get it started.

Data and modeling platforms that support new underwriting approaches are important for all stakeholders in the alternative capital ecosystem. Better use of data supports the launch of more profitable programs, and in turn makes it easier for alternative investors to deploy more capital into reinsurance. The downside is that enterprise sales cycles and network effects can take a long time to materialize.

The final approach we included is a platform or marketplace that better matches non-traditional capital with underwriting opportunities. This approach may match investors, or may even directly participate as a buyer/seller. Greater liquidity in reinsurance would drive even more alternative capital into the space, and it supports increased visibility, transparency, and efficiency. The flipside of course is that it’s very challenging to do this more effectively than reinsurance brokers, especially when many of the largest reinsurers still value discretion. This category of innovation is therefore complex and would likely take a long time to scale.

The approaches outlined above are definitely not exhaustive, and are not even mutually exclusive, since they largely complement each other. They demonstrate a range of solutions and opportunities that are supported by (and in turn also support) the growing availability of alternative capital. If, like us, you believe more tech-enabled specialty insurance will drive even more non-traditional capital into the industry, you might expect to continue seeing new businesses emerge across each of these archetypes, as well as others. If you’re building in this space, or interested to discuss further, we’d love to hear from you – reach out to adam@equal.vc.