Investing in Insurance Today

Our perspective on the insurance sector

*Join this discussion on Twitter

Insurtech generally remains out of favor for many venture investors today, and I’m often asked about whether I continue to be excited about the sector (spoiler: yes).

Equal’s Product Owners recently conducted overviews of the current investment landscape in our respective focus areas. Today, we’re sharing our perspective on the insurance sector — linked here via Docsend. We encourage you to review the deck and let us know your thoughts!

Below is a quick TL:DR of the key stats and takeaways you’ll find inside.

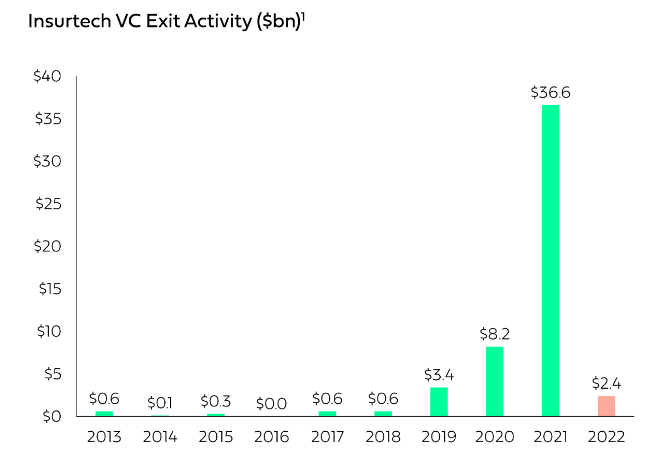

We witnessed a classic hype cycle: Insurtech investments surged over the past decade from a very low base, but then multiples collapsed and liquidity dried up. There is definitely lots of pain felt by VC investors, and many have given up on the sector. It’s not altogether different from broader growth/fintech, but sentiment is negative and early-stage investors remain cautious on insurance.

The disruption hypothesis is history: We’ve said this before, and by now the market is acutely aware that it’s not so easy to disrupt legacy insurers — check out the great recent piece on this topic from WSJ, for example. Product innovation led to major UX improvements and legitimately made it easier for consumers to purchase in new channels and with greater transparency (which is excellent, and a long-term catalyst for more innovation). But an insurance company should have the capacity to make money, not just product. Loss-making UW books and high CAC was value destructive for this first generation of challengers.

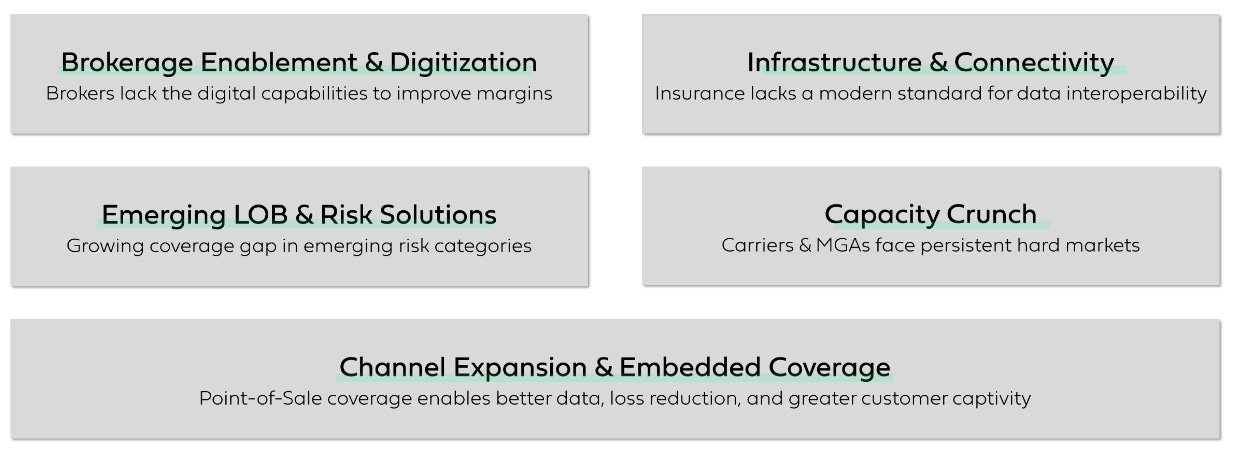

Digital Leverage creates value: If loss-making “disruption” is out of favor, digital transformation is alive and well. Tech-enabled ecosystem enablers still have a long runway to create value in the $1T+ insurance sector. Relatively new entrants that aligned stakeholders in the fragmented distribution space (e.g., Acrisure, Ryan Specialty) have quietly created tens of billions in value over the past decade. These platforms are way less sexy than the product-focused tech challengers, but also much more profitable. Meanwhile, there’s increasing evidence that legacy insurers are accelerating their push to obtain digital capabilities. Carriers and distributors weren’t disrupted by the first wave of insurtech, but they are hungry for tech leverage nonetheless.

At Equal, we’re excited about insurance today — embedded and hybrid channels are evolving; digitization and interoperability are increasingly top of mind; and better customer data helps to address challenges in emerging/challenging lines of business. I’m biased on this subject — but the confluence of strong secular trends and negative investor sentiment points to meaningful opportunities for those who still have conviction in the sector.

If you’re building something new along the themes discussed in the deck, or want to chat more about the state of insurance investing today, please reach out!