Licensed To Scale

Follow the conversation on LinkedIn

Walk into Target and pick up a New York Yankees hoodie or a Pokémon lunchbox. Chances are, the brand on the label didn’t make it, ship it, or even sell it to the store. Somewhere far from that shelf, an intellectual property owner signed a licensing deal, quietly turning their name into a high-margin product without ever touching the supply chain.

Licensing is one of the few growth levers that can compound in chaos. When supply chains tighten and customer acquisition costs spike, it accelerates. A well-crafted contract can launch a brand into new categories, geographies, and channels without the capital risk of owning factories, hiring new teams, or guessing at consumer demand. At its best, licensing is controlled expansion in a turbulent economy: faster velocity, lower capex, and delivering products people already want.

MARKET OPPORTUNITY

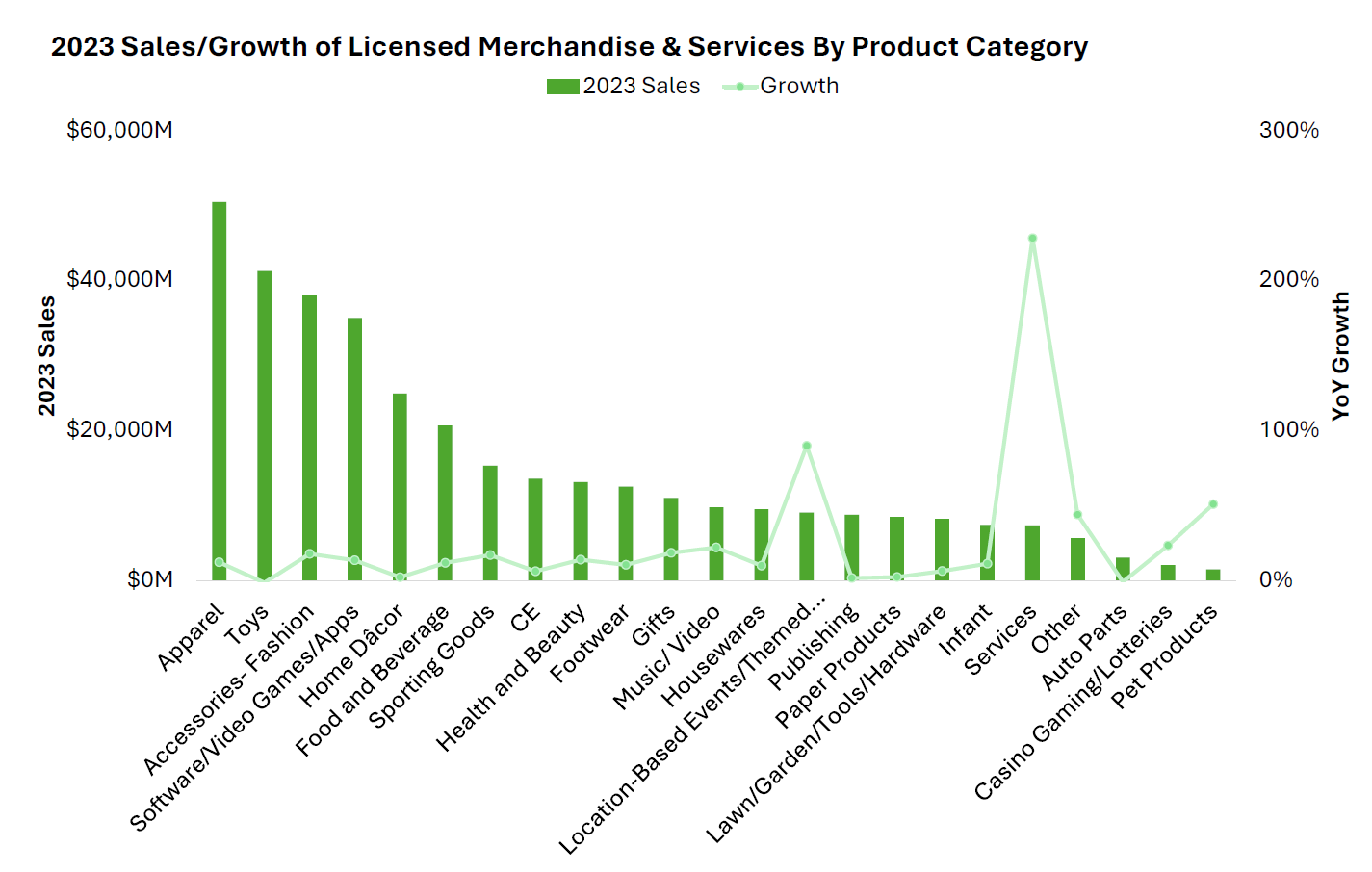

Global sales of licensed goods reached $369.6 billion in 2024. The United States and Canada dominate with roughly 60% of spend, but EMEA and APAC are steadily climbing with ~6% and ~7% market growth respectively. Entertainment still rules the property charts with $149.8 billion in revenue at a 5% growth rate, but corporate and brand licensing (think Authentic Brands Group or Nike) are in second place. And beyond apparel and toys, the fastest-growing segments are services and location-based experiences, according to the “Licensing International 2024 Global Licensing Industry Study.”

LICENSING 101

For the brand owner (the licensor), this is the ability to scale influence without scaling infrastructure. High-margin, recurring royalties roll in without inventory headaches, while cultural relevance extends into places the brand could never have reached on its own over the same time period. For the operator (the licensee), it’s about borrowing trust. A familiar logo can unlock instant shelf space, win over buyers, and move products at a velocity that outmatches private label offerings. When it works, both sides win together: stronger IP attracts better licensees, better licensees deliver stronger results, so on and so forth.

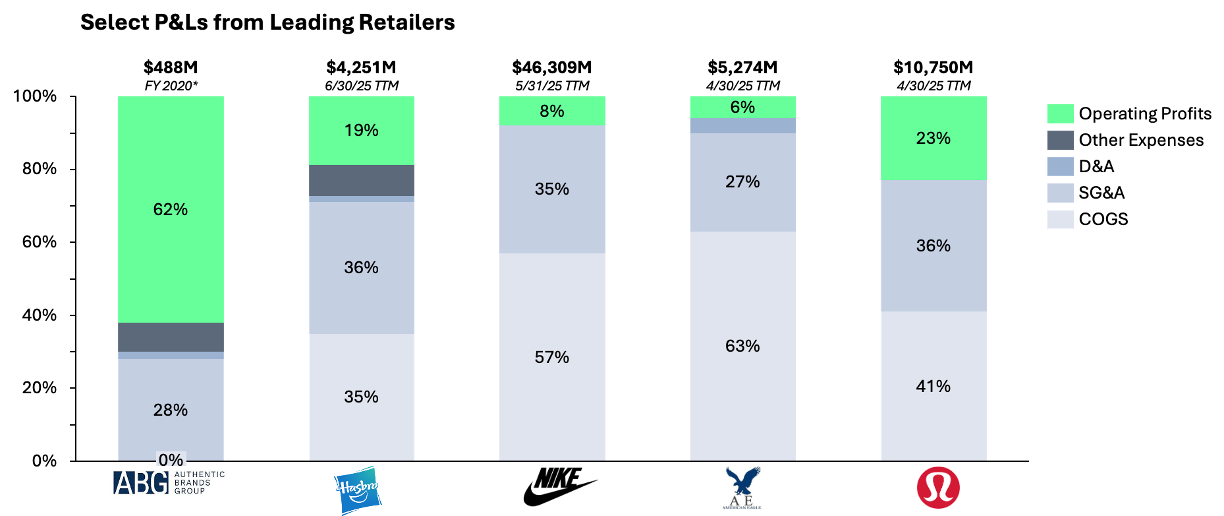

Take a product that sells for $100 at retail. Roughly half goes to the retailer before anyone else gets paid. The licensee’s $50 wholesale shrinks to $25 after cost of goods. A 10% royalty takes $5 off the top, the agent who brokered the deal claims about $1.50 of the $5 royalty, and retail fees or co-op marketing pull another $2. What’s left for the licensee (after addtl. overhead) is roughly $11 to $13. For the licensor, though, that $5 royalty is almost pure profit.

The chart below showcases the same story. Licensors like Authentic Brands Group carry almost no COGS and post operating margins near 60% in this sample. Brand owners and retailers such as Hasbro, Nike, American Eagle, and Lululemon absorb 41 to 63% COGS and 27 to 36% SG&A, which pulls operating margins into the single digits or low twenties. The profit pool sits with the licensor; the licensee wins only with volume and tight execution.

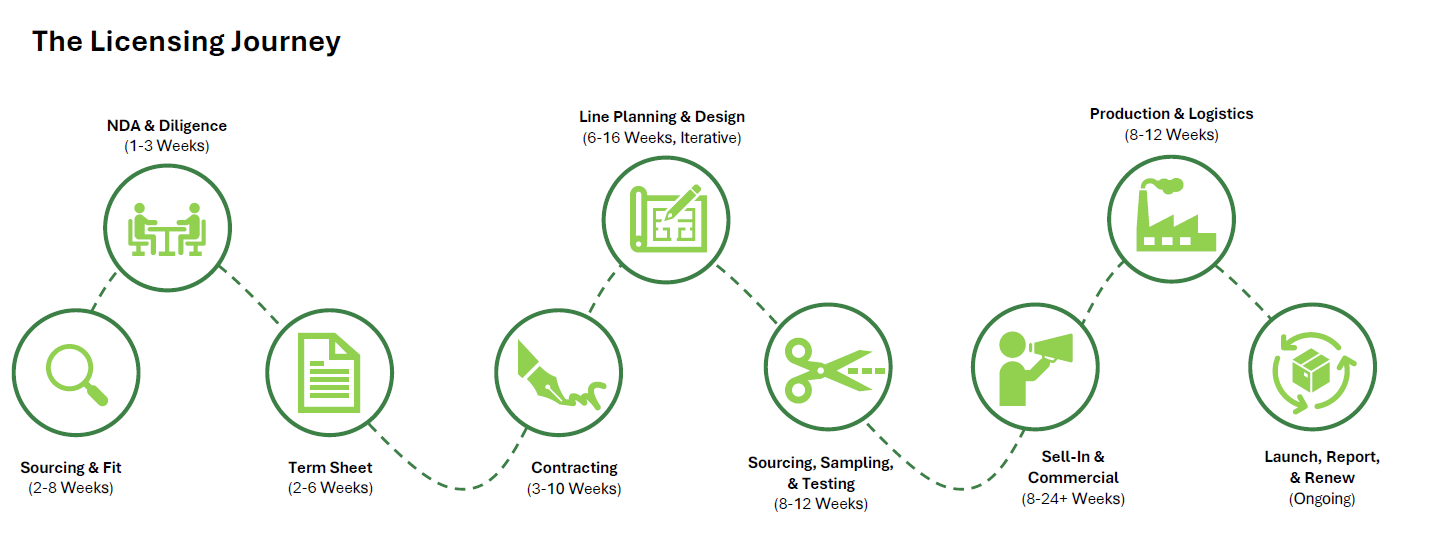

Those take rates sit atop a long, often fragile process that is less assembly line and more obstacle course. Friction is present at all stops. A licensing deal can take anywhere from six months to two years from the first handshake to product on shelf. In that time, a dozen different choke points can kill momentum as the process can touch 10+ different organizations and dozens of people across disciplines.

OPPORTUNITY ZONES

From the outside looking in, licensing appears to the untrained eye as sign the contract, collect royalty checks, and watch the brand multiply on shelves. Inside, incredible licensing operators understand the fragility and treat the process like air traffic control: managing people, priorities, and timing with precision and care. Success depends on anticipating where things will stall and building in contingencies before they do, because most bottlenecks are solvable. They require tools, processes, and operators who can align all sides around speed and clarity. The next era of licensing will belong to those who can compress timelines, reduce friction, and create visibility across the entire value chain. That means opportunities across three critical areas:

Faster Matchmaking

The process of pairing the right IP with the right manufacturer or retail partner is still slow, opaque, and relationship bound.

Streamlining discovery, especially for emerging IP like mid-tier creators, niche media brands, and fast-moving cultural properties, can unlock products that hit shelves while the moment still matters.

Connected Infrastructure

Licensing still runs on PDFs, email threads, and siloed networks.

There is still white space for platforms that unify deal negotiation, compliance, approvals, and reporting into a single shared workflow.

Compressing timelines and unifying stakeholder management can become a competitive advantage.

Financial Clarity

Royalty tracking, contract compliance, and payment reconciliation are still riddled with leakage and delay.

Modernizing how money moves through the value chain, and making it visible in real time, could free up capital, reduce disputes and build trust across stakeholders.

If you’re building something to make that possible, we want to hear from you. Please reach out to sophia@equal.vc or chelsea@equal.vc!