Navigating the Energy Transition Amidst Russia's Invasion of Ukraine

At Equal, we’ve published our thoughts on different facets of the energy transition, from business-in-a-box solutions for clean energy developers to the importance of unified data solutions. We believe in the power of a prepared mind, and understanding how the energy markets respond to the crisis in Ukraine is no different.

As one of the largest producers/exporters of oil, Russia is the backbone of energy for numerous countries around the world. 40% of Europe’s natural gas and 27% of their oil come from Russia. This impacts the US as well — Russia is our third-largest supplier of oil. The closure of key nuclear plants further disturbs existing energy infrastructure, increasing the need for new power sources. With NATO members continuing to sanction Russia and put energy security at risk for hundreds of millions of people, conditions in energy markets could become increasingly uncertain.

Many believe this uncertainty will accelerate the energy transition, pushing countries to prioritize new energy technologies as a means to bolster energy independence and deflate the economic influence of countries like Russia that are rich in fossil fuel natural resources. We believe that energy independence and security are critical for equality and national security, however, recognize that geopolitical conflict could have the potential to present challenges to the energy transition. We think it’s important for founders and investors to recognize these obstacles, so we’ve laid out our thoughts below.

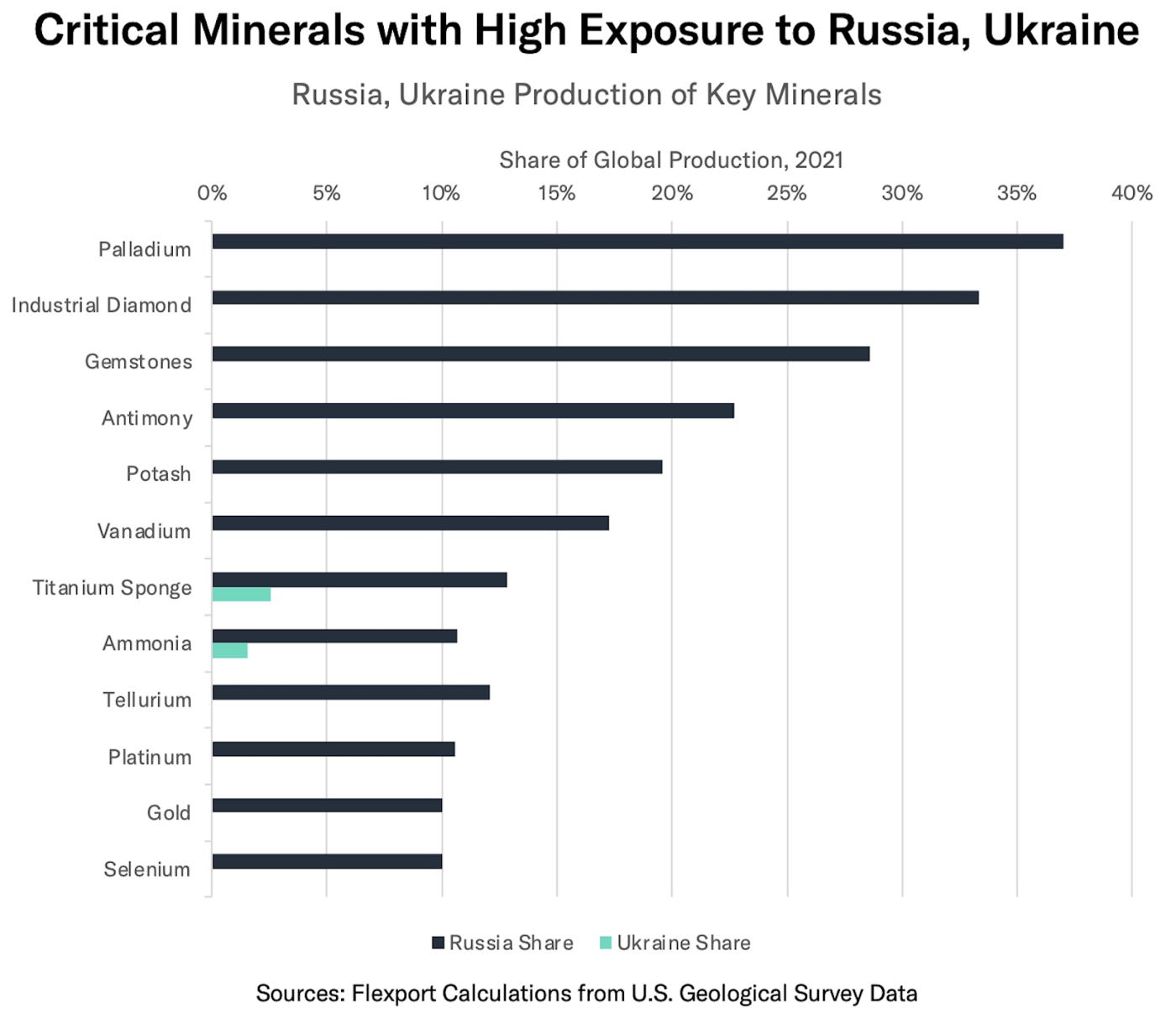

Rare earth materials required for batteries may become harder to find

To date, discourse on the energy transition has been predicated on supply chains operating relatively smoothly outside of Covid’s impact, but the crisis in Ukraine is going to place additional strain on a fragile system. Russia is a major exporter of minerals critical to renewables manufacturing, like nickel, lithium and palladium. Ukraine also sits on massive amounts of lithium, which is non-negotiable for battery manufacturing but may now be tough to extract given Russia’s war zone. With sanction-driven supply chain disruptions already stymying EV production and increasing prices, the US will have to look elsewhere for these components if they want to drive DER growth.

Trade tension with China may limit access to other DER components

If we see increased tension between global superpowers, we could find ourselves facing additional trade barriers to the DER manufacturing powerhouse, China. China owns 70% of global solar manufacturing and 90% of global lithium-ion battery manufacturing. Despite their poor track record on human rights, we’ve nonetheless leaned on China for low cost manufacturing to drive down the cost curve. If China declares its support for Russia, it may indeed be the straw that breaks the camel’s back, leading to subsequent tariffs and escalating the cost (and availability) of DER components.

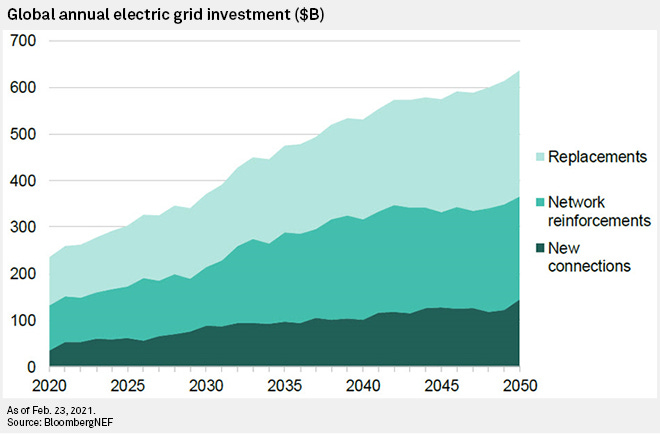

Our grid may not be ready to “electrify everything” overnight

Even if the US successfully established new trade partners and domestic manufacturing abilities, our grid infrastructure would require significant investment to be able to handle the high degree of electrification needed for true energy independence. It’s estimated that energy infrastructure investments must increase to $14T globally and $4T in the US by 2030 to build a reliable grid that can handle EVs, solar, storage, and wind by 2035. Even then, experts believe that goal may already be out of reach. The time and capital required to upgrade the American grid will complicate our path to full energy independence in the near term.

“Keeping everything charged will call attention to vulnerabilities in our power system, namely aging infrastructure, dependence on fossil fuels, and exposure to cyber attacks. Investment should continue to flow to building a smart, resilient and reliable energy grid that can withstand macro shocks.”

— Founder of a public energy financing company

These conditions may lead to increased, near-term reliance on gas

The extended timeline for the energy transition described above may push us to rely on natural gas as a source for power in the near-term. Gas production takes time, but it can still ramp faster than renewables, which often get stuck in interconnection queues and other regulatory processes. The US also has an extensive natural gas pipeline network in place already, while the same can’t be said about an electrification-ready grid. Natural gas is cleaner than other fossil fuels like coal or petroleum, and the US produces almost all of its consumed natural gas domestically. If we want reliable energy supply in the near-term, natural gas seems likely to be a significant part of the solution, since we can scale production and distribution fairly efficiently based on current resources and infrastructure.

“The recent conflict has exposed the highly sensitive interconnectedness of global energy networks and the importance of reliable (local) energy supply. Energy security will emerge as a key priority for many countries and will ultimately lead to a diversification of energy sources that includes both carbon-free as well as an uptick use of fossil-based resources, in the short run.”

— Investor at an American utility CVC

Green hydrogen could take a step back

Ukraine has massive untapped clean energy potential, largely because it houses one of the largest gas transportation systems around the globe. This gas transportation network, proximity to bodies of water and high solar and wind potential has made Ukraine a strong contender for green hydrogen. While many cite green hydrogen as Ukraine’s energy independence savior, it will take at least $3.5B to upgrade and retrofit the country’s energy infrastructure for hydrogen. The more Russia destroys Ukraine and its infrastructure, the more capital will be required for upgrades, and the more difficult it will be to actually deploy it. While Russia’s war may push some countries to increase adoption of renewables, it will force others to take a step back.

“Ukraine is home to a very ambitious green ammonia development program focused on Odessa in the Black Sea that now clearly faces a huge setback. The project outlay makes it clear why Ukraine, like so many other regions in the EU, is a great candidate for green fuels and chemicals (ammonia, methanol, hydrogen) — they have the kind of dense interconnections of infrastructure (pipelines, electrical), industry (steel, shipping, etc), and resources (on/off-shore wind, solar, nuclear) that can drive rapid adoption and viable business models for companies focused on industrial decarbonization…the loss of this kind of industry leading project is disheartening.”

— Investor at a multinational electronics company CVC

Final thoughts

It’s always hard to predict the future and these recent events make that more evident than ever. Entering a phase of de-globalization may drive an increased focus on the energy transition given the added benefits of energy independence and national security interests, however, it will not come without its costs. Energy markets, supply chains and communication infrastructure are all globally connected and we may see productivity gains in these areas pulled back if the divide between the geopolitical states intensifies.

That said, every challenge presents opportunities. As the stakes raise higher, the call to action for founders and investors to build and fund solutions grows louder. The US is seeing itself engage with nations that we long considered hostile all in the pursuit of energy supply. This is showing that the energy transition isn’t just about climate, it’s about issues that both Democrats and Republicans can align on like the economy and national security. We need innovation in our energy sector more than ever before and think that this crisis has served as a wake-up call to the world around its importance. It’s time to meet the call.

If you have thoughts or perspectives to share, please reach out to us on Twitter or LinkedIn (you can find us at @simrangsuri and @Rick_Zullo). If you are building something to usher in the energy transition for all, we would love to hear from you.

*Read this on Medium here

**Read more on Twitter here