Opportunities for Innovation in the Insurance Agency Software Stack

*Engage with this post on Twitter here

Legacy Solutions, Modern Users

In Part I of this series about agency enablement, we established that there is a long runway to make broker distribution more effective, and that there is urgency to meet changing customer expectations. This post explores the application of tech-enabled solutions in brokerage workflows.

Any conversation about insurance software starts with the Agency Management System (AMS). That is to say: vertical SaaS for insurance agencies is not a new phenomenon. A majority of agencies use an AMS, and providers like Applied Systems and Vertafore, the leading providers of P&C agency software, have built multi-billion dollar businesses dominating this market.

An AMS is effectively the core operating system for agencies. The AMS houses all customer data and information, and is the source of truth for policy details. The AMS also acts as a conduit for data transfer with insurers, most importantly for commission data and reconciliation. Most AMS accommodate policy download from carriers, and many include (or integrate with) raters.

But most AMS are designed around legacy workflows and on legacy tech stacks. Vertafore and Applied Systems are each more than 40 years old. Their category dominance goes back so far that Larry Wilson, the founder of Vertafore, has even been referred to as the “Father of Insurance Software.” Operating effectively as a software oligopoly enabled these incumbents to extract high margins over decades and across multiple different owners. Vertafore was acquired by Roper Technologies in 2021 for more than $5bn with estimated $600mm in revenue and close to $300mm in EBITDA. That’s approximately double what Vista and Bain Capital paid for Vertafore five years earlier. Applied, meanwhile, was acquired by PE for $1.8bn in 2014, with a “sizeable” strategic minority investment from Google in 2018, and estimated $540mm in 2020 revenue.

Despite incredible value generated for shareholders, the workflows facilitated by incumbent architecture leave a lot to be desired on agent and customer UX. Insurance brokerage NPS is estimated around just 20–30%, yet legacy AMS remain ingrained in agencies due to the immensely high switching costs of transitioning to new systems. This leaves a lot of low-hanging fruit to address: getting client data in and out of Excel; eliminating paper processes; automating repetitive marketing tasks with campaigns; expanding access to new lines of business, etc. All this could be achieved simply by expanding utilization and interoperability of these systems.

Enabling Efficient Agency Workflows

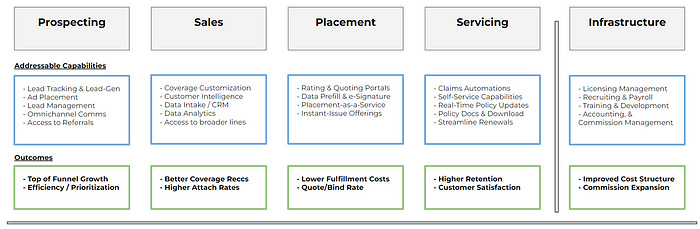

McKinsey argues that insurance is on the precipice of a “seismic shift” in technology adoption, and that “agents of the future” will be “process facilitators and product educators” with the ability to recommend and sell very broad lines of coverage. To identify innovation that will accelerate this transformation towards “agencies of the future,” we look to brokerage capabilities. In reality, agency workflows are complicated– the workflows to place commoditized personal lines policies are immensely different from those for big-ticket commercial and surplus lines. But at the end of the day, we can distill this complexity into a handful of simplified categories. At the 30k-foot view, agents are most effective when they do the following basic things well:

Prospecting: Acquire customers with addressable coverage needs

Sales: Convert customers by offering great advice across broad market categories

Placement: Compile data, submit to the right markets, and bind the best option

Servicing: Manage updates, handle claims, and maximize retention / LTV

Below, we highlight the ways in which technology is accelerating agency transformation. While this is by no means a comprehensive overview, it reflects the breadth of this opportunity space.

Sales & Prospecting

In an industry historically known for brick-and-mortar interactions, agents face the challenge of meeting customers in their preferred channels. Acquiring online insurance shoppers and managing multi-channel interactions is an ongoing point of friction. While this may seem straightforward, a 2022 survey by Liberty Mutual found that fewer than 50% of agencies have implemented video calls, live chat, or self-service portals. CRM and marketing automation helps to extend agency growth and acquisition capabilities beyond the basic (and underutilized) features rolled into legacy AMS.

Some transactional touchpoints that directly involve agents will inevitably become automated and pushed to self-service, particularly in less-complex lines. In a world where interactions are increasingly automated or asynchronous, the educational and consultative interactions that do directly involve agents become more critical. As low touch interactions are automated, platforms that provide a 360-degree view of customer data will empower agents to provide more personalized recommendations, contributing to increased cross-sell and retention, and ultimately to higher CLV.

Select Examples of Leading Sales & Customer Data Solutions:

Better Agency, Agentero, EnnablAreas for Innovation:

- Recommendation automation for cross-sell and upsell

- Frictionless omni-channel communication and automation

Policy Placement

Smaller agencies often lack access to coverage products and carriers outside their core focus areas, which handicaps their ability to cross-sell and customize solutions. Quoting, rating, and submissions software increase the speed, conversion, and cost-effectiveness of placement across lines.

One set of solutions in this space, including Quote/Bind platforms, marketplaces, and submission APIs, help agents access more quotes more quickly. These platforms often include or integrate with appetite guides, data-prefill solutions, electronic signatures, and online application submission, all of which reduce time spent on quoting and placement, and reduce turnaround times for customers. In the absence of streamlined submissions capabilities, brokers prepare and submit individual applications (these are often submitted via email and then manually compiled by the carrier before even making their way to an underwriter). Automating the quoting and submission stack therefore pays big dividends for agents and has attracted a significant amount of VC attention in recent years.

The range of solutions in placement workflows also includes standalone fulfillment platforms and services that help agents access new coverage lines. For example, agents may have many customers that need a coverage product that they don’t have experience placing efficiently. The juice of the sale might not be worth the squeeze of overseeing a manual process that sits outside the agent’s core area of expertise. In that situation, what the agent needs isn’t a rater, but an end-to-end fulfillment solution or tech-enabled BGA, into which they can offload the entire placement process. This allows agents to tap into new revenue streams (and better meet customer needs) without making up-front investments in new capabilities.

Term life insurance jumps to mind as a space in which we’ve seen this trend play out in recent years. Despite cross-sell opportunities across most agents’ books, many inevitably choose not to bother with the high-friction conversion funnel for term-life products. Historically, that meant missed revenue opportunities for agents and coverage gaps for customers. To address this, leading B2C digital agencies have started offering agency fulfillment products. Offloading placement to a third party with automated workflows and better unit economics presents a compelling win-win for all stakeholders.

Select Examples of Leading Placement Solutions:

ThreeFlow, Semsee, Wunderite, Policygenius Pro, Plum LifeAreas for Innovation:

- Reducing friction for IAs to access a broader array of product categories

- Faster (or instant) quotes in traditionally complex lines (e.g., E&S, Small Commercial, Benefits)

Servicing

An experienced agency operator we spoke with remarked that “agents don’t make money selling insurance; they make money servicing and retaining it.” Brokers (and the carriers who also stand to benefit from higher retention) increasingly recognize this. A study conducted by Bain found that agents using digital tools achieve NPS scores 17 points higher than those that do not, and as a result, 80% of insurance CEOs are now tracking CX metrics in their long-term strategy. Post-sale self-service capabilities are particularly impactful on this front, as they enable asynchronous product discovery and reduce friction in closing renewals.

Beyond providing better UX when customer urgency is low, providing a better claims experience (which has been described as “ground zero of retention”), can also help to reduce churn. While much of the claims stack sits outside of the broker’s explicit ownership, broker-focused solutions that speed the preparation of claims paperwork or the disbursement of funds can improve the UX and potentially reduce churn and even reduce loss.

Select Examples of Leading Servicing Solutions:

Covu, GloveboxAreas for Innovation:

- Streamlining and automating retention workflows

- Self-service capabilities for modifications

- Claims UX and speed (processing and payout)

Agency Infrastructure

While most of the startups we see are focused on agent-facing solutions, there is tremendous opportunity in enabling the infrastructure layer of the agency software stack. Getting information to and from systems (especially with the interconnected nature of agencies and carriers) is itself a herculean effort with IVANS (a sub-division of Applied) which dominates the space. IVANS enables direct download of policy information to the AMS from the carriers and has effectively monopolized the space (even Vertafore, Applied’s biggest competitor, is a customer). We’re seeing several startups target IVANS with more modernized APIs as well as others tackling other back-end pain-points and bottlenecks to unlock opportunities for operational efficiency. Amongst these, we’ve seen startups focused on accounting and commissions management to support higher commissions and bonus thresholds, digital payments to reduce unintended lapses and the friction in the last-mile of policy binding and licensing management to accelerate onboarding of brokers and reduce the probability of non-compliance incidents. These solutions collectively focus on improvements to agency cost-structure and back-office efficiency to drive margin expansion, while also freeing up bandwidth to focus more on core customer-facing, revenue-generating activities.

Select Examples of Leading Infrastructure Solutions:

AgentSync, Ascend, IVANSAreas for Innovation:

- Accelerated carrier appointments and onboarding

- Streamlined brokerage payroll (commission splits and automation)

- Agency talent management (recruiting, training, development)

-Distribution APIs and carrier/broker connectivity

Digitization of the Legacy Stack?

None of the aforementioned categories is totally novel, or even unaddressed by legacy providers. For example, a look at Vertafore’s solutions for small and midsize agencies (below) shows standard feature offerings spanning agency management, CRM, sales data, and placement. But delivering new technology through a legacy provider moves slowly. Despite meaningful investments and acquisitions across the legacy ecosystem, we still see untapped transformation potential and low-hanging fruit across the value chain.

Agencies can deliver better customer UX, access new lines of revenue, and improve operating margins by adopting tech-enabled solutions across their stack. While there’s a long way to go in terms of digitization, we’d be remiss not to mention the difficulty of selling software into markets with ubiquitous category leaders and notoriously low willingness to pay for software. Digital solutions across the areas discussed above can add tremendous value for the brokers that adopt them — but often struggle to scale to a point of creating defensible, competitive advantages in a market with such challenging dynamics. We recently asked one P&C agency operator about how they interact with the rater and submissions features in their Vertafore AMS 360 implementation; they said that it was just easier to “do things the old school way.” The agency stack is ripe for solutions to help it break free from its archaic infrastructure– the question is how?

Our next post in this series will explore the challenges of selling to agencies and dive into business model innovation and platform approaches that accelerate digital transformation. In the meantime, we’d love to hear from you if you’re building something in the agent-enablement space or have strong opinions about compelling areas for innovation in the brokerage value chain.

Read this post and others from Equal Ventures on Medium