Persistent Pains For SMBs Call For New Benefits Solutions

Follow the discussion on X and LinkedIn

Healthcare Costs Are Squeezing SMBs

Healthcare costs continue to rise at rates that far outpace inflation, placing immense pressure on small and medium-sized businesses. According to the Kaiser Family Foundation, over the past decade, employer contributions to health benefit premiums have surged by over 60%, with employee contributions also rising steadily. This dual worsening outcome, compounded by higher deductibles, makes affordable care access even more challenging.

This increase has left SMB owners and HR leaders grappling with difficult decisions as they strive to offer competitive benefits without derailing their financial stability or committing to unsustainable plans. These stakeholders face not only the financial burden of rising costs but also a lack of tailored solutions or clear guidance to help SMBs navigate an increasingly complex benefits ecosystem.

Employer Vs. Worker Premium Contributions (Last 10 Years)

Traditional Benefits Approaches Don’t Work For All Businesses

For larger enterprises, the solution has been to self-fund benefits plans, with the share of employees governed under such plans rising sharply over the past 25 years. These strategies are feasible for large organizations that are supported by seasoned HR teams and supplemented with external consultants, advanced tooling, and deeper pockets relative to SMBs. Large organizations also tend to have more claims data and lower variability in claims outcomes, given costs are spread across more lives. However, what works for large organizations often doesn’t translate to fast-growing SMBs, whose resources and needs differ significantly.

While SMBs have shown increasing interest in self-funding, evidenced by a ~10% percentage points increase in self-funding for employers with fewer than 1,000 employees since the turn of the millennium, we believe these SMBs often encounter a highly opaque and complex landscape. Lacking accessible tools and tailored resources, many SMBs struggle to navigate the path to self-funding, leaving them at a disadvantage compared to their larger counterparts.

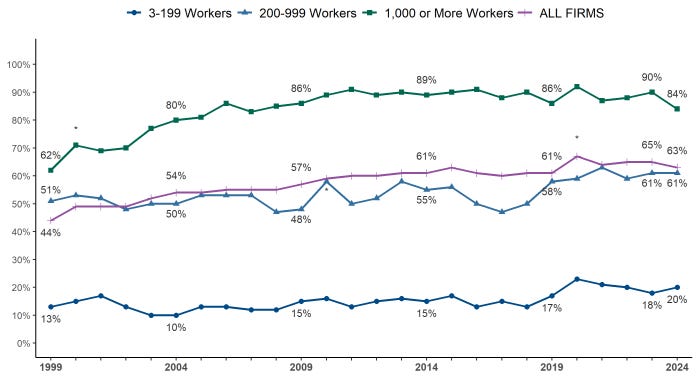

Percentage of Covered Workers Enrolled In A Self-Funded Plan, By Firm Size

Instead, they often rely on their existing Professional Employer Organizations (PEOs) or standardized group plans that are convenient initially but grow increasingly expensive as headcount rises. PEO fees tend to scale directly with headcount, ranging from $40-$250 per employee per month and/or a percentage of total payroll ranging from 2-12%. As an SMB grows, PEO plans often fall short of meeting their evolving needs, such as providing flexible regional coverage or accommodating specialized workforce demographics. Furthermore, the KFF reports that 75% of employers with fewer than 200 employees only offer one health plan.

The Unique Challenges Facing SMBs

In SMBs, benefits management is often overseen by individuals juggling multiple responsibilities who don’t have the time or expertise to navigate complex benefits transitions. If an SMB has HR resources at all, they tend to be focused on talent and recruiting – and may have no experience in overseeing benefits, let alone in managing a complex transition to new plans or brokers. This is particularly true for fast-growing or venture-backed SMBs, where benefits optimization may be a lower priority compared to scaling operations, hiring, and navigating other organizational challenges related to growth.

At the same time, high-value tools like stop-loss coverage and cost-containment platforms are typically designed for larger enterprises, given their higher propensity to self-fund. For SMBs, these tools can be prohibitively expensive or overly complex to implement, leaving smaller organizations without the resources they need to optimize their benefits programs or to weigh the benefits/risks of prospective changes.

Finally, switching from a PEO or group plan can also pose a significant burden, even for a team with differentiated HR resources. Transitioning often requires months of effort, significant internal resources, and a deep understanding of benefits administration, and may require months to implement. The administrative burden and upfront costs make the process feel unattainable, and compel many SMBs to remain on their PEO even when they know there may be more affordable options.

This Creates Missed Opportunities And Rising Costs

The challenges of managing affordable benefits create ripple effects that hinder SMBs’ ability to grow responsibly. Many businesses remain stuck on outdated or one-size-fits-all plans, overpaying for benefits that don’t fully address the needs of their workforce. Inadequate or expensive benefits packages also make it harder to attract and retain employees, especially in competitive labor markets or sectors.

Without access to modern tools and strategies, SMBs miss critical opportunities to optimize costs and improve the employee experience, further widening the gap between themselves and larger enterprises.

Better tooling and strategy cannot negate the core underlying challenge of runaway health benefit costs. However, increasingly we believe that advances in technology and benefits design offer solutions that better align with the needs of SMBs compared to the status quo. For example, smarter benefits platforms are simplifying employee enrollment and engagement while offering greater customization. These platforms help SMBs meet diverse workforce needs more effectively.

Cost-management strategies are also becoming more accessible, leveraging real-time claims data and tailored stop-loss coverage to help SMBs control healthcare expenses. By integrating these tools, smaller businesses can achieve meaningful cost savings without sacrificing quality.

In addition, streamlined administration solutions are reducing the operational burden on HR teams. By simplifying workflows and automating key processes, these solutions make it easier for SMBs to transition away from outdated setups and adopt more efficient benefits models. SMBs (and the brokers/consultants who serve them) who learn to navigate these new tools, data and strategies stand to benefit compared to those who simply leave solutioning to their PEOs.

At Equal Ventures, we see a tremendous opportunity to build and support solutions that finally make best-in-class benefits distribution viable for growing SMBs. If you’re working on SMB-focused benefits models, we’d love to hear from you.

Contact us:

Sophia@equal.vc | Adam@equal.vc