Predictions for 2025 that are NOT about AI

Follow the discussion on x.com

Every year, I tell myself that the upcoming year will FINALLY be the year where things will start to slow down and that I can achieve a bit more balance in my life. I’ve been telling myself this for nearly 15 years and really believed it heading into 2020 when we finally raised Equal 1 (boy, did I get that wrong…). With that, this year I’m taking a different approach. As Oscar Wilde quipped "To expect the unexpected shows a thoroughly modern intellect". I won’t attest to having a “thoroughly modern intellect”, but I do think that recognizing (and accepting) the continuous chaos of the world around us is a helpful evolution in mindset for managing the instability that life throws at us. Periods of repose are merely opportunities to prepare for future volatility. The ability to adequately prepare for these moments may very well determine your success (or failure) in navigating them.

As I look to 2025, it feels like we’re likely to ease down from some of the tension and volatility that 2024 presented us. That said, it’s moments like these (as I felt in the beginning of 2020 just before the global pandemic) that pose the greatest risk of being upended. While I’ve already highlighted some of my thoughts on areas of investment opportunity in 2025 elsewhere, below are a few of my non-consensus opinions about what we MIGHT see in 2025. These are not probabilities, but rather possibilities that I do not feel are properly priced into the calculus of many investment managers and decision makers. If any of these do come to fruition, they have the potential to significantly upend companies and portfolios, so I believe they merit exploration for those attempting to build sturdy ships amidst what (at least for now) seems like a calm sea.

1) The stock market will see a correction of at least 15% with technology stocks taking the biggest hit

We’re already starting to see a lot of 2021 behavior peek its head back into the market and that always makes me concerned. A lot of folks have a VERY bullish projection (Oppenheimer is calling for the S&P to hit 7,000 which would be a 19% lift from today’s oepning) after we finished the year down 5% from the all-time attained earlier in December. Perhaps I’m a perma-bear, but I think valuations are stretched, risk tolerance is too high and the chances of economic decline are much higher than most folks think. I think trading will be choppy throughout the year and that we could see aanother 15% of downside from where we currently are at some point in 2025.

First, valuations. The magnificent 7 (Apple, Microsoft, Amazon, Alphabet, Tesla, Meta, and Nvidia) represent roughly 50% of the Nasdaq and more than a third of the S&P. As they move, the stock market moves, especially in light of the index based investing (which saw $1T of inflows in 2024, the highest on record). As I look at these companies, I can make a case for each of them seeing a significant downside scenario in 2025. Let’s leave that aside for a second, however, just to talk about the valuations.

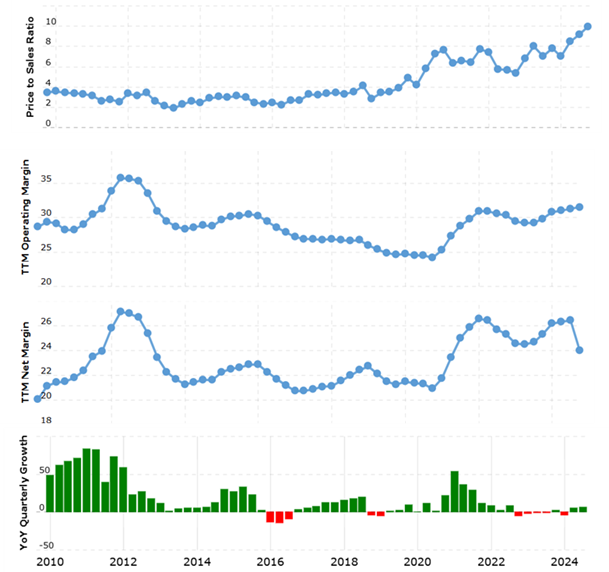

I’ll cherry pick a name to pick on here given something I saw on Twitter and let’s take a look at Apple. The chart below show’s Apple’s P/S ratio at 10x (nearly 3x its 10 year average), despite limited change in operating margins, declining net margins and flattening growth. That’s not the story you want to see to reach all-time highs in your multiple. Again, Apple isn’t the only one of the M7 that is trading with overly robust valuations with declining fundation

Apple isn’t the only one in tech. As I look at Bessemer’s cloud index, we are seeing rosy multiples (and these are amplified for the highest quality companies) for SaaS companies despite increasingly concerning fundamentals. Revenue growth rate and Rule of X are the worst they’ve been as far back as this data is tracked, yet multiples are back in the 2017-2020 range. This means folks are paying the same price for lower growth and efficiency. Just like in the M7, we could discuss some pretty significant downside scenarios to these companies, especially with how fast we are seeing generative AI applications stealing share.

Secondly, let’s discuss risk tolerance. More people expect the stock market to rise in the coming year than in any year on record – and by a wide margin to any data point on record. Whenever I see 1) a data point several standard deviations away from the mean or 2) a hockey stick change in perception, I believe it warrants further consideration and this case we see both at the same time. I believe the market is trading into this and the reality is that when the market gets greedy like that, the hammer eventually drops. The best investment periods tend to be when the confidence is lowest (see in 2008-2009 or in 2020-2021), not when it becomes utterly consensus to invest. We’ve seen other risk-on tendencies re-emerge such as the infatuation with meme-stocks and meme-coins that tend to be precursors to bubbles.

Lastly, let’s discuss the downside risks to the economy. I think much of the current narrative is how deregulation, tax cuts and other Trump political maneuvers will stimulate domestic corporate earnings and they might. But I also think they will coincide with inflation given the tariffs associated with the America First agenda. I also don’t think we are properly equipped to digest this degree of manufacturing capacity, especially in what is still a relatively tight labor market. Amidst this, we see flashes of inflation still showing and while the Fed has already signaled slowing of rate cuts, I fear that we might have to start raising rates sooner than folks think.

I also worry about how our economic isolationism impacts the global economy. In many ways, I feel we are trading GNP for GDP and this could impact corporate earnings (as many retailers have already warned), but also lead to demand destruction from foreign economies and a crash in asset prices. Foreigners own ~20% of the US stock market and 33% of US treasuries…as their economies suffer we deter demand for US stocks and US treasuries. While there is a safe-haven argument to be had here, globalization is centered in sound economic theory of competitive specialization and I don’t think the downside risks of unrolling that are properly priced in.

2) We’ll see more defections from big VC funds and more emerging managers “growing up”

I’ve written about the transitions happening in big funds and I think this exacerbates further in 2025. As part of the Emerging Manager Circle, I’m receiving a tremendous amount of preliminary interest from partners within these firms to figure out how to start their own funds. While this was done quietly in 2023, it has gotten MUCH louder and more frequent over the last 6 months.

There are a few reasons why these defections are occurring (some know they will get bounced out, others are tired of sharing returns with a more diluted talent pool or in dealing with the bureaucracy of a larger organization), but it’s hard to go a single week without seeing a major departure from one of these firms.

This REALLY impacts the calculus for how upstream managers, founders and LPs need to manage their businesses. It used to be that these firms were perceived as the safest sources of capital – after all, they had almost limitless resources to fund your company and have some of the most talented and experienced investors on staff. While these conditions remain, a LOT of the investments being made are coming from investors with limited track records and perhaps even more limited timelines with those firms. The risk implicit with this is that investments made by these investors are largely left unsupported after the sponsor leaves. This is perhaps THE most discussed topic in my conversations with other emerging managers and I suspect it will be spoken about much more broadly in 2025.

This is leading myself and other upstream managers to be a bit more surgical with who we select as downstream partners and I encourage other fund managers and founders to consider doing the same. Similarly, I think LPs really need to evaluate the perceived safety and forward-looking returns potential for these firms knowing that upstream founders and investors no longer perceive these institutions to be the safe haven support systems they once were. In my conversations with LPs, I’m seeing a sea change in mindset around this and suspect that we are nearing a time where their defections from these funds will become more common as well.

That said, this capital needs to go somewhere and I suspect it will go to a cadre of emerging managers capable of growing into becoming more established institutions and/or life-cycle investment funds. From my discussions with LPs, this is a product that many in market are looking for, but the process of managing a $20m seed fund is certainly different than leading a full life-cycle $200m fund. I suspect that we’ll see some defections from multi-stage funds result in the formation of firms with this profile (as we saw earlier this year with Chemistry, a fund led by alums of A16Z, Bessemer and Index) and suspect that we will see other venture managers graduate up.

3) A record number of funds will close up shop

The LP market seems to be defined by haves and have nots as capital allocators look for alternatives. While I believe more money will be deployed in 2025 than in 2024, I sense fatigue from LPs and emerging managers alike and believe a significant amount of emerging manager wind downs will occur.

A lot of LPs are tired of picking through thousands of non-obvious emerging managers to determine if there is any alpha potential. With a record number of new funds launched in 2021 coinciding with an inflated seed market and a large contraction in downstream funding rates, few of the managers from these vintages have lived up to the hopes that the managers and LPs had for those funds. Absent breakout performance, it has become incredibly difficult for these LPs to determine whether to double down for subsequent funds or commit to a second-time fund, especially with more obvious homes for capital.

Similarly, many emerging managers are equally exhausted from these fund raising efforts. Many of these managers successfully raised funds in 2021 and came back to market in late 2023 or early 2024. They’ve now been fundraising for 18+ months and are starting to become the stale bread on the dinner table, making it VERY difficult for them to raise (especially as new “hot” funds come to market). While many of these firms could simply raise smaller funds, they won’t. The economics don’t really work, given the high cost of administrative expenses and the even more expensive cost of earning a right to win in what has been an incredibly competitive landscape. When these managers are looking at their take annual home pay and the value of their carry, many of them are questioning whether this is all worth it, especially amidst their GP commitments and otherwise more lucrative career alternatives.

As I speak to colleagues in this situation, they are frustrated by the lack of support from LPs and are a bit dejected by the reference point of peers who have been operators, founders or crypto investors making dramatically more money. In reality, being an emerging manager (like any other entrepreneurial endeavor) only makes sense if you can break out into a success story. Perhaps a boom market in 2025 makes that possible, but if we don’t see a significant recovery in venture markets accompanied by a massive wave of capital to these managers, then I suspect we will see a lot of firms close up shop.

As a founder, co-investor or LP, you NEED to be pricing this into your decision making. I’ve heard stories of companies taking a term sheet from a lead investor only to have those firms announce that they were shutting down prior to closing the round (yes, less than a month later). I know of others where large portions of an investor syndicate lay dormant and unhelpful given that the managers have moved on to other things. For LPs, there could be cases where managers will indeed handover the entirety of the economics realizing that their likelihood and timeline to carry simply isn’t worth it.

I will always be an advocate for Emerging Managers and the tremendously positive impact that they have on the venture ecosystem, but I feel 2025 will test the mettle of many in our cohort.

4) Tech and Trump break up

I’ve seen many end of year pieces discussing how swiftly the tech community and Trump have aligned with one another and suspect you will see a lot of staffers making their way to venture firms in the coming year.

In a matter of a year, the venture community’s infatuation with the government (which they previously sneered at with disrespect for its lack of productivity and innovation) has become an obsession. This isn’t just in defense, I’m seeing individuals and fund managers go all-in on being part of the national tech agenda. The shift from athleisure-laden coffee chats in South Park to three-piece suit round tables in the West Wing is a pretty stark pivot, but I’m seeing the same fervency as the crypto crowd talking up their NFT book at a yacht party in Miami in 2021.

With many of technology’s greatest innovations spurring from government research labs and institutions, perhaps NOW is the time for the next golden wave of government. This relationship has manifested immensely quickly and the capital and expertise of the tech community likely has the potential to further cement America’s economic prowess as well as Trump’s legacy.

That said, I think many investors and managers are failing to price in the possibility of break-up here and the impacts it could have on the tech industry. Again, this is not a probability, but what I believe to be an underpriced possibility with significant downside risks to private and public market technology companies.

I believe the recent immigration disagreements between traditional MAGA and new wave technologist for Trump showed a glimpse of the incongruencies between various facets of Trump stakeholders and I’m not fully confident these fractures can resolve themselves. There are components of each agenda that are very difficult to reconcile with one another and at some point, Trump might have to decide between his traditional MAGA base and the tech community. I don’t know enough about him to determine how he’ll make such a decision, but he’s had very public and combative break-ups with powerful figures who have been far longer-standing loyalists than those in his tech circle right now, while remaining ardently behind his populous base.

Should this occur, I think you could see a significant downside with many of the recent public-market darlings that are trading at truly laughable multiples. I think it could also lead to pressure on venture friendly policies and other more overt anti-innovation efforts (keep in mind that Trump is decidedly anti-globalization, which itself was a massive innovation and economic expansion wage spurred by advancements in telecommunications infrastructure).

I’m very hopeful this does not occur given the impact it could have on our venture portfolio and the broader innovation environment and suspect this is lower probability than other items I’ve discussed here, but nonetheless am making sure to monitor closely in the coming year.

5) America gets back to “business”

I think America is finally getting over its pandemic hangover and I’m seeing a significant push to go “back to business”.

I’m seeing most employers go back to the office at least 4 days a week and even a few VCs telling me that they refuse to fund companies that aren’t in the office. The same asset allocator that told me that he’d “never be able to find enough ESG product to fulfill his demand” in 2021, now tells me ESG demand is virtually dead. All this points to a lens where the zeitgeist is zoned in on making money above other factors. There are also more subtle social cues into this behavior as well. Some of the most progressive cities and states in America saw the largest swings of political support to the right that have seen in decades (and most dramatically in democratic bastions like NY, NJ and CA). While I’m not a fashionista, I’m told there has been a massive resurgence in suits and hard-toe shoes, suggesting that Americans want to appear professional (or at least want folks to perceive them as such).

All of these items were decidedly out of vogue over the last several years and it’s hard for me to tell whether their resurgence is simply cultural whiplash, a function of a weakening labor market or a long-term persistent trend.This all seems in very stark contrast to the work from home, when you want, how you want and if you want manner of the last few years. Is the pendulum swinging to a more pro-business, neo-conservative lens or is this simply a temporary reaction spurred from other societal, political and economic factors? Truthfully, I have no idea, but I believe it impacts more of how we operate than what we currently give credit to.

Whether employers decide to go back to the office will have an immense impact on who lives in our cities and how they operate (as a function of the political and capital support from those employees). I think many cities aren’t equipped for the social capacities they have committed to and we could see some dramatic events from either the forfeiture of previously promised services or ballooning municipal debt.

Professionally, I’ve seen a much less empathetic tone for performance. My peers from school are telling me their employers are cranking up the pressure and it seems that many are embracing a tougher mentality around accountability and results than we have in the past years. I also hear stories from these same folks that work-life balance is falling out of favor in major corporate circles as the brass in these companies champion those ready to burn the midnight oil to get results. Those ready to do so are embracing the job with the same enthusiasm as they would be for playing for a championship level team, lauding it over their less ardent colleagues as if they were benchwarmers. It’s now “cool” to be the hardest working person in the office and this is certain to have implications on how we hire, develop and retain talent within companies.

Perhaps none of this overt, but it does feel palpable. For a while, it seemed uncool to try. People want to have side hustles, not to rise the corporate ladder or become moguls. They wanted to work 9-5 from some remote location with a low cost of living, not commute into the office to burn the midnight oil. They wanted to wear sweatpants and sneakers, not suits. Perhaps this anecdotal, perhaps it’s temporary and perhaps it's irrelevant, but it feels like there is a national, seismic shift to go back to business (reminiscent of adulation for corporate success we saw in the 1980s) and my guess is that it will impact how we work in more ways than I can currently contemplate.

That’s it for my 2025 predictions. No AI manifestos or preaching our book, just 5 things that I’m wrestling with as I think about the uncertainty in the year ahead. While few if any of these things may come to be, I believe sturdier ships weather stronger storms and that the best way to navigate the peaks and troughs of volatility is to consider the broadest set of potential impacts. Preparing for such events costs you little, but ultimately may help you significantly if they come to be. Our ability to protect against the future will always be imperfect, but I’m hopeful this serves you all a bit headed into 2025 to help you capitalize on this year (and the years beyond) the best you can.