Scale & Certainty: Turning Energy Assets into Financial Assets

Follow the discussion on LinkedIn | Follow the discussion on X.com

To unlock the energy transition, we need to make DERs “bankable”

Distributed energy is growing. But as with all growing things, it’s easy to misinterpret the forces behind that acceleration. Is it driven by long-term economic tailwinds, or is its general upward trajectory disguising short bursts fueled by specific events? For DERs, today’s rapid growth does not necessarily translate into long-term economic viability.

When we think about DERs, the focus often lands (rightfully) on their energy value—how they make the grid more resilient, reliable, and flexible. But a common mistake is to overlook their financial value. In many ways, regulation and incentives have propped up the DER market, creating the perception of economic progress. While these mechanisms have enabled initial growth, they are not enough to sustain the industry long-term. To truly thrive, DERs must achieve a scale that allows private capital markets to confidently step in.

To make this leap, DERs need to become a bankable asset class. A bankable asset possesses a few key financial characteristics: predictability, transparency, and creditworthiness. Those characteristics ultimately require both scale and certainty. At its core, bankability is about bridging the gap between energy markets and capital markets. The ability to confidently underwrite an asset’s performance and forecast revenue is what transforms a speculative asset into a bankable, financial asset.

In order for energy value = financial value, we need to increase penetration and participation in VPPs

One of the primary mechanisms to convert DERs’ energy value into financial value is through Virtual Power Plants (VPP). Unfortunately, we have not been able to consistently translate this value. Despite VPPs being an agile solution to support peak capacity, they have struggled to translate their energy flexibility into financial viability.

For instance, let’s take an example from conversations with VPP experts:

Utilities must overplan for peak capacity. Most of this capacity is covered with traditional generation like gas, but planners may leave a small percentage to be covered by more flexible resources—VPPs via demand response programs. However, in order for these VPP programs to work, utilities may need ~20% of all eligible DERs to participate.1 Unfortunately, DERs are often not at the penetration and participation levels to make these programs work effectively.

Low DER penetration: Nationwide, 3.5-3.8% of households have rooftop solar, <1% have BTM batteries, and 12.9-13.8% have smart thermostats.

Low participation rates: Even of the eligible DERs, only ~4% typically participate in demand response programs (way below the ~20% needed).1

Nevertheless, when programs are able to hit these participation rates—VPPs demonstrate massive potential to deliver the most flexible and (at times of peak demand) the lowest cost option for capacity. Ultimately, utilities want to source this power, but only if they can dependably get penetration rates to correlate with long-term planning cycles.

Turning energy assets into financial assets requires scale and certainty

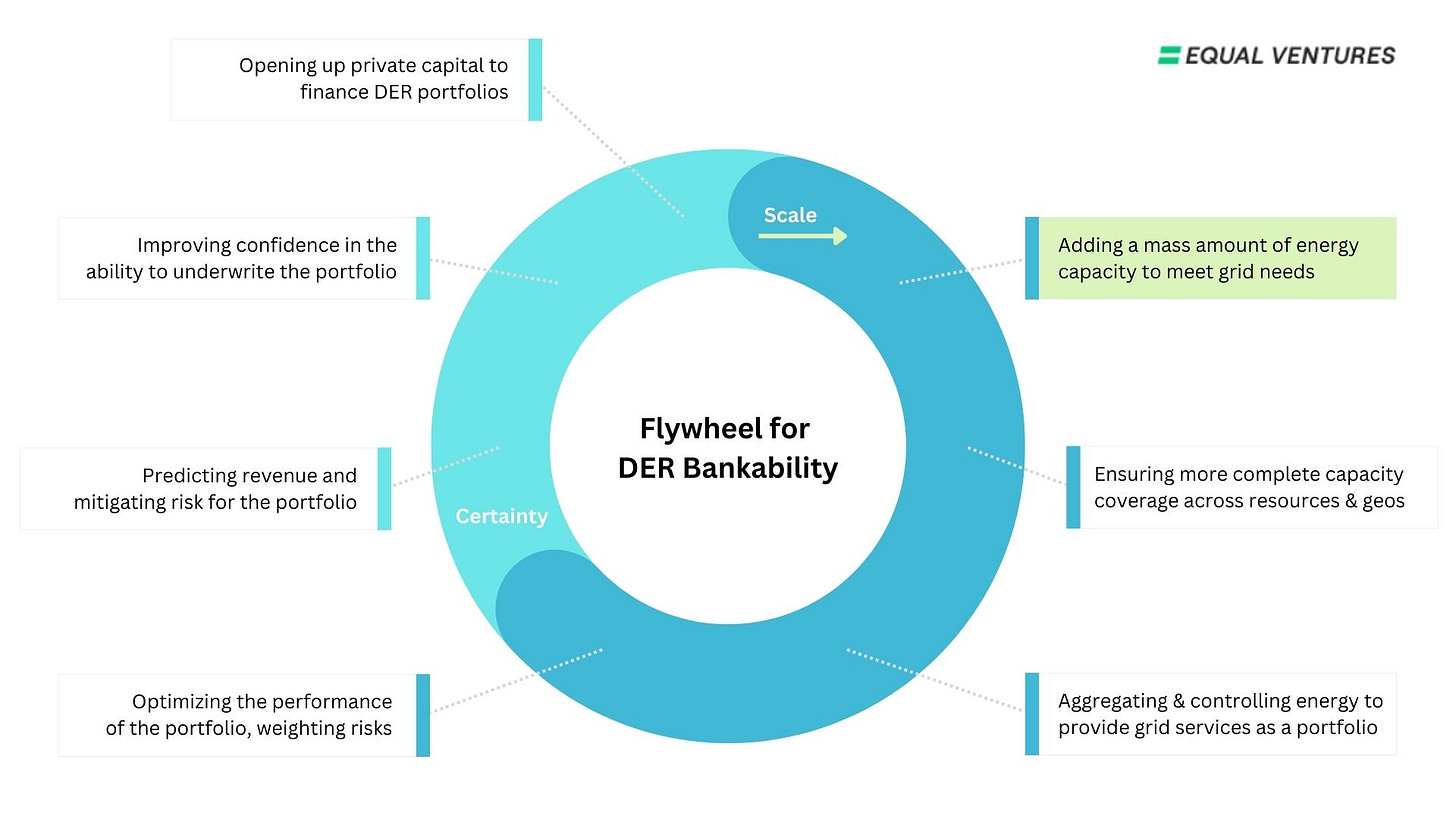

In order for these VPP programs to “pencil out,” we need to create an ecosystem that activates private capital. This means enabling two key factors: scale and certainty. When working in tandem, these elements can create a financial flywheel to turn DERs into a bankable asset class for capital markets.

Scale: Pooling and managing DERs at scale across diverse territories creates economies of scale and enhances portfolio resilience. Diversification reduces risks and supports reliability.

Certainty: Reliable performance and predictable revenue streams make DERs attractive for financing, ensuring that the risks of the portfolio are properly identified and weighted so that the right cost of capital can be applied. Certainty lowers the cost of capital, which in turn supports further scaling of DERs.

By achieving scale and certainty, DERs can more effectively signal their predictability, transparency, and creditworthiness. Scale and certainty accelerate the transition from being purely energy assets to becoming financial assets that private capital can confidently underwrite and finance in bulk.

We need new structures to unlock the potential for VPPs

The future of DERs hinges on their ability to be managed not just as energy assets, but as financial assets. This means rethinking how DERs are managed—shifting from incentivizing isolated, bespoke energy solutions to optimizing holistic asset portfolios. For DERs to become a truly bankable asset class, we need to create structures that ensure both scale and certainty. Only by providing consistent growth and profitability can DERs attract large-scale investment. With the right frameworks, DERs should evolve into a reliable financial asset class that bridges the gap between energy and capital markets, unlocking their full potential for both the grid and private capital.

1. VPP participation rates based on theoretical example where a utility plans for 120% capacity, leaving 10% to be covered by VPP programs.