The "Best-Priced Business" in Insurance Today

Follow this discussion on Twitter

The Ultimate Hard Market

Earlier this quarter, we posted thoughts about the impact of weather volatility on property insurance, a secular and important theme we remain deeply interested in at Equal. Broadly, 2023 was a challenging year for property insurers managing exposures to natural catastrophe risks. In some ways, it was a perfect storm (both literally and figuratively) for carriers: a record spike in secondary peril activity occurred alongside historically low supply (and skyrocketing rates) of reinsurance and significant inflation.

The net 2023 combined ratio for the P&C industry is estimated at 103.9%, and for homeowners it is estimated around 112% — the worst in over a decade. This reflects the long-term need for better/specialized underwriting and programmatic loss control: carriers cannot sustainably insure worsening weather with outdated risk models. It also reflects the lag between losses and rate approvals in admitted markets — it takes time to realize rate increases.

Naturally, as losses and weather volatility increased, many carriers moved to the sidelines, sacrificing growth to clean up their underwriting ratios and await rate adequacy. Though carriers were rewarded for this pullback, it unfortunately gutted some of the largest and most distressed property markets. Lemonade, for example, showcased reduced growth in its homeowners segment in its recent Q4 shareholder letter, with the percentage of new premiums from homeowners falling to 13% in 2023 from more than double that in 2021. The drop was even more precipitous in CA, where new homeowners’ business effectively collapsed to zero.

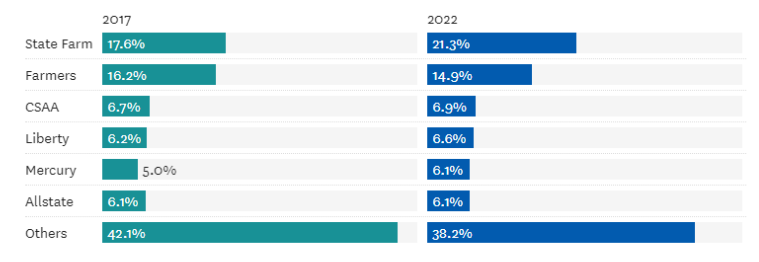

Whereas Lemonade’s new business is only a drop in the bucket in a $120bn+ premium market, large national carriers followed the same pattern. State Farm, Allstate, and Farmers alone comprise >40% of homeowners policies in CA, and are among the carriers that paused new business in the state last year. By Q4 2023, there was an estimated 20% reduction in insurance availability in CA compared to a year earlier. The FAIR plan more than doubled over 5 years to >350k policies and as many as 12% of homeowners forgo insurance at all.

Reasons for Optimism?

The trend towards higher losses and reduced supply are unsustainable and alarming — for insureds, regulators, carriers, and all other stakeholders. But as rate increases begin to incorporate the impacts of climate, new competitive dynamics are making way for what some are calling the most attractive insurance opportunity in years.

No one expressed this more directly than Chubb CEO Evan Greenberg in the company’s recent 2023 annual shareholder letter where Greenberg wrote, the “property business is the best-priced business in the world right now, and as long as we are paid adequately, we have the balance sheet to take greater concentration and volatility from earnings from property.” Chubb’s lower combined ratio and focus on commercial sets them apart from some of the more challenged personal lines carriers, but Greenberg’s comments nevertheless call attention to the increasingly favorable “risk-reward” as property pricing rises.

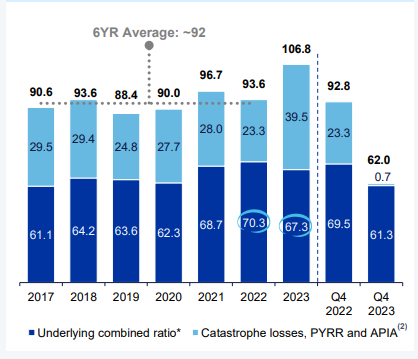

Or look at Allstate’s Q4 homeowners results, which similarly suggest stabilizing losses and improved rate adequacy. Their homeowners cat loss ratio ballooned to >39.5 in 2023, a 16 point increase year/year, and the driver of the ~107% combined ratio. But in Q4, cat losses were minimal (-22 points compared to a year earlier), and the underlying combined ratio ex-cat came in much lower, at levels not seen since 2017. One quarter does not tell a complete story, so we cannot read into the anomalously low cat loss in Q4. But it does suggest that moderating inflation and reduced expenses are starting to reduce combined ratios in this segment (if cat losses remain moderate).

On the capital side, property reinsurers generally enjoyed low losses in 2023 driven by fewer large/named events and much higher rates compared to 2022. Accordingly, there are signs that more alternative capital is heading toward property and cat risk. Markel, for example, noted a $38m swing in pre-tax earnings year/year at Nephila in their recent annual shareholder letter, and expects AUM to grow and “attract positive attention” from investors given 2023 performance. In fact, ILS and cat bonds had a record year of inflows and yields, with $7bn of inflows and estimated $42bn in outstanding cat bonds at year-end 2023. Reinsurance rates remain at the highs and supply remains constrained — but new capital is at least starting to head toward the industry and renewals normalized compared to a year ago.

There are also greenshoots of regulatory action in some of the most distressed markets. The CA Dept of Insurance (DOI) recently announced draft measures that would allow carriers to use forward-looking models to measure wildfire risks, and which would encourage/require the use of data regarding risk mitigation measures. The DOI has also taken steps in recent months to make the historically slow rate filing process faster. There is still significant red tape that blocks admitted carriers from fully pricing in their costs of reinsurance, but this is at least a step in the right direction if the goal is to bring capacity back to the market.

The Road Ahead

Money is made in soft markets, but the biggest insurance wins have historically happened as markets turned. This is when competition has been snuffed out, pricing expectations raised and risk management lessons learned, creating a lean window for companies to capture asymmetric profit opportunities. We believe we are seeing one of those opportunities in the property market today.

As the broader P&C industry gears up for cyclically higher profitability, there is no question that the property market will remain challenging with continued upward pressure on rates and supply constraints. It is encouraging to start seeing signs that capacity and appetite are coming back to pockets of the sector, but it’s a long road to get the market back to stability — just last week, State Farm announced >70k fresh non-renewals. A few quarters with low realized natural catastrophe losses and receding inflation is not going to resolve the structural, weather-driven insurance supply gap in distressed markets. For a true long-term solution, the industry will need new paradigms for risk selection and mitigation that reflect the actual increase in risk from climate change.