The Equal Ventures Insurance Index

Q3 2024

Follow the discussion on Twitter

The Equal Ventures Insurance Index is a quarterly summary of public equity performance in the P&C insurance industry. This post summarizes Q3 2024 performance of our insurance indices, and aims to highlight key themes and trends underlying the price action. As always, our goal is to help support observers of the insurance industry in identifying key drivers and catalysts (and not to recommend any specific investments).

Broadly, the insurance sector outperformed the market in Q3 — continuing the strength we’ve seen over the past 12+ months. Earlier this year we wrote about the pricing power playing out in P&C insurance, and Q3 outperformance reflects this ongoing cycle. Just a year ago, carriers were reeling from ballooning loss ratios, and the market was looking for an inflection in profitability. What a difference a year can make. Today, with P&C rates continuing to trend higher and with combined ratios much healthier, it’s all about growth. We remain at a sweet spot in the cycle, and the top performing companies in our indices are being rewarded for large y/y gains.

Q3 2024 Summary Stats:

P&C Carriers ripped during the quarter, across the board and especially in personal lines. Companies in our index of legacy P&C carriers were up by a median of +13% in Q3, compared to the SP500 +6%. YTD, the average company in this index is up by a staggering 28% (which is especially impressive given that the median market cap in the index is >$20B). So much for insurers being boring!

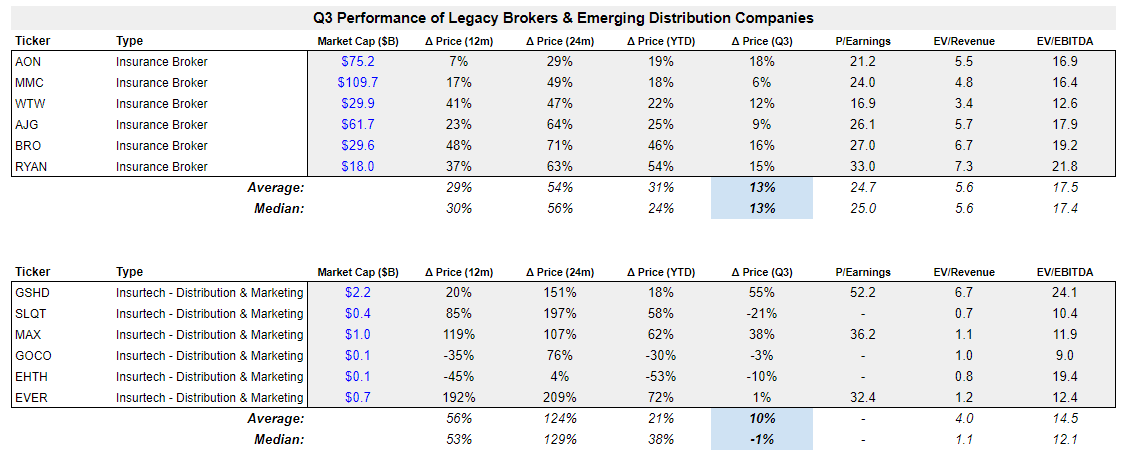

Leading brokers (+13%) were strong in Q3 as well, as they continued to post solid revenue growth in a healthy rate environment and with macro remaining positive. The average gain in our brokers index YTD through Q3 is north of 30%.

As these sectors moved higher, legacy company multiples expanded:

The median P&C carrier Price/Book Value rose to 1.9 from 1.7 last quarter and vs. 1.6 in Q3 2023.

The median P&C carrier Price/NTM EPS rose to 12.3 from 10.9 last quarter and vs. 10.5 in Q3 2023.

The median Broker Price/NTM EPS rose to 25.0 from 23.6 last quarter and vs. 23.1 in Q3 2023.

Insurtechs were more mixed — at the median, both insurtech indices were down marginally, but with the typical massive swings across single names. As we’ll dive into in more detail below, significant ad spend is flowing back into the sector, and despite huge y/y gains at full stack insurtech carriers, they didn’t quite meet the expectations that built as they plowed higher in 1H.

Takeaways from Q3 Performance:

If there is a single takeaway from Q3, it’s that the market craves growth in GWP and policies now that we’re in a healthy rate environment. Expectations were high coming in to Q2 earnings reports this summer, and the top performers are those who delivered on growth.

In our report last quarter, we commented on accelerating P&C ad spend in 2024 as underwriting ratios improve. Whereas the preceding two years were characterized by a negative 20% CAGR in P&C ad spend (reflecting carrier focus on profitability and reduced/negative new customer LTV when personal lines combined ratios were >100), acquisition spend started to recover earlier this year and inflected higher last quarter.

MediaAlpha (MAX), an insurance lead-buying platform, has been a top performer in our index (+38% in Q3; +62% YTD) on the back of this trend. Their July shareholder letter reported P&C ad transaction values up 320% while adj EBITDA >5x’ed y/y. Company commentary was consistent with our observations above: “Multiple carriers meaningfully increased their spending…and we expect this trend to continue as additional carriers refocus on growth in light of improving underwriting profitability.” Everquote (EVER) results followed a similar narrative (+1% in Q3 but +72% YTD). Their revenue fell 31% from 2021-2023, but is now increasing fast as auto ad spend rises: their P&C vertical revenues more than 6x’ed in the Q2 2024 results reported in August vs. the prior year quarter.

Personal lines carriers with strong underwriting margins and efficient acquisition were the beneficiaries of this increasing spend. Progressive (PGR, +22% in Q3) is generally regarded as the most efficient of the large personal lines carriers; they demonstrated massive 2024 growth, and have been rewarded for it by investors. In their August presentation for Q2 results, PGR reported that their CAC relative to Earned premium rose to 10% in 1H 2024, compared to 6% in 2023 (when ad spend was dead). As shown in the chart below, they reported spending close to double what competitor carriers are spending on acquisition (given their more effective marketing engine and strong direct channel). With their personal lines CR <87% in the first six months of the year, they are stepping on the gas, and delivering: they came into 2024 with ~15% market share, and grew premiums ~20% y/y.

The story is a bit more complicated for full stack insurtech carriers, who also delivered huge growth in premiums and continue to improve their underwriting losses, but who didn’t quite clear the hurdle of market expectations. As far as insurtech carrier turnarounds go, Root (ROOT) remains the one to watch. While the stock is still up 260% YTD through 9/30, it fell 27% in Q3 on results that would look quite impressive if they hadn’t already been baked in. It’s hard to overstate the extent of the transformation in their profitability and growth over the past year: their Q2 report in August shows the CR hovering just above 100% (vs. 150% in the prior year quarter) and the expense ratio at 30% (vs. 57% in the prior year quarter) — very material improvements to their unit economics. Y/Y, they more than doubled GWP and almost doubled policies in force. But the market was looking for accelerating growth in the quarter, and didn’t see it: policies in force was up just 1% sequentially over the prior quarter, despite expectations for >10%. You can’t quite call a ~25% drop on earnings “tanking” when the stock is up so much YTD, but the market definitely did not like ROOT’s Q2 Policy In Force results.

By comparison, Lemonade (LMND) has had much more muted 2024 performance, but they, too, failed to deliver as much growth as was hoped. LMND increased Sales & Marketing expense by 27% in 1H 2024 compared to 1H 2023, and saw its gross loss ratio improve to 79% in the July 2Q report vs. 94% in the prior year quarter. In Force Premium grew an impressive 22% sequentially, but came in just below the low end of guidance. Like ROOT, LMND ripped in July ahead of its earnings report, but then fell back to earth when results (albeit very solid) didn’t hit estimates.

As strong as carriers were in the quarter, the broker segment performed even better. This was driven by a combination of 1) robust macro (i.e., we avoided a recession for now and interest rates are moving lower); 2) E&S rate growth that continues to decelerate more slowly than expected; and 3) generally strong earnings and revenue growth. Aon (AON, +18% in Q3) posted revenue growth of 18% in their July report on the back of the NFP acquisition, including a solid 6% organic growth. Brokers with specialty and wholesale practices (again) led the charge higher; names like RYAN and BRO each up ~50% YTD through 9/30.

Importantly, we continued to see large and thematic brokerage M&A in Q3. We closed the quarter with Marsh’s mammoth acquisition of McGriff, a retail agency with >$1B of revenue and reported $500m of EBITDA for ~$8B in cash. First and foremost, this transaction demonstrates the ongoing quest for scale and revenue growth that is driving brokerage consolidation, less than six months after Aon/NFP closed. The transaction also demonstrates continued investor focus on wholesale and specialty brokerage. McGriff was previously part of Truist Insurance Holdings (TIH), which was purchased by PE investors for >$15B earlier this year. TIH assets included McGriff, the life insurance BGA Crump, and CRC, a leading wholesale broker. By selling the ~50% of total enterprise value of TIH that was retail, the PE buyers have backed into a less diversified wholesale asset. This looks like a good move, given the continued strong specialty/wholesale performance we called out above.

Lastly, despite the very strong quarter for the insurance sector, we also saw clear reminders that the industry continues to face large secular challenges including climate change and weather volatility. This is a theme that we have repeatedly written about at Equal, but it was very relevant in Q3 (and in the weeks that followed since) given the spate of powerful hurricanes in the Southeast. Reinsurers briefly dipped sharply in early October as Hurricane Milton barreled toward the Tampa area, though the sector recovered when a worst case scenario for insured loss was avoided. The human and physical toll of the storms was enormous; but the combined loss estimates from Helene & Milton are now in the range of $30-$50B, which is massive but lower than had been feared (Ian in 2022, for example, incurred $65B in insured loss).

YTD insured losses from natural catastrophes are tracking about in line with the 10-year average (and are actually trending below the last four years), which is less of a comment on 2024 being benign and more a reminder of how unacceptably high typical loss years have become. NFIP, the federal flood insurance program managed by FEMA, is reportedly “one big storm away from bankruptcy” and three-quarters of FL Citizens claims were denied following Hurricane Debby in August (since flood and surge damage is generally excluded). With stronger storms moving further inland, non-coastal areas like Asheville are experiencing increased flooding. Property insurance remains inadequate to meet the moment — and this is becoming increasingly clear as even “climate havens” suffer generational disasters. We believe this is a critical problem to solve, as well as a massive opportunity for innovators bringing new solutions and capacity to the market.

Q3 2024 was a huge quarter for performance of our indices and for the P&C insurance industry. We’re at a point in the cycle where rates are high, inflation is moderate, macro is strong, and underwriting ratios are healthy. Even the companies that underperformed estimates last quarter posted meaningful y/y improvements. It won’t last forever, but growth is the name of the game right now. With Q3 earnings reports just around the corner, we’re eager to see what the current quarter has in store. As always, if you’re interested to further discuss any of the themes in this post, don’t hesitate to reach out.