The Equal Ventures Insurance Index - Q4 2023

The Equal Ventures Insurance Index is a quarterly summary of trends in the insurance industry based on public equity performance. This post summarizes performance of our indices and of the broader industry in Q4 2023, and showcases valuation trends over calendar year 2023.

Q4 Summary Stats:

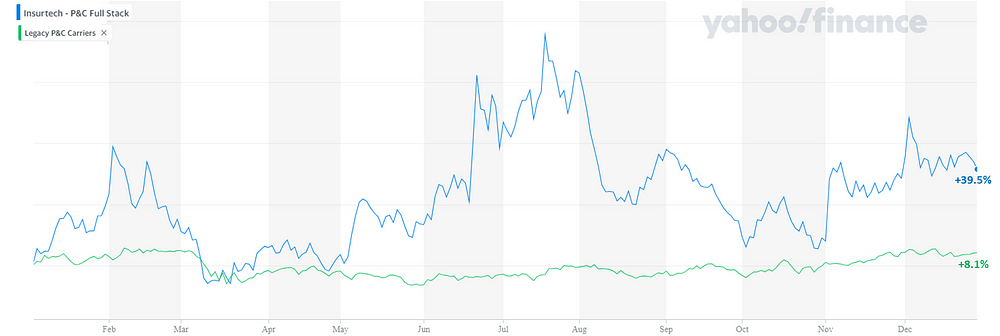

In Q4, our insurtech indices significantly outperformed their legacy peers, with both the insurtech carrier and tech-enabled distributor groups surging by >20% in Q4. This is consistent with the trend over 2023: insurtechs in our indices recovered in a strong equity market. Over the course of the full year, insurtech carriers and distributors rose 55% and 39%, respectively, compared to the Nasdaq composite index +43%.

Despite impressive Q4 price performance, the insurtechs are still *way* off 2021 highs. Average 2Y performance remained down >50% for both insurtech indices at the end of 2023.

Brokers generally underperformed in Q4 — price action in the legacy broker index was noisy, but the average was effectively flat. Tech-enabled marketing and lead-gen companies, among the poorest performing stocks over the preceding 24 months, were particularly strong in Q4.

P&C carriers, which underperformed throughout the first three quarters of 2023, were strong on average in Q4 (a trend we will click on below, as this group continues to outperform QTD in Q1`24).

Takeaways from Q4 Performance:

As claims inflation recedes and rate increases look increasingly baked-in, brokers are starting to face tougher comps on revenue growth. The same trends that caused this group to outperform in the first half of 2023 is now weighing on the legacy broker index, and prompted a number of analysts to take down targets in Q4 for names like RYAN, AON, and others. On the other hand, the insurtech companies in our distribution & marketing index outperformed, largely driven by an ongoing risk-on bid in the broader market. Insurtechs demonstrated recovery in Q4, and ultimately throughout all of 2023, though these stocks remain well off their highs.

Our universe of legacy brokers was mostly down in Q4, though WTW was a bright spot. It shot up on Q3 results in late October after announcing organic revenue growth and adjusted EPS ahead of estimates. WTW guided to “mid-single digit organic revenue growth” going forward and to “adjusted operating margin expansion for FY 2023,” offsetting some of the concerns described above faced by competitors.

But perhaps the biggest story in our broker index in Q4 came from AON — which announced in Mid-December that it would acquire middle-market P&C broker NFP, the 10th largest P&C agency by revenue, at a price of $13.4B (~15x EBITDA). NFP itself completed >200 acquisitions from 2018–2022, and will now be a source of growth for the second largest US brokerage. While brokerage M&A decelerated in 2023, this deal could be the harbinger of ongoing consolidation to come.

Whereas the legacy broker index underperformed in Q4, P&C carriers outperformed, reflecting improving expectations of carrier profitability. For example, SwissRe’s January 2024 US Property & Casualty Outlook points to lower combined ratios in 2024–2025, with claims inflation moderating and rate increases mostly realized (and in some lines, decelerating). The result (as displayed in the table below) is much higher forward projections for ROE at P&C carriers. In Q4, as a number of large carriers announced rate increases (and profitability) that exceeded expectations, the group started to rally.

The earnings surprises and positive price action was particularly acute in Q4 for personal lines carriers in our index, like ALL, PGR, and KMPR. 2023 loss ratios in personal lines were >20ppts higher than commercial loss ratios. Homeowners and PL auto lines got crushed by claims inflation in 2021–2022, and premiums were slower to ramp compared to commercial and liability lines. Now, expectations for future profitability are increasing (as rate increases catch up faster than anticipated and on improved expense efficiency), and those carriers are catching a bid. Allstate, the top performer in our legacy carrier index in Q4, underperformed through the first three quarters of 2023 and still reported a loss in Q3 earnings; but the stock ripped as they demonstrated improvement in auto performance (where CR narrowed by >15ppts y/y) in early November.

The trend in legacy carrier expectations and performance in Q4 highlights a number of important takeaways for insurance investors:

Cyclicality of Profitability — insurer rates (and ROE) tends to follow a cyclical pattern (for example: losses increase → rates increase, often slowly → carriers adopt improved UW and expense discipline during the period of lower returns → recovery and rate normalization). As demonstrated in Q4 results, the best performing equities don’t necessarily tend to be those at their peak ROE, but those set to improve.

Expense & UW Discipline— since returns are cyclical, expense efficiency and risk management take on structural importance. Carriers cannot directly control inflation, and tend to face rate filing/approval cycles that lag claims activity (especially in admitted lines). Therefore, having disciplined UW and maintaining a low expense ratio create long-term advantages for carriers (i.e., to outperform when the group is cyclically weak). Increased investment in platforms that help carriers monitor/reduce UW risks and reduce claims/admin costs will remain secularly important for competitive, long-term differentiation across cycles.

Divergence across product lines — As SwissRe calls out in their 2024 P&C outlook, different lines of business are “at very different points in the cycle.” Even in ALL’s strong Q3 earnings report, where they demonstrated faster improvement in their auto segment than anticipated, homeowners CR worsened by >14ppts year/year fueled by nat-cat losses. While claims disinflation will generally benefit property carriers, ultimately the ongoing steep losses from climate change are structural (as weather patterns change), not just cyclical. Since rate increases here have been insufficient to control losses, carriers may continue to pull back from at-risk region, driving a growing coverage gap. As we wrote last week, this is a systemic risk for society, and a huge opportunity for startups that can introduce novel approaches to risk management.

Q4 was an exciting quarter for the industry, dotted with a large M&A announcement, insurtech price recovery, and carrier outperformance. As we write this Q4 update, public insurance carrier stocks have reached record highs along with the broader S&P500, suggesting that Q1`24 could be another interesting quarter for providing commentary on the industry.