The Rebirth of Retail

Announcing Leap's Series A

In 2018, I wrote a memo to crystalize my thoughts on the retail space. Even then, the retail industry was experiencing unprecedented disruption at the hands of Amazon. I titled the memo, “The Rebirth of Retail” and called for someone who could be an offline competitor to Amazon/Shopify. The hypothesis was that if someone could establish a shared offline retail platform that leveraged data to optimize the placement and utilization of brands across locations, they could have a monopolistic advantage over the rest of the retail market, experiencing lower costs, higher store utilization, better risk management and higher sales per store than any legacy retailer could on their own. In doing so, they’d have the opportunity to capture millions of stores and grab a huge chunk of a $1T prize.

3 years later, I’m ecstatic to finally publicly announce our investment in Leap. We first invested in Leap in 2019 as one of the earliest investments at Equal. We had scoured the market to find a company capable of being a platform, instead seeing companies preaching innovation, while operating with the same broken business model as Macy’s. Leap wasn’t creating a “WeWork for Retail,” they were creating the “Shopify for Retail,” a platform that any brand could build on top of their rail and scale their footprint. We were fortunate to be part of the seed round with Costanoa and were excited to double down on the Series A at the beginning of 2020. Their business was growing like a weed, the team was performing incredibly well and we were starting to see the early signs of platform dynamics take place.

Then Covid hit. We didn’t announce the Series A because it didn’t make sense to brag about investing in a brick and mortar retail platform when retail felt like it was going to die and go away forever. It would have been really easy for everyone to say “Look, we should just pack it up”. But that wasn’t the case. Make no mistake, those months were tough, nearly every one of our stores closed in the Spring. But the nature of our business model allowed us to survive, whereas others were left completely underwater on long-term leases with expensive capex builds. Dating back to the seed round, investors asked whether we could survive an economic downturn. Instead, we went through the equivalent of the retail apocalypse and still finished 2020 up nearly 100%.

As Covid waned and the economy began to recover, the true power of Leap’s platform became much more obvious. Brands now saw the risk they were taking and favored a partner like us over expensive builds in-house. We started getting a flood of brands interested in working with Leap and have now had over 391 brands who have applied to be part of the Leap platform (they’ve accepted 30 as partners so far, making Leap more selective than Stanford GSB). Our data underwriting model (leveraging a blend of 1st party in-store/POS data and each of the brand’s Klaviyo/Shopify/CRM data) was now robust enough for us to leverage data intelligence in ways no one else could, enabling us to navigate the shifts in the market well before others. Lastly, we were able to hit critical mass in many of our core markets (we’re now in 7), to enable the platform dynamics to show a noticeable economic impact. The results are conclusive, Leap is the most effective retail platform in the market today and (we believe) demonstrates a path to OWN the offline retail dynamic tomorrow.

Leap proved 4 incredibly impressive things over Covid:

Stores perform better with Leap

The core asset of our business is the ability for data to drive better results for our brand partners. Nowhere has this been more conclusive than with brand partners who have handed us over their existing stores. These brands not only saw their costs of managing these stores go down significantly, but Leap was able to drive significantly more sales. Every industry has its own set of sector-specific KPIs and as you look at these metrics it’s clear, no one can operate branded retail stores better than Leap. We made unprofitable stores profitable and our edge there is growing stronger with each store.

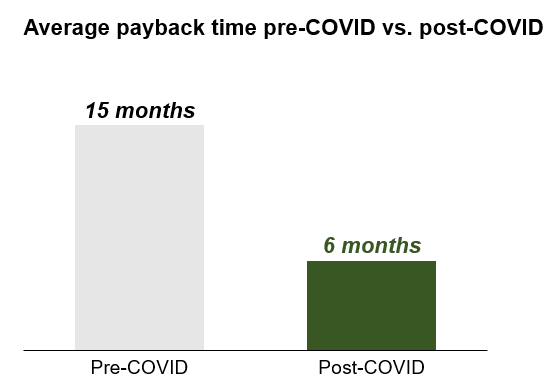

Our paybacks are simply unprecedented

Generally speaking, payback on retail stores is calculated in years, not months. Leap has driven paybacks to <6 months. That’s pretty solid for a SaaS company, but we’ve hit those numbers inclusive of capex. We could push more of that into higher rents (tenant allowances) and/or longer leases (part of WeWork’s strategy), but we’ve remained disciplined in avoiding financial engineering, choosing to focus on brute force execution and prudent risk management. While COVID has certainly provided challenges to our ability to open stores, our Post-Covid cohorts are performing even better than our earlier stores, with some of our recent stores paying back in 2–3 months. These paybacks are consistently improving with every cohort as we gain additional leverage across our markets and start seeing the platform dynamics take hold.

Platform dynamics have truly taken hold

One of the most compelling things about Leap is the compounding advantages we’ve started to see take place — this is getting further confidence that we’re truly becoming a platform, not a retailer. Each Leap store we add to a market generates a) lower opex per $ of sales, b) higher GMV per square foot and c) a better confidence interval on future stores (we measure as a function of our ability to predict store performance for incoming brands). Lower costs, higher revenue and lower risk translate to better economics. As we add stores to a market and see brands recycle through the platform, economics consistently improve demonstrating our compounding advantages in the market. Other retailers or asset-intensive businesses like WeWork generally see these numbers head in the opposite direction. The flywheel has started to kick over and the economic value proposition we make to brands is getting stronger each day.

Brands are being built on Leap

Not only are we seeing brands trust us with 100% of their brick and mortar business, in some cases we are seeing our portion of their business now outpace their own D2C channels. Top brands are now making Leap their de facto offline channel. We’ve already signed close to 50 stores and work with some of the most exciting brands in the market today. The CEOs of these companies see us as a core partner to their business. Conversations about Leap are being had at the board / CEO level. The decision to partner with us is a big one, but we’re seeing some of the best brands in the market come back over and over for us to represent them.

Startups have lots of twists and turns on their way to success. This team has personified grit, going through hell and coming through the other side better than before. Amish and Jared likely have a bit more grey hair than before, but they’ve built an incredible team that brings the best of the digital and retail worlds together. They’ve established Leap as a trusted platform to brands and landlords alike and I feel confident that they bring the leadership necessary to transform an industry much in need of it. When I wrote my memo 3 years ago, there was no way I could have predicted the events of the last 18 months. That said, having seen the data points I have over the last 18 months, I’m more confident than ever before that the “Rebirth of Retail” is here and it’s with Leap.

*Read this on Medium here

**Read more on Twitter here