The Wonderful World of Wholesale

Follow the discussion on LinkedIn

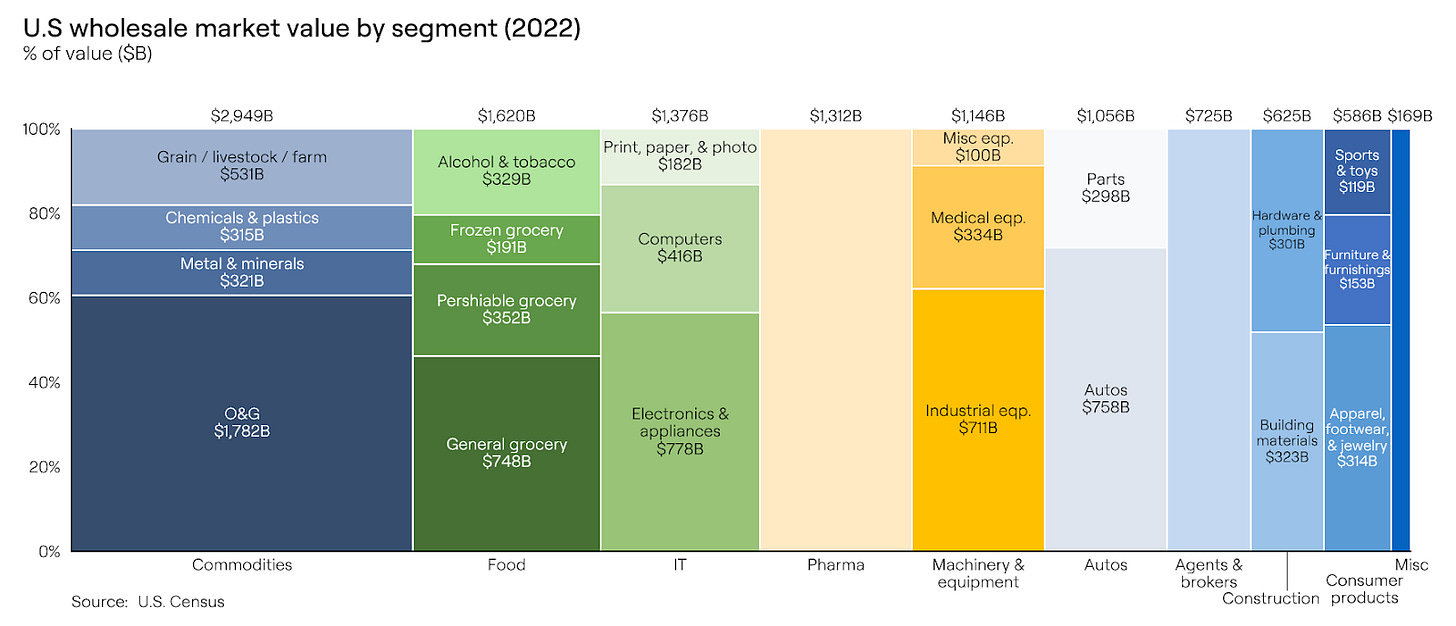

We at Equal have previously highlighted under-served segments and channels of the broader $7T retail market (see the $6T brick & mortar channel and the $2T CPG opportunity). Today, let’s get into an even larger, and more under-the-radar segment of the U.S. economy, the scarily massive $11.6T wholesale market.

Wholesale 101

Wholesalers are broadly defined as businesses who buy goods at bulk from manufacturers with the intention of reselling them, primarily to other businesses. The wholesaler is almost as old as the retailer (shoutout to the OG Dutch East India Company!) and as the middlemen of our economy, wholesalers have their hands deep across all aspects of our economy. From consumer staples like groceries and pharmaceuticals to soft goods like apparel and toys to durables like automotives and computers and non-obvious categories from commodities like O&G to industrial machinery & equipment to construction products - the wholesaler is everywhere.

The terms distributor and wholesaler are often used interchangeably and while both are generally buying in large quantities at an attractive price and reselling in smaller quantities at (hopefully) a higher price, traditionally, a distributor can be thought of as a specialized wholesaler:

Wholesalers are generally focused on fulfilling orders from their customers, who are typically retailers. Wholesalers usually do not have exclusivity agreements with manufacturers, which allow them greater pricing flexibility and portfolio diversity.

Distributors are generally focused on supporting the manufacturers. Distributors will take on the additional burden of the warehousing & fulfillment of the physical products themselves as well as sales & marketing and customer service on behalf of manufacturers. This means distributors typically will have to invest in physical assets, typically warehouses and transportation fleets, where economies of scale can create significant advantages. Distributors are more likely to have exclusivity agreements and stronger relationships with manufacturers, which may outline stricter pricing control, but don’t always carry inventory on their balance sheet.

In reality, the lines between distributor and wholesaler are increasingly blurring. The same company can act as a wholesaler for some products and more of a distributor for others. Ultimately, the advantages of either model vary significantly by the dynamics and needs of the end industry. For example, grocery retail requires an owned logistics network to be competitive given the perishable nature and high turnover of the product category so most wholesalers are distributors while owning distribution is less critical for a durable consumer product category like apparel. Pharmaceutical distribution is dominated by the top three players that all benefit from strong barriers to entry including nationwide distribution, complex regulations and licensing, and deep relationships with the top pharmaceutical companies. Per above, for durable consumer products where distribution is not as critical, we see a much healthier mid-market and long tail of wholesalers as well as agents & brokers, who by definition do not need to make significant capex investments and instead focus on building deep expertise and relationships.

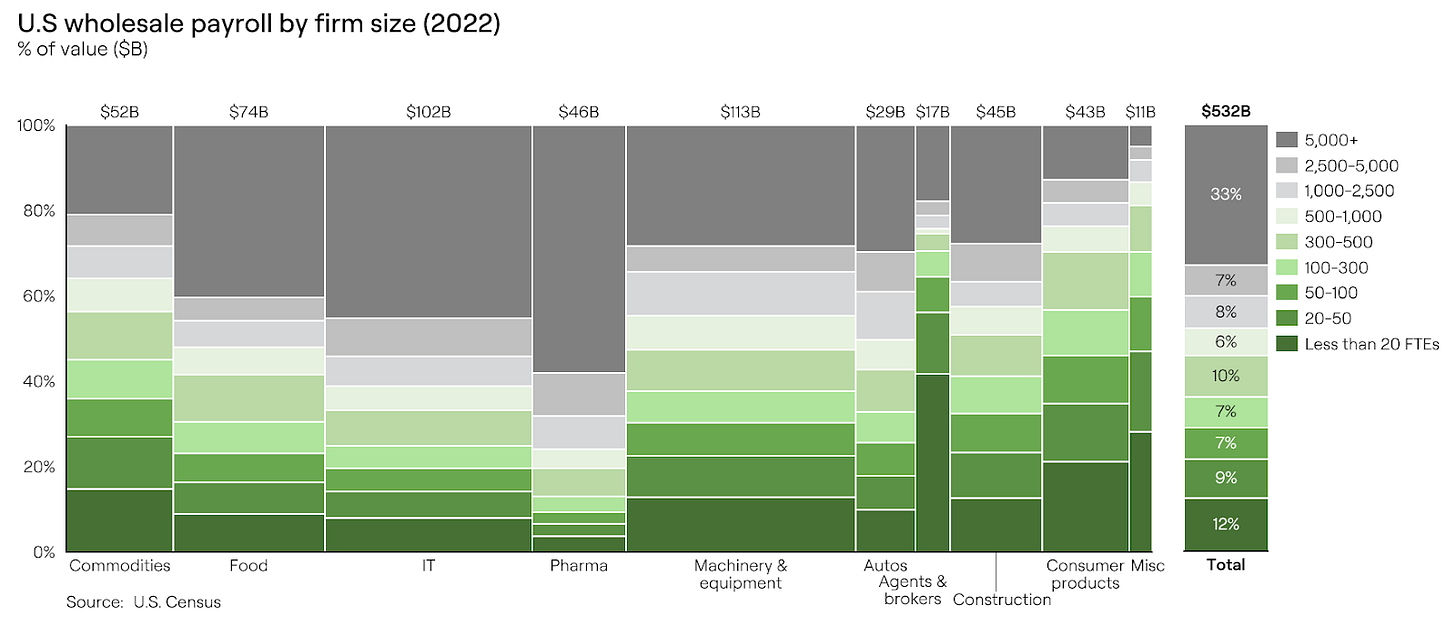

Wholesaler gross margins vary widely but generally fall between 15-30%. What IS consistent across all wholesale end markets is how significant labor costs are as a percent of total industry revenue. Wholesale workflows are still incredibly manual, particularly for the SMB segment who does not have the balance sheet to invest in technology. The long tail is still significantly reliant on humans to source products, process invoices, inventory management, customer service, and more. Firms with fewer than 1,000 employees make up less than 40% of all revenues but more than 50% of payroll costs and this delta is even more stark for certain end segments like agents & brokers. There’s an obvious opportunity here to enable SMBs to improve operational efficiency, which should have a massive impact on wholesalers’ bottom line given their thin margins.

The Changing (?) of the Guards

While wholesale still has a long way to go in terms of tech adoption, we are starting to see sparks of innovation, particularly for consumer products. For example, the rise of 2nd generation ecommerce marketplaces, notably Amazon, eBay, and even newer upstarts like Whatnot, Poshmark, and Ghost has enabled the professional reseller model. Many of these resellers essentially function as SMB wholesalers, where they are able to source bulk inventory at an attractive price, often through discount channels or private marketplaces or other wholesalers, and then resell directly to the public at a mark-up. The ability to leverage the consumer reach and digital and physical infrastructure of digital marketplaces has made selling direct-to-consumer economically viable vs. traditional wholesale models.

The AI age will create even more opportunities to both enable and disrupt the wholesale industry - a selection of some ideas we’ve been kicking around:

Enabling the wholesaler: automating antiquated and legacy workflows to improve labor efficiency (the biggest line on wholesaler’s P&L besides COGS) should create significant value

Roll-up legacy wholesalers: we love roll-ups at Equal (see EqualParts) and there could a comparable opportunity to roll-up wholesalers and inject AI to improve both topline growth and bottom line efficiency

Become a next-gen wholesaler: leveraging the explosion of marketplaces, workflow tools, data analytics platforms, and more to compete directly as a new entrant and compete as a best-in-class reseller!

There’s $11.6T of spend up for grabs across endless end markets - many of which are huge in their own right! We’re incredibly excited about wholesale enablement and disruption opportunities within the Age of AI. If anyone’s building in this space, please reach out to Chelsea (chelsea@equal.vc)!