Black Friday Is No Longer What It Used To Be

How The Rise Off-Price Retail Is Rewriting The Rules Of Black Friday

For decades, Black Friday reigned as the retail event of the year: a one-day frenzy of doorbusters, long lines, and massive consumer spending. But today, its dominance as a singular shopping holiday is waning. While the holiday season remains crucial, Black Friday has morphed into a month-long stretch of discounts driven by consumers' appetite for year-round deals and brands and retailers’ excess inventory challenges.

This isn’t to say that Black Friday is irrelevant – it remains a key part of the retail calendar. However, its role has changed. To thrive in this new environment, brands and retailers must rethink how they approach discounting, striking a delicate balance between maximizing inventory liquidity and preserving pricing power and brand equity.

The Declining Uniqueness of Black Friday’s Value Proposition

Retailers now stretch promotions across October and November, with Amazon’s October Prime Day serving as the new catalyst for holiday spending. This has diluted the urgency that once made Black Friday special and has changed consumer shopping habits.

Extending the duration and depth of the discount season conditions consumers to postpone purchases, creating an expectation that brands will eventually lower prices. Williams Sonoma CEO, Laura Alber, articulates this dynamic well, “That’s all good for the short-term, but then you get customers trained to wait for that promotion, which is never a good thing because you’re really competing with yourself.”

Shoppers are becoming increasingly strategic in their approach. A financial planner and buyer at a major retailer mentioned, “We are seeing a lot more add-to-cart and wait this year.” Presumably, shoppers are tracking their items to assess the depth and quality of the discount as per Laura’s prediction. Given these dynamics it is no surprise that we expect Cyber Monday to outplace Black Friday in total sales again. Furthermore, these consumer bargain-hunting tactics are becoming more sophisticated with generative AI. The number one use case is to “find the best deals for specific items” according to BCG.

This dynamic works well for high-ticket categories like electronics and appliances, where discounts and careful comparison drive purchase decisions. However, for other categories, particularly apparel, Black Friday’s influence is waning. With fewer consumers feeling compelled to shop on this specific day, the once-dominant retail event has become less critical to overall strategy.

Year-Round Bargains Have Changed the Game

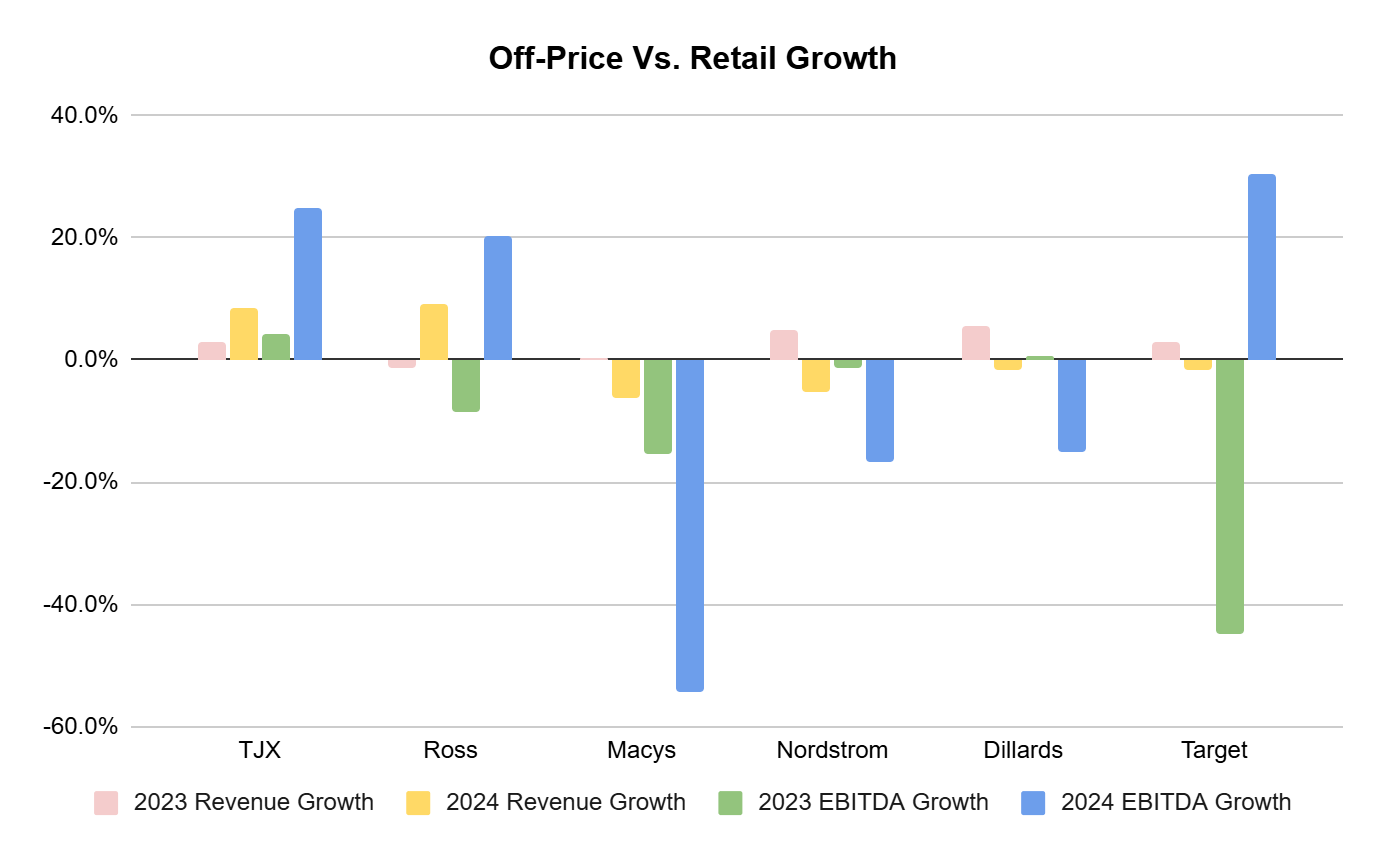

Black Friday’s decline as a singular event is also tied to the rise of year-round discounting. Off-price retailers like TJX and Ross have normalized value shopping, training consumers to expect bargains throughout the year. Over the past several years, off-price retailers have consistently outperformed traditional retailers, achieving stronger revenue and EBITDA growth, reinforcing this shift in consumer priorities toward value-driven purchasing.

Retailers’ excess inventory challenge further exacerbate this shift. Surplus products often lead to heavy discounting, which erodes brand equity and pricing power. The cautionary tale of J. Crew exemplifies this dilemma. In 2020, the company filed for bankruptcy after excessive promotions devalued its brand. However, J. Crew’s turnaround strategy offers valuable lessons. By no longer leading with promotion tactics, the company increased its average order value (AOV) and revitalized its brand image.

These examples highlight a critical tension in today’s retail environment. While promotions might temporarily boost revenues, they often fail to improve margins in a meaningful way. Retailers must find a way to balance discounting with protecting their brand’s long-term integrity.

The Path Forward

The extension of the Black Friday season offers a glimpse into retail’s future: a world of annualized discounting that risks becoming a race to the bottom. To adapt, brands must adopt innovative, value-driven approaches that meet evolving consumer expectations while safeguarding brand equity and profitability. Platforms like Ghost, Revive, and Leap provide solutions to these challenges.

Ghost: Enables brands to play in the year-round discounting game without destroying brand equity via their marketplace.

Revive: Helps brands extend the product lifecycle of returns / dead stock to ensure that seasonal dead stock can still recoup value while maintaining brand positioning.

Leap: Enables brands to capture on in-person Black Friday without the capital-intensive overhead of traditional brick-and-mortar expansion, while enabling year-round in-store discounting and/or sample sale opportunities.

These platforms allow brands to navigate inventory challenges strategically, transforming liabilities into opportunities. Extended Black Friday promotions are already a preview of this broader, ongoing approach—one that prioritizes liquidity, margins, and long-term value creation. Retailers who ignore these levers and cling to the past might end up with profits as thin as the crowds at a midnight doorbuster.