Climate is NOT Cancelled

Our thoughts from Climate Week NYC

This past week, we participated in Climate Week NYC with our biggest Climate Capital Summit yet.

For us, it was important to bring an audience bigger in scope and scale than we had in the past given the tumultuous state of the climate universe.

Earlier this week, the administration outlawed terms like “climate change” and “sustainability” from the Department of Energy. We’ve also seen a decided pull back from generalist VCs in the category as well. Many in the category have shifted their attention to priorities that are more aligned to the goals of this administration, leaving behind many of the companies that they so fervently backed (at astronomical prices) back in 2022-2023.

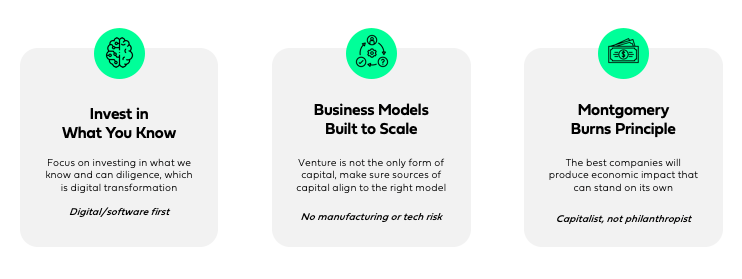

None of this is a surprise to us. As we outlined in our synopsis of the climate tech ecosystem a few years ago, we expected this boom and bust nature of tourist capital to come in and subsequently leave. We restrained ourselves from buzzy carbon pricing based models given our concerns around economic viability if regulation never came to bear (we call this mindset the “Montgomery Burns principle”).

What we never predicted, however, was the immense impact that AI would have on the energy landscape and the central stage that (and its impact on energy prices) would take on the climate investing universe. This has catapulted a new set of narratives for investment in the sector that were heavily palatable during our events and others during this year’s climate week.

Ultimately, those narratives tell a tale of two stories:

The first, is that of a critical and acute need for energy solutions to support hyperscalers and secure American energy independence. This is leading to massive investment in supply-side innovation (I had the pleasure of doing a panel with the inspirational co-founder of Commonwealth Fusion Systems, Brandon Sorbom) and leaders in the data center space (such as Paul Schuster, North American Head of Sustainability, NTT Data). While these are the acute needs of today, given the massive influx of AI-based energy consumption, solutions to today’s shortages are not yet in hand. Energy prices will continue to rise, as will intermittency and reliability issues. Reliability and affordability will certainly impact the hyper-scalers, but the real losers amidst this bottleneck aren’t the cash-rich tech companies, but rather the mainstreet American families and companies who are already struggling to pay their bills. We see the ONLY interim solution to this as batteries/VPP and have invested accordingly.

The other is a more nuanced story, one where we’ve made a fundamental shift in the nature of energy markets. Clean energy isn’t about the environment any more–it’s about making money. Simply put, it is the lowest cost to deliver energy supply available to us now and in the foreseeable future. Utilities can no longer stand idly by relying on a 10% coupon on their asset base, they need to transform their operations to manage disparate supply and demand nodes. If they don’t they will die. The only way to do this is through a massive investment in digital transformation and AI. Lastly, emerging markets are seeing superior economics here in the US given rapid demand-side growth, rising cost of commodities and freer trade borders. All of this calls for a mass digitization of the global energy market as we see the grid start to look more and more like the internet.

Call this what you want–clean tech, green, climate, the energy transition. I DON’T CARE. Investing in innovation in this sector has never had a better business case than right NOW.

While there is ample chaos in the climate market, sea change events like this create the opportunity to build and invest into category defining companies that will transform this sector and produce massive economic impact.

As I said to Chris Kemper, Founder/CEO of Palmetto, during our fireside chat, “Great companies last longer than presidencies.” Regardless of your political affiliations, we are seeing the business case for investment into this sector demonstrate more promise than ever before, driven NOT by environmentalism, but by pure economics.

With that, despite the calamity, rhetoric, and volatility of today’s climate investing environment, I fervently believe we are seeing the early days of what will ultimately be the sector’s most category defining companies.