Winning in Vertical AI: The 2 Pathways for Success

Join the conversation on Linkedin

As we highlighted in our recent Insurance x AI and Logistics x AI posts, we’re starting to see the first wave of breakout Vertical AI companies across sectors. We’ve been tracking many of these closely and have backed several thus far. As we’ve done so, we’ve started to see a few distinct patterns emerge in how AI takes shape across industries, and how market conditions allow certain approaches to flourish over others.

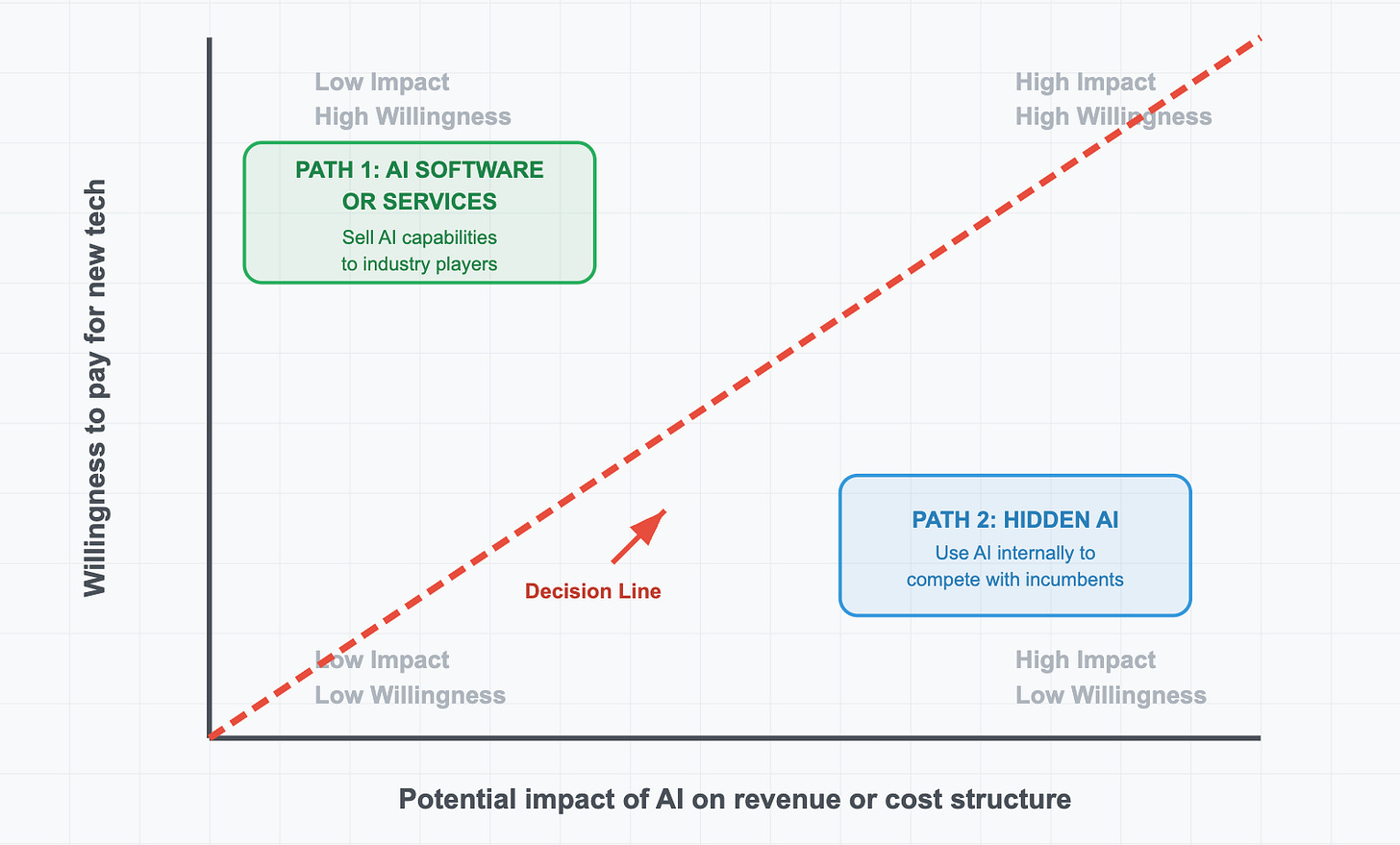

As founders look at transforming a space with AI, the first question that we see them needing to answer is whether they intend to sell AI capabilities to a customer segment (through AI Software or Services), or whether they intend to leverage the technology to compete head on with industry operators.

Although these considerations vary by vertical, we’ve found a helpful framework to guide this decision is to map the impact that leveraging AI-enabled capabilities can have on an industry customer, and to gauge the willingness to adopt and pay that the end customer may have.

The chart shows a simple breakdown: If customers have high willingness to pay for AI solutions, sell them AI software or services. If customers are resistant to pay or adopt solutions and the impact can be high, consider ingesting AI to compete head on.

High Willingness to Pay

If customers recognize the impact that AI can have on their businesses and are willing to adopt and pay for solutions, companies building AI powered software or services can flourish.

We’ve found this is an especially clear choice if the impact of the AI-driven solution is marginal on the overall company’s ability to generate new revenue or change its cost structure. This doesn’t necessarily mean the solution is not impactful to end customers. Coding agents, scribes, and AI receptionists have gained steam across industries, demonstrating they can increase efficiency in certain departments, even if they don’t necessarily drive meaningful changes in the cost structure.

Solutions in this camp can take the form of copilots (augmenting existing workers w/ AI powered software) or coworkers (automating or autonomously executing work that might otherwise be done by humans).

We’ve seen a number of verticals where AI Software & Services approaches have gained steam. In highly regulated environments such as healthcare and legal, copilots can augment skilled professionals without requiring wholesale workflow disruption. Examples include OpenEvidence and Abridge, which assist doctors with decision support and note-taking, and Harvey, which helps lawyers accelerate research and document analysis. AI services have today found more traction in routine, high-volume settings where fault tolerance is greater. Retail customer service is one such area where AI-powered customer service agents can take on repetitive, structured tasks from start to finish, effectively functioning as artificial coworkers.

Meaningful Impact on Cost Structure

On the flip side of the chart above, if leveraging AI can dramatically impact unit economics but adoption resistance for new solutions may be high, you may be able to leverage new tooling to compete head-on with incumbents. We’ve been referring to these businesses as those incorporating “Hidden AI”. From the outside, these businesses look like their legacy industry counterparts. However, behind the scenes, they are leveraging new capabilities to service customers better and/or cheaper. We’ve seen many forms of “Hidden AI” companies, from those that re-build new companies from scratch to those that may purchase and transform existing companies.

The insurance industry illustrates a few areas where we believe these Hidden AI companies can shine. Our portfolio company, Stand, is building a full-stack insurance carrier from the ground up, leveraging new models for climate risk underwriting and mitigation. In contrast, another portfolio company, Equal Parts, is building a new-age insurance agency by partnering with existing insurance agencies through acquisitions and implementing AI-driven solutions to turbocharge their operations.

We’ll share in subsequent posts further frameworks for how we think about when it makes sense to build a ‘hidden AI’ company – either de novo from the ground up or by acquiring and transforming existing industry operators.

Driving For Success

Beyond market conditions, the path and form factor that a founder takes will also depend greatly on their own capabilities. AI Software & Services approaches will favor founders with deep technical and product capabilities. These founders can develop and bring highly proficient products to market and succeed with a capable go-to-market motion.

We believe Hidden AI approaches require a different founder profile: deep operational expertise and the ability to manage and scale complex service businesses. Although technical proficiency still matters, founders also need to be able to manage complex operational businesses that can compete with legacy incumbents.

Each of these models will have a place in different parts across the economy and we’re especially excited to be backing founders bringing AI-powered solutions to our core sectors of Retail, Supply Chain, Insurance, and Climate. If you are building something in this space – we’d love to hear from you!