Softer Rates & More Innovation

Insurance market competition and strategic takeaways for 2026

Follow the discussion on LinkedIn

In a report last week, Gallagher Re referred to Jan 1 renewals as a “period of choice..and opportunity for cedants.” Reinsurance capital is at record levels, driven by “strong retained earnings” in reinsurance, growing availability of “alternative”, non-traditional capacity, and “structural” rate adequacy across most lines of business. They conclude that we are entering a market with both “record levels of capital” and a strong “motivation to deploy it.”

In other words: the insurance industry is flush with capital. Insurers still perceive rates to be high enough to be worth growing their book, which in turn is driving more competition, and pushing those “adequate” rates lower. Just a few years ago, in an extremely hard market driven by inflation and natural catastrophe losses, reinsurance capital was supply constrained. Carriers were generally forced to pay high premiums and to cede less risk than they hoped. This year, Gallagher Re noted that “some reinsurers were not able to deploy as much capital” as they planned. We’ve effetively rotated from a reinsurance market with too-little capacity to a softer environment with excess capital looking for new opportunities.

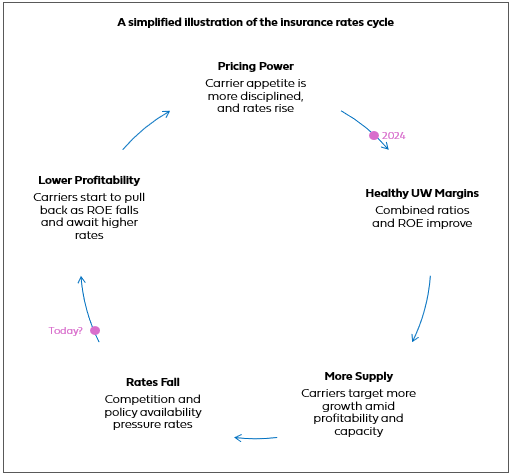

In 2024, we wrote about the shifting insurance rate cycle, from a decidedly hard market into a period of renewed growth and profitability. Since then, rate increases have moderated, new MGAs and carriers have entered the market, and carrier spend on advertising and growth recovered from depressed levels.

Whereas 18 months ago the industry was on the precipice of a growth-fuelled recovery, now it seems the game is about to get more difficult. Through this cycle carriers and insurtechs have been rewarded for showing strong PIF and premium growth; this will necessarily moderate amid falling rates, increased competition, and tougher y/y comps.

As the insurance environment becomes more challenging, it will accelerate ongoing industry trends and create strategic opportunities for carriers adept at managing the cycle. Below, I outline some of the ways in which I expect a softening reinsurance market to impact the industry over the coming months.

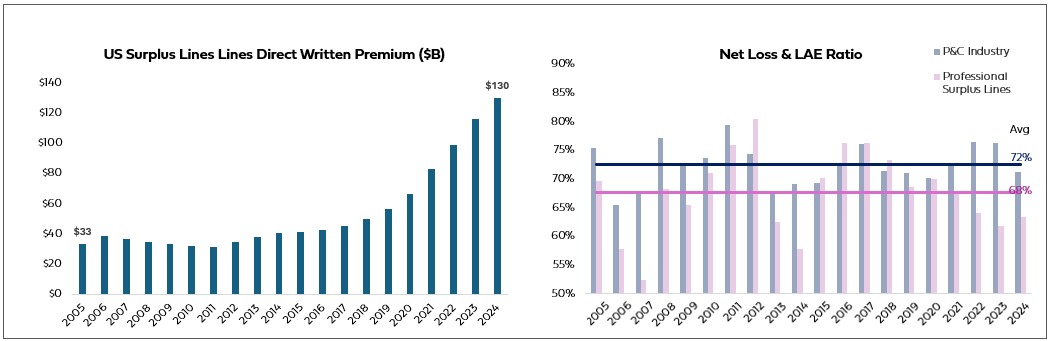

The MGA boom will continue

As reinsurers look for more opportunities to deploy capital, MGAs will offer them the fastest opportunity to do so. Underwriters focused on traditionally high-loss categories and E&S will continue to be appealing, because of the opportunity for tech leverage and because there is generally less competition in those segments. As shown in the charts below, surplus lines have grown fourfold over the past twenty years, and in some lines have outperformed the broader admitted P&C market on losses.

Interestingly, Gallagher Re’s report noted that alternative capital in “long-tail lines” (i.e., the riskiest and toughest to insure) “has roughly doubled” over the past year. This means capital is rushing towards areas like catastrophe-exposed property (where rates fell by 10-20% on Jan 1, and where 2025 losses actually fell despite the LA fires). The same categories that reinsurers did not want to touch two years ago are now growing the fastest. I expect to see more capital go to specialty underwriters and MGAs with a track record in these categories.

Carriers will seek new ways to differentiate

Admitted insurance coverage tends to be fairly commoditized. But in an increasingly competitive market characterized by falling rates, insurers will want to avoid a race to the bottom on pricing. Insureds and brokers will increasingly demand user experiences and products that meet their needs. This might look like more personalization of coverage, faster claims experiences, new embedded parametric offerings, and broader proactive risk management services. While these bells and whistles are unlikely to command a premium from most buyers, they may help carriers and MGAs attract customers and differentiate their brands at the margin. Personal lines insurers might also aim to achieve this through advertising and brand-building – Progressive, for example, massively ramped ad spend in 2024-2025 (their Q1 2025 spend was 86% higher vs. Q1 2024). Marketing growth will decelerate (since it already recovered) and incremental dollars will likely have diminishing returns, but total spend is likely to remain high.

Growth, but with more precision

Carriers are still hungry for growth with rates still generally attractive/adequate, but underwriting margins are expected to narrow. It is becoming incrementally more difficult to acquire new business compared to 12-18 months ago. To compensate, carriers need to more thoughtfully optimize their business mix and growth strategy. Instead of an indiscriminate land grab, they will target the customers with whom they have a right to win with more precision. There is evidence that they have already started to do so. In Progressive’s November earnings call, when asked about the decelerating rate of growth and the increase in competition across the market, CEO Tricia Griffith replied, “This is when the fun starts.” She then detailed the company’s strategy to implement more robust segmentation and bundling/cross-sell to fuel growth now that rate increases have moderated. Similarly, Chubb’s Evan Greenberg made comments last quarter about “discipline” in underwriting and vowed not to “chase” reinsurance opportunities or resort to a “gut feeling” in segments where they don’t see adequate rates.

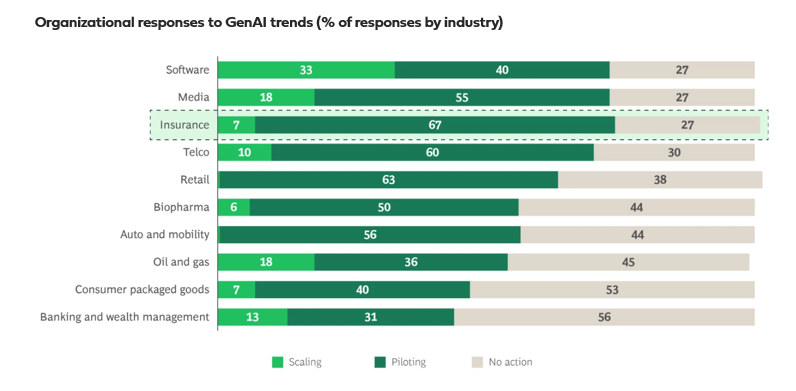

Operational Excellence > Balance Sheet

Insurance is fundamentally a finance business: access to a balance sheet or capacity drives the ability to write and scale policies profitably. But at a moment when there is excess (and increasing) capital flowing into the industry, an outsized share of competitive advantages will derive from operational effectiveness rather than from access to capital. Automation and the infrastructure transformation that underpins it are becoming even more important as new underwriters enter the market and rates face pressure. A survey by BCG (shown below) suggests that the insurance industry is already ahead of the curve in “piloting” GenAI compared to other non-technology industries.

As a result, vertical AI is rapidly proliferating across underwriting and claims - a trend I believe will continue, and that I remain excited about. But piloting is not enough; you can see in the same chart above that insurance lags in scaling AI initiatives. As competition intensifies, the biggest winners will be those who invest in infrastructure and processes to enable and scale innovation most effectively. The urgency of automation and transformation was already true independent of the softening market, but I believe the rate cycle will further catalyze and accelerate innovation in the months to come.

If you are building something new in insurance or want to talk more about any of the themes discussed above, please reach out to adam@equal.vc.

And for insurance industry executives, operators, and investors: Equal is excited to launch the 2026 Insurance Capital Summit this spring in NYC. More information to come in several weeks, but for now, if you’re interested in speaking roles at the summit, you may submit your information here.