The case for the baby and the bathwater amidst “SaaSpocalypse”?

Follow the conversation on X and LinkedIn

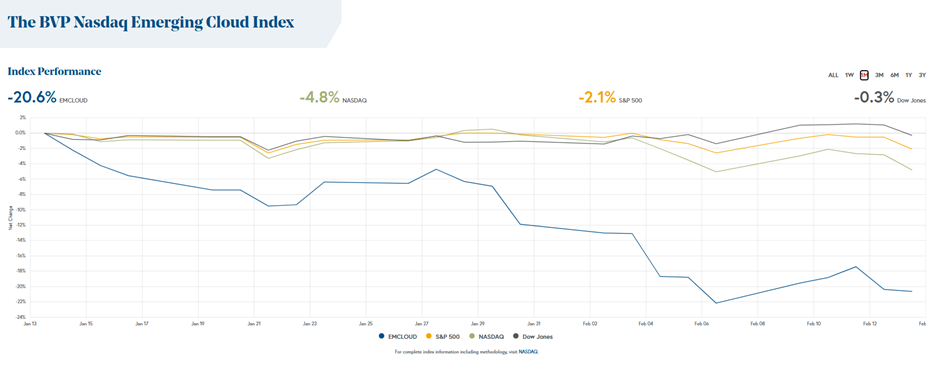

Let’s call it how it is…it’s been a tough month for SaaS believers.

While I’ve never claimed to be a “SaaS” investor, I find the latest drawdown (20% in the last month alone) to be fascinating. What started as a globalized meltdown of the sector based on fear of AI disruption is now morphing into a far more subtle debate as the true merits of these companies.

Truthfully, these were the debates investors should have always been having on these type of companies. As we highlighted in our piece “Death to Revenue Multiples – Long live the DCF”, revenue multiples were always a terrible way to value software companies because each company is built and scales differently. Software companies typically had high barriers to entry (large build and distribution costs) that impeded competition and gave further advantage to scaled incumbents (If it takes each company $5m to launch a new product, but the scaled company has 1) a built in distribution network and 2) lower cost of capital, then they have clear competitive advantage over a startup). This enabled virtually EVERY startup company of scale to generate meaningful profits. Then times changed.

Over the last few years, we started to see the cost of developing and distributing software products come down dramatically, along with an acceleration of capital that significantly broke down those barriers to entry. The result was that a lot of companies grew very quickly, but this was primarily driven by a value transfer of once profitable incumbents (who were now being valued by a function of EBITDA / DCF) to startups (who were valued based on revenue multiples, indiscriminate of the underlying economics of these companies. While I’m most traditionally a seed-stage investor, looking at the financial statements of later stage companies would break my brain. Companies were spending endless dollars on “R&D” which was really just to maintain product parity with the market. The same went for promotional discounts, customer success and other items that made it clear that if the spending ever stopped, that these companies would churn customers and become irrelevant. The terminal value of these companies is truthfully “ZERO”…there was zero chance for them to ever achieve FCF profitability. Nonetheless, the broader market would value them on a growth-adjusted revenue multiple and investors were happy to fund the tab.

Now, AI has put this dynamic on steroids. The costs of developing and distributing software products has collapsed more in the last 12 months than it has in the last 12 years. This is what scares SaaS investors, as the cost of maintaining revenue growth for standard SaaS companies is skyrocketing. Folks are questioning who is going to flip the bill to maintain customer and market parity (let alone growth) and realize that there is an existential threat to the survivability of these companies. SaaS was just another “product” and like any other consumable, could be easily copied, produced cheaper and its momentary profits seized. Truth be told, many of these companies could (and undoubtedly) will, go to ZERO.

The reality, however, is that not all revenue is created equal. Amidst the landscape of SaaS slop, there are great companies. Ones that maintain durability via competitive advantage (or what we refer to as “Capabilities” and are actually being accelerated by AI.

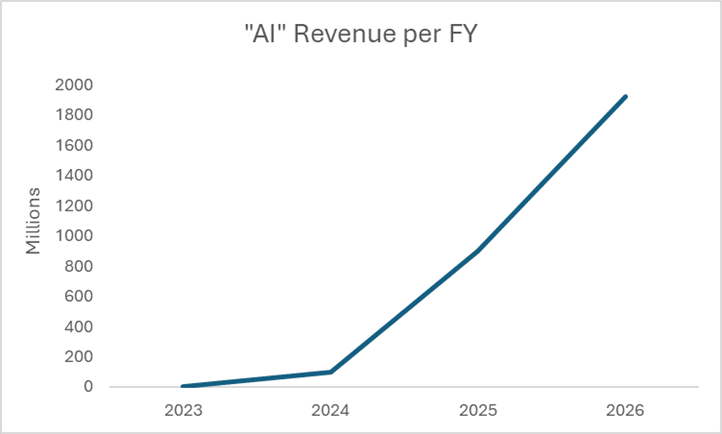

Take a look at the chart below. This is the estimated “AI” revenues for a company that I’m personally invested in. Zero to nearly $2b in 3 years, not bad. What value would be put on an AI business that went from zero to $2b in 3 years when we see the best firms in the valley giving $500-$1b valuations for startups with $1m of ARR? AI is only part of the business for the company, but the overall business is demonstrating nearly 40% EPS growth (yes, its profitable), yet only trades at 4x sales, 14x EBITDA and 14x forward PE.

Most of you have probably figured this out already, but the company below is Salesforce (who I believe will be a huge beneficiary from AI) and is trading at a market cap of ~$175b despite over $40b of trailing twelve month (TTM) revenues. Salesforce is a great example of “the baby being thrown out with the bathwater”, as great companies are being beaten down indiscriminately from the bad ones amidst the SaaSpocalypse.

As you look across the SaaS landscape, there are known pockets of resilience. Companies that have built in developer platforms, cross customer network effects and/or maintain the system of record for their clients and the industry. We don’t view these companies as “products”, we view them as “platforms”, given the inherent flywheels in their business / product that enable compounding competitive advantage. These companies may (and often do) yield a low NPS score, but they are amongst the highest retention companies in existence. That’s not a sign of weakness, but rather of strength. Despite the countless startups that have attempted to take them down, nothing has stopped these companies and AI is likely an accelerant to the existing advantages of these companies by enabling them to rapidly develop, launch and distribute new features and customer experiences that they previously couldn’t…all at a fraction of the cost of what it would have previously cost them and a fraction of the cost of what it would cost upstarts to achieve parity.

In 2024, we dove into this dynamic and allotted each of the companies in Bessemer’s Cloud Index to “Product” or Platform”. What we found is that Platform companies demonstrated superior operating margins, FCF yield and Rule of 40. They tended to grow a bit slower, but they were superior businesses, yielding higher multiples. To my surprise, when we reexamined the revenue multiples of these companies to their SaaS peers, their multiples came down as much or more (see below). Many of the SaaS companies had made significant efforts to improve their efficiency metrics (Rule of 40 improved from 43% to 50% for our comp set over that time period), but that still dwarfed in comparison to the nearly 70% demonstrated by our platform bucket. Despite these sets of companies operating remarkably differently with entirely opposing positioning in today’s AI-fueled market, the entire basket was indiscriminately treated with a large draw down.

All this is to say that this “SaaSpocalypse” is temporary. To paraphrase Benjamin Graham, ‘The market is often wrong in the short-term, but always right in the long-term”. The destruction (or at very least, devaluation) of “product” SaaS companies is an inevitable and truth be told, I still think they are criminally over-valued. Many of these companies will die. The product platforms, however, will likely experience a very different fate and today’s lows may represent a generational buying opportunity.

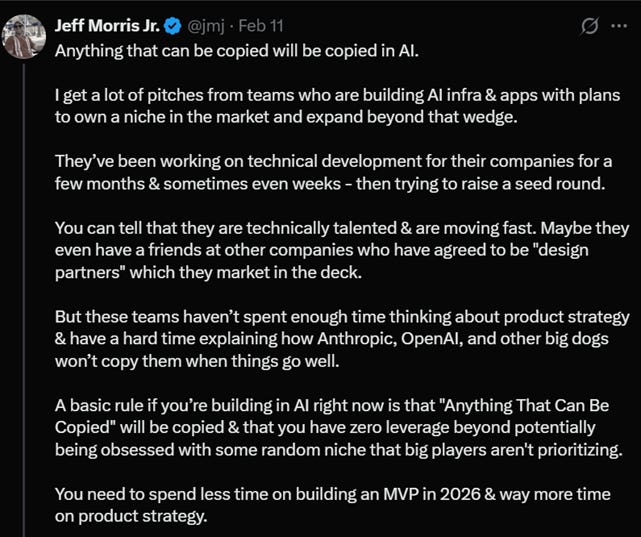

As a founder, you need to be architecting your company as a platform from Day Zero, embedding the aspects of compounding competitive advantage into your product from the start. This tweet from my friend Jeff Morris Jr. sums it up well…”you need to spend less time on building an MVP in 2026 & way more time on product strategy”. As an investor, this is even more emphatically true…nothing is worse than investing in a road to nowhere and companies that are living on product pull without a defensible strategy are likely doomed to failure.

In the age of AI, build platforms, not products. Otherwise, you might as well be investing your time and money into dirty bathwater.