The Equal Ventures Insurance Index

Q1 2025

The Equal Ventures Insurance Index is a quarterly summary of market activity in the P&C insurance sector. We look at segments of relevant public equities to highlight key themes and draw insights about trends underlying market performance. This post summarizes our indices in Q1 2025. As always, our goal is to help support observers of the insurance industry in identifying key drivers and catalysts (and never to recommend any specific investments).

Q1 was volatile and disappointing for US equities (though only a taste of what we’ve seen over these first three weeks of Q2). Despite the shockingly terrible LA wildfires in January (and the resulting tens of billions in insured losses), the insurance industry significantly outperformed the broader market last quarter. Legacy companies benefitted from strong profitability and a generally defensive orientation amid macro headwinds, and insurtechs continued to demonstrate operating improvements.

Q1 2025 Summary & Highlights:

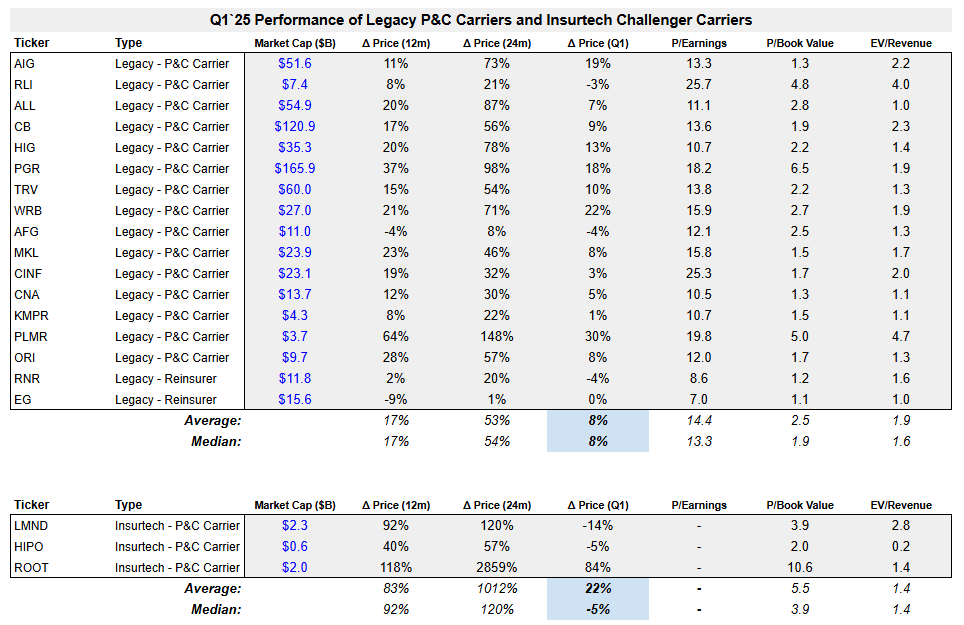

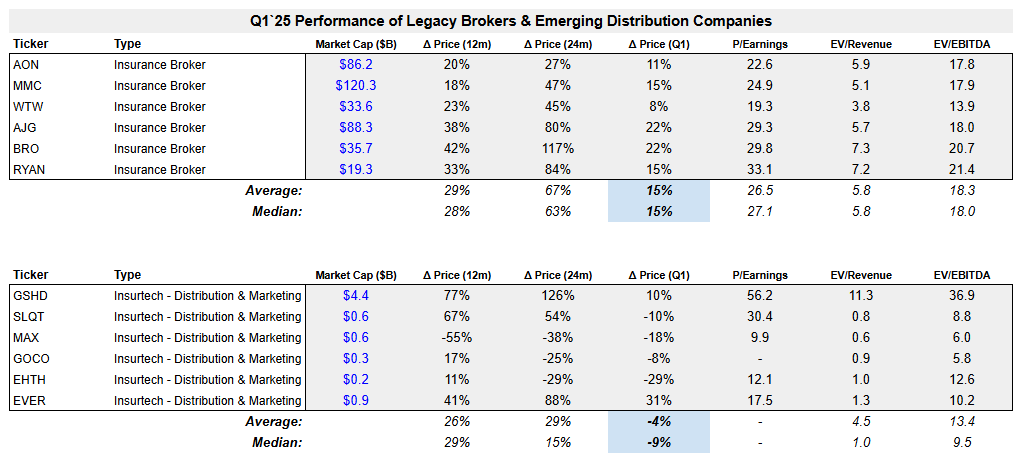

Our legacy indices performed well in a defensive market. Every broker in our index was up, with a median move of 15%, while carriers increased by 8%. This compares to the SPX Index down ~5% over the same period.

Legacy company multiples pushed higher: broker PE ratios rose 3 points q/q, and carrier P/BV increased by an average of ~10%.

Insurtech stock performance was more mixed over the quarter, but the group continues to demonstrate stronger operations and margin expansion. At risk of sounding like a broken record: ROOT was (again) up >80% in Q1.

As we started to see increased volatility in equities and caution on macro in Q1, the insurance industry outperformed the market.

We entered 2025 at a favorable point in the insurance rate cycle following multiple quarters of combined ratio improvements and with solid expectations for P&C industry ROE. While rate growth was set to decelerate in 2025 (compared to a robust 2024), the context coming into January was largely healthy. You can see this reflected throughout Q1 in generally strong carrier/broker performance across Q4 earnings announcements. Strong industry fundamentals is also reflected in accelerating industry spend on growth: EVER (+31%), a P&C marketplace, jumped in February after announcing 74% y/y revenue growth in their 4Q24 report.

Amid that backdrop of healthy combined ratios and growth, we saw (continued) operating improvements at leading P&C insurtechs. When I started writing this quarterly two years ago, virtually that entire post was a reflection on the upside down combined ratios at insurtechs. After a solid year and a half of consistent improvements it is hardly news, but insurtechs continued to announce impressive progress last quarter.

ROOT (+84%) announced in its Q4 results in February that GWP increased 18% y/y with an additional 4 points of loss ratio improvement. Over two years, the company more than doubled GWP, shaved 20 points off loss ratios, and took the business from gross profit negative to net income positive. This is the same company that for a while two years ago had negative EV. LMND (-14%) is not quite as far along and got dinged for its low 2025 guidance, but still reported a 90% y/y increase in gross profit, a sixth consecutive quarter of loss ratio improvement, and a narrowing adj EBITDA loss.

Munich Re’s acquisition of Next may also demonstrate the budding confidence and excitement in digital carriers. Though off its 2021 valuation, $2.6b is well in excess of the capital raised, and the company announced it did >$500m in 2024 revenue. With insurtech fundamentals improving, big exits being announced, and growing excitement around the impact of vertical AI, it’s no wonder we’re starting to hear rumors that the Insurtech Spring is here. I believe it is.

No discussion of Q1 2025 can gloss over the impact of the LA wildfires. Carriers incurred tens of billions in losses, but ultimately the one-time nature of those cat losses didn’t hit most of the stock prices in our index very much. S&P’s larger P&C index fell roughly 3.5% at the onset of the fires, but recovered within about a week. Reinsurers underperformed, but still landed roughly flat. Even if the impact on equities was more subdued, the fires clearly got investors, carriers, and policymakers talking about the impact of climate risks on homeowners insurance and on asset values more broadly. Allianz’s CEO, for example, recently said that the climate crisis “threatens the financial sector,” and meanwhile carriers continue to walk away from the CA market. The urgency of resiliency is a theme that is certainly not going away, regardless of the muted impact on stock performance last quarter. We are likely to continue learning more about the extent of cat losses and changes to reserves as Q1 earnings reports land over the coming weeks.

Claims inflation (both from pending tariffs and from ongoing social inflation across casualty lines) continues to pose risks to the industry. TRV (+10%) reported its Q1 earnings report today as I am writing this post, and touched directly on these topics. In their conference call, when asked by an analyst if social inflation was starting to “stabilize,” the CEO replied that “social inflation is unfortunately alive and well.” Perhaps it is related that the company recently announced they will cede more casualty risk to reinsurance. Growth in net written premiums trailed gross written premiums by roughly 4 points as a result, and the GL (casualty) segment grew much more slowly than commercial property or multiperil —all potentially consistent with carriers seeking to reduce casualty risks at the margin.

There is so much uncertainty around tariffs it is hard predict what their impact may be, though higher prices likely translate to higher claims. As detailed in this recent note from PWC, broad tariffs could have a substantial impact on carrier reserves and losses. The commentary in the same TRV call referenced above already pointed to higher anticipated personal lines and auto losses in the back half of the year. Since carrier rate changes will lag macro (and since macro is likely to be volatile), this might portend well for E&S carriers (who maintain more pricing and underwriting agility compared to admitted carriers) and their brokers if loss ratios do rise.

The insurance industry materially outperformed the market in Q1, and investors have a lot to be excited between insurtechs demonstrating their ongoing turnaround and healthy legacy industry operating performance. Cat losses, macro uncertainty, and the possibility of tariff-driven inflation could all impact underwriting profitability, reserves, and premium growth over the coming quarters. It’s way too early to predict what’s ahead, but we’ll be paying close attention to company commentary during earnings season.

**We’ll be talking about these trends and others at the Insurance Capital Summit on May 8th. The summit brings together executive leaders from across carriers, brokers, insurtechs, and private equity firms. Apply here for your (free!) ticket ASAP before registration closes.**