The Point of No Return? A New Model for Reverse Logistics

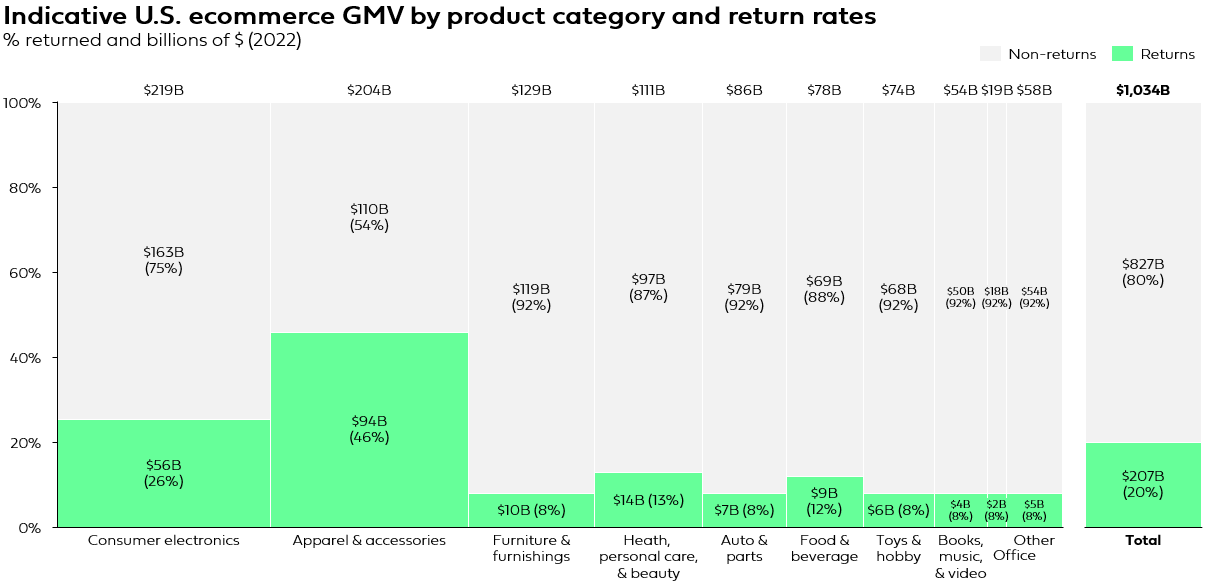

Free and seamless returns have long been cited as a critical part of the ecommerce customer experience. Over the past few years, as retailers and brands made ecommerce returns increasingly effortless, consumers bought more stuff online and, because returns were getting easier, returned more stuff! A vicious, unstainable cycle of returns proliferation had started and COVID made things even worse. ~40% of retailers further relaxed their return policies in order to incentivize purchases - the value of all retail merchandise returned in 2021 reached $761B with return rates of ~20% for ecommerce, vs. 15% for non-ecommerce sales. The story is even worse when we zoom into different product categories.

The two biggest categories within ecommerce, apparel and electronics, make up ~40% of overall ecommerce sales and have by far the worst return rates - almost 50% of U.S. consumers have returned an item within apparel within the last 12 months. As Tony Sciarrotta, executive director of The Reverse Logistics Association said in an interview to Retail Dive, “The bedroom is now our dressing room, or the living room is now our dressing room for products we buy, clothing especially.” The analysis below suggests that almost $100B of GMV in apparel ALONE is likely to be returned in 2022.

Some retailers are starting to fight back - for example, Zara in European markets is now charging for ecommerce returns to third party locations. In-store returns remain free given that consumers often make net new purchases through brick & mortar visits, unsurprisingly a channel with significantly lower return rates. A few other major retailers such as J. Crew, Abercrombie & Fitch, American Eagle, have enabled some form of “restocking” fee for mail-back ecommerce returns but for emerging brands that do not have a B&M channel, charging for returns is likely a non-starter as they battle already low conversion rates and high CACs. As we’ve discussed previously, we remain firm believers in the power of omnichannel strategies. Leap, a retail-as-a-service platform (and Equal portfolio company), is helping both digitally native and omnichannel brands expand their brick & mortar. In addition to enabling brands to grow through an economically sustainable channel, Leap also makes cross-channel returns accessible to sub-scale brands.

The True Cost of Logistics

The logistics costs associated with increasing returns are well reported and readily apparent: shipping costs associated with getting products back to warehouses, processing costs of evaluating and grading returns, and even costs of disposition into discount / liquidation channels. Pitney Bowes reported that online returns can cost retailers on average 21% of order value, devastating given that ecommerce margins benchmark at 10%. However, and perhaps more critically, the returns process, especially a long returns process, locks up valuable inventory, the lifeblood of any retail business. Any inventory not available for immediate purchase, whether that’s sitting at a consumer’s house waiting to be returned or at a 3PL waiting to be processed is dead inventory.

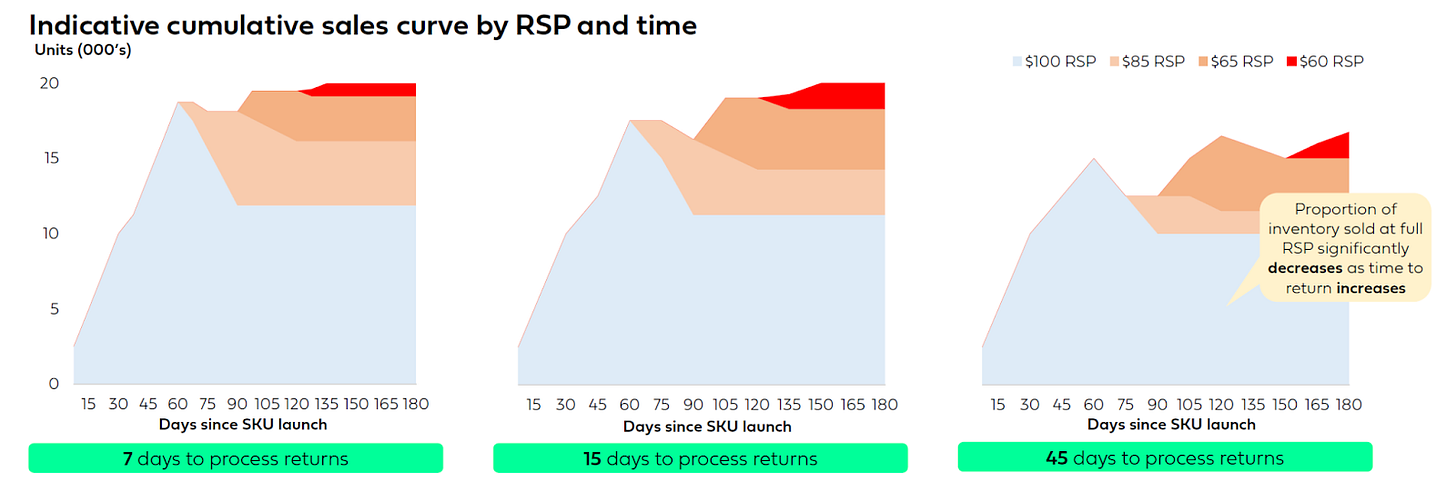

Continuing Mr. Sciarrotta’s analogy, consumers are now treating the bedroom as the new dressing room, e.g., making purchases with the intention to try, not buy. However, unlike the dressing room, where rejected SKUs, whether it be for size, fit, color, style, or just plain consumer whimsy, can be returned to the retail floor almost immediately, rejected SKUs sold through the ecommerce chanel can take weeks, if not months, to get back “on shelves.” For ecommerce sales, “on shelves” requires consumers to mail back the product, parcel carriers to deliver, the 3PL to evaluate and process, for a SKU to be ready to be sold again.

In this era of steep discounts, that lost time off “shelves” is a massive problem for brands. Retail margins decline precipitously over time along the discount curve, not even including the aforementioned logistics costs associated with returns. As the graphics below show, the longer return times results in more discounting and higher return rates and steeper discounting curves exacerbate this dynamic. It’s no surprise that Asos, a major fast fashion retailer with persistent discounting, noted in their last earnings statement that “elevated returns are expected to drive higher levels of markdown and a continuation in the negative impact of returns on product mix.” If not already clear, returns have long been a massive problem for BOTH the top and bottom line. As early as 2018, Revolve spent $531M on returns after accounting for processing costs AND lost sales, but only put up $499M in topline sales as reported by Vogue Business.

Not only do returns erode profitability to the brand, but also to the 3PL, with most of our 3PL network informing us that they lose money on single parcel returns. In addition, there is a startling lack of clear data sources associated - most brands have no visibility into processing status, with only the most sophisticated of 3PLs able to offer a differentiated degree of returns sophistication.

The Returns Decision at time t

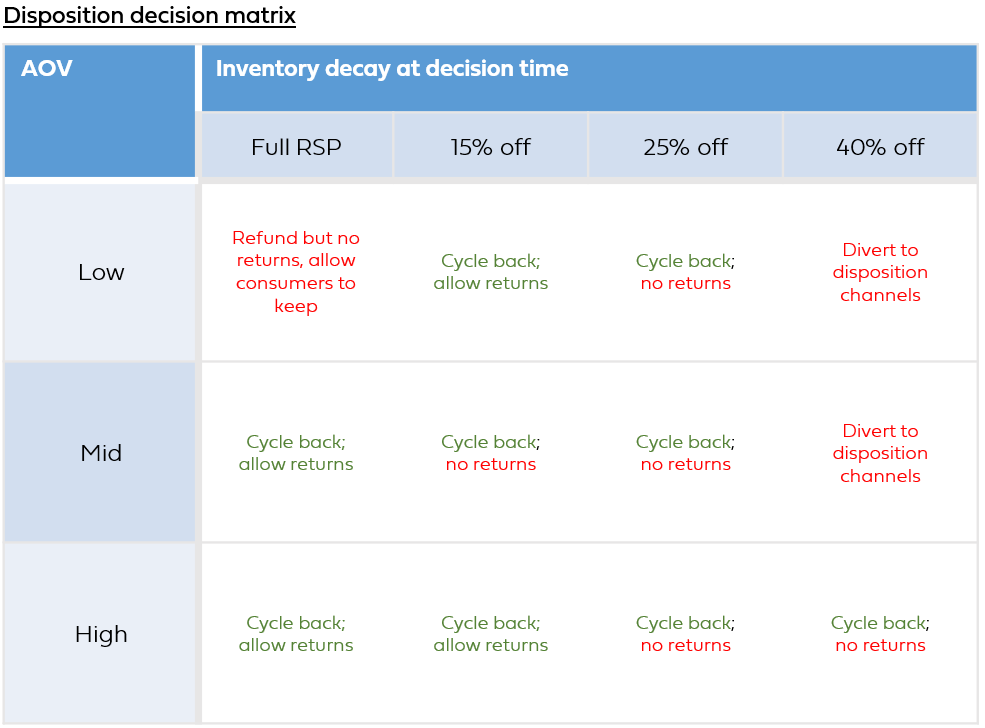

At its core, the returns decision is a math equation. Sophisticated retailers like Amazon, Walmart, and Target now will issue refunds and simply let consumers keep low AOV SKUs because they know the return costs outweigh the potential value of that item being sold again. Shein, the master of dirt cheap fast fashion, employs a similar strategy. At any specific moment in time, depending on where a product is in the discount curve (which is a function of “Days since SKU launch”) and the cost structure of a particular brand’s return infrastructure, there is a profit-maximizing decision. While the status quo is for brands to return items to their warehouse, we’ve found that other disposition options may indeed be more economical.

Unfortunately in practice, only a select number of retailers and brands have the ability to both assess the economic impact of returns in real time and execute on their disposition decisions in a timely fashion. Disposition economics decline rapidly with delays due to the retail discount curve, i.e., a brand can make significantly more through the same liquidation channel IF they are able to funnel their inventory there faster. Most brands lack the data infrastructure and scale required to make returns less costly and few have the brand equity to push the cost of returns onto the consumer. Traditional liquidation channels that can help dispose of inventory without cannibalizing premium customers include off-price retailers like TJ Maxx, but this still requires returning orders to a centralized location. Legacy reverse logistics providers can accept returns directly, but generally offer limited visibility into what disposition value and/or brand protection will be for those items.

Ghost, an Equal portfolio company, fills this gap by offering a liquidation marketplace for excess inventory that provides 1) real-time visibility into disposition value, 2) maximized disposition value across buyers and 3) brand protection to avoid cannibalization of premium customers. Ghost ultimately doesn’t accept returns due to a lack of data fidelity with returned inventory today. To unlock the value of returns, brands will need to bring the data necessary to determine disposition value, the scale to drive down processing costs and the diversity of disposition channels (to maximize value) to unlock returns, but unfortunately this simply doesn’t exist for any but the largest brands and retailers.

The Power of Scale

Major retailers like Amazon, Nike, and Walmart already have processing centers dedicated to returns. These players have mastered the process of determining value, lowering processing cost and disposing products through the appropriate channels to maximize profitability. We see the same opportunity to extend this capability to all brands, democratizing profitable returns management. Our personal belief is that this challenge isn’t solved by software alone. Each of the companies above is equally masterful (perhaps more so) in logistics as they are in technology. Returns is a bits AND atoms problem - requiring the data, scale and efficiency to solve.

We at Equal Ventures believe there is a massive opportunity in fundamentally rethinking the reverse logistics infrastructure to better enable today’s brands. If you are, or know anyone, building in the space, we would love to chat (chelsea@equal.vc)!

*Read more on Twitter here

**Read this on Medium here