"Why Now?" and Why It Matters

The attention span of today’s investor is incredibly finite. It seems that every other week a new sector is razor “hot,” leading to a spree of founding companies in the category and an equally rampant sprint of investors going after those companies. For better or worse, our little firm is likely to get priced out of these categories if a category and team are consensus “hot,” so our only real choice is to ignore the noise of “heat” and focus on categories we are going to love over the next twenty years.

Thus far, I think we’ve been pretty solid at picking categories that ultimately became hot (but hell, its 2021, everyone looks like John Doerr, right?), but that’s not our intention — it’s to focus on what will create enduring value as it transforms a category over the next decades, not what is likely to raise a FOMO driven Series A.

With that, we tend to think a lot less about “what is hot?” and a lot more about “why now?”. One of the core questions in our investment process is “what catalysts create a why now for this company?” Other investors have cited the importance of “why now?”, but I thought it was important to establish why this matters so much for us.

Catalysts represent the opportunity to impact “system design.” Many of the industries we invest in operate like systems and, by and large, inefficient ones. They are held back by technological barriers, misalignment of incentives and operational inefficiencies — that’s why we love them, there is so much room for improvement across these multi-trillion dollar markets. Often we ask, “why does this part of an industry operate so ineffectively?” We’ve all seen something that just doesn’t make sense in plain sight. In most of those cases, there is a real reason why — it’s not that the industry accepts it out of carelessness, but that it’s simply not realistically plausible to solve at that point.

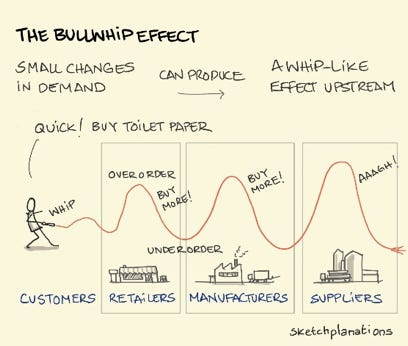

The thing about systems, however, is that small ripples in behavior can have tremendous impacts (some refer to this as the “bullwhip effect”). We’ve seen this for the last year in supply chain. A single ship getting stuck in a canal has led to billions of dollars of economic loss given the rigidness of the global supply chain system. Catalysts open the door to system re-design and with that, the potential for hundreds of billions of dollars to switch hands. We are seeing this in real-time with the advent of digital grocery (as a byproduct of Covid’s lockdown mandates), leading to tens of billions of dollars (and what we believe will be hundreds of billions of dollars) changing hands from brick and mortar grocers to new digital players. These catalysts create the “why now” for redesigning those systems. That’s not about attacking a category that is hot for the next 12 months, but rather redefining a category in a way that was never before possible over the next 20 years. That’s far more exciting to us.

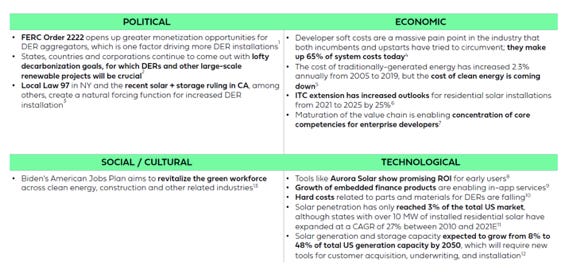

Identifying these catalysts before they are obvious isn’t easy and likely isn’t possible without a prepared mind. The research we do into our core sectors enables us to see these trends take hold earlier than others and that’s information asymmetry we use to invest/act upon. We use the PEST framework (Political, Economic, Social and Technological catalysts) to codify these trends, but these frameworks mean nothing without the nuanced knowledge of the industry behind it.

We’re in a world that is moving fast, but our team will continue to focus on the long-term. We’re looking to be in the companies that redefine their industries and transform the lives all those that industry touches. Sometimes those industries will be “hot” and other times they won’t. For years “cleantech” was the dirtiest word in the venture vocabulary, but we’re now seeing “climatetech” as hot as any category in the market. I’ve worked with energy companies dating back to 2005. We’re not excited about “climatetech” because it’s “hot” — we’re excited about it because we’ve seen system inefficiencies for multiple decades and NOW see the opportunity to re-design the system. Similarly, companies like Shopify weren’t fully appreciated until their categories accrued mainstream awareness. We’re here for the long game and see comparable opportunity across all of our core sectors. If you are a founder looking to build in any of those sectors, we look forward to hearing more about your “why now?” to redefine these systems regardless of whether it’s hot or not.

*Read this on Medium here

**Read more on Twitter here