Pairing Generalists & Specialists in Venture

Follow the discussion on x.com

You’ve probably heard the saying, “the whole is greater than the sum of its parts,” a concept often credited to Aristotle. The idea is that a well-coordinated team can achieve more collectively than the individual contributions of its members.

For us at Equal, this phrase shines light on our style of investing. Since inception, we’ve sought to be thesis-driven investors at the earliest stages, with the explicit intention of developing a prepared mind on market opportunities of interest, often in advance of meeting founders in the space.

The firm has staffed up and structured the team with that goal in mind. We have “Product Owners” who are specialists in a specific industry, with a dedicated investor covering each of our core verticals: Retail, Insurance, Supply Chain, and Climate. Our product owners are complimented with an equal number of generalists. Ali re-joined the firm in January, Sophia joined the firm last month, and Equal’s Managing Partner, Rick, has long embraced a multi-sector approach to investing.

Although we are still early under this new structure, we’ve found this system to be working well.

The Role of Generalists at Equal

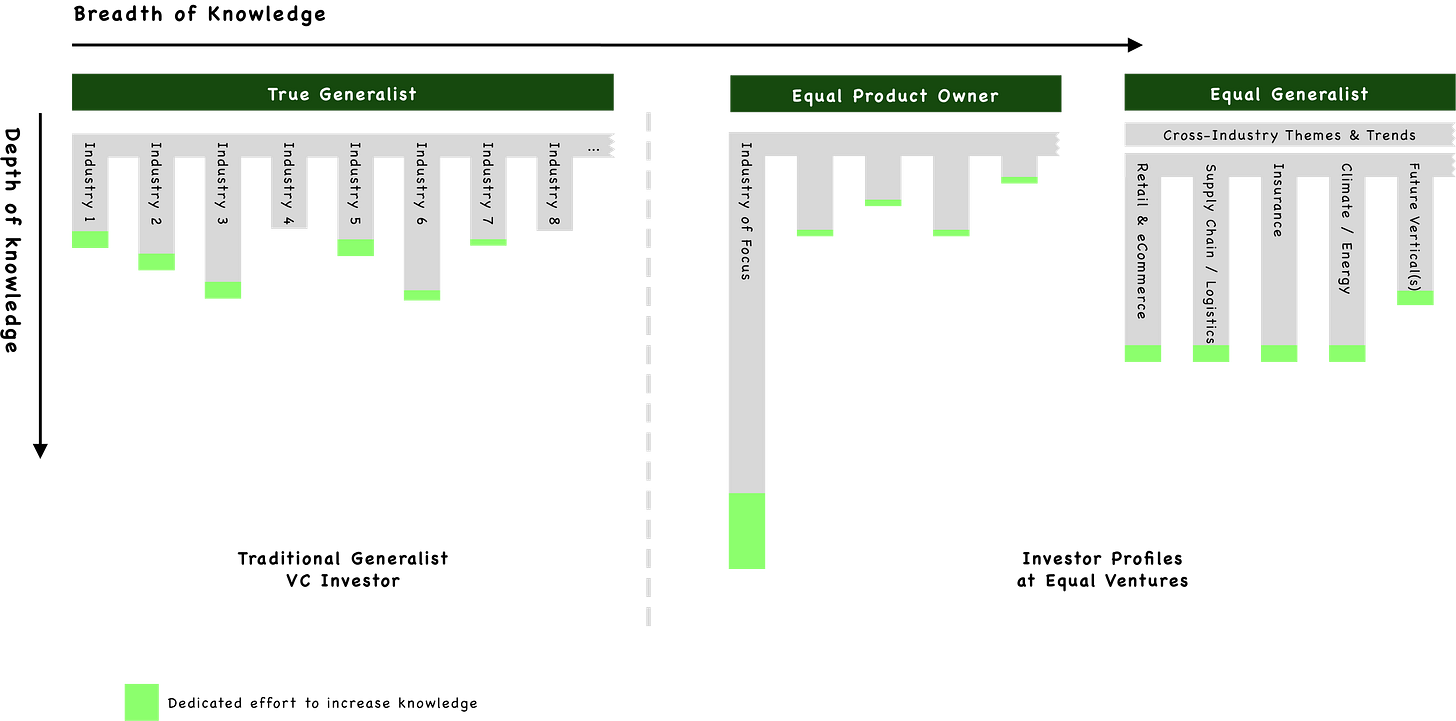

On the surface, the generalist role at Equal in many ways resembles a more ‘traditional’ approach to early-stage Venture.

Generalists play a multi-functional role that spans the full range of activities that an early-stage VC partakes in across investing, portfolio support, and operations.

Within the investing category, generalists source and lead deals across each of our verticals. While our specialists seek to compound their expertise through building industry-specific relationships (e.g. industry executives, industry specific PE firms, other thesis-driven VCs in that sector), generalists focus on building their own compounding network operator and investor relationships across all our sectors (e.g. top-tier startup operators and VCs at generalist firms).

These are not mutually exclusive - specialists and generalists often build relationships across the ecosystems - but we’ve seen this emphasis on networks across channels to be an effective way to ensure we’re increasing our coverage of opportunities.

Generalists are also intimately involved with our thesis development process – driving investment ideas, running research sprints to develop prepared minds in areas of interest, and exploring themes that are broadly prevalent across markets. We find that pairing a generalist with a specialist in this process acts as an effective sparring partner to address gaps or expand ideas.

From a sourcing perspective, a deal can come through and/or be led by anyone in the team. There is no “I” in “Equal” and we don’t care about attribution. We work together to make sure we get the right members of our team around the table to win, bringing a combination of specialists and generalists together into that process as early as possible.

This culminates in a collaborative process, with specialists and generalists teaming up on deals in motion to develop relationships with founders and analyzing opportunities. This allows our team to have informed and well-rounded perspectives when making final investment decisions.

Given the nature of how we invest at Equal - with almost all investments falling into one of our four core verticals - our generalists possess a deeper knowledge base than a ‘true generalist.’ Instead of boiling the ocean of opportunities, we also orient ourselves around our categories and ensure we understand enough in each of the markets to be dangerous.

Generalists and Specialists Working Together

At Equal, we view VC as a team sport. Pairing specialists and generalists creates a productive team that identifies the best opportunities and supports our founders.

Earlier this year, we introduced the 3 Hats Philosophy for staffing portfolio support. Every company now gets a GP, a specialist, and a generalist, offering a full suite of resources and support.

Specialists bring industry-specific context and expertise, while generalists offer insights and relationships from top operators and investors across industries. This combination ensures our portfolio companies get the best of both worlds: specific market knowledge and broad industry benchmarks and best practices.

Equal is a firm in evolution, and we’ll always be looking to sharpen our strategy. By teaming up specialists and generalists, our ambition is to unlock the full potential of our human capital to find opportunities others have not found and provide support to our portfolio companies in ways that others can’t. While breaking from the conventions of VC operating norms is never easy, we believe this blend of diverse perspectives and deep expertise compounds our learnings, and makes our whole greater than the sum of its parts.

Thanks for sharing this update. The combination of specialists and generalists is a unique approach that will offer both deep industry knowledge and broad perspectives. The 3 Hats Philosophy seems like a great way to provide well-rounded support to portfolio companies, leveraging diverse insights for a bigger impact. It's exciting to see Equal challenging the traditional norms and embracing new ways to find and support the best opportunities. Looking forward to seeing how this innovative model continues to evolve and make waves in the VC world!