The Equal Ventures Insurance Index

Q2 2025

Join the discussion on LinkedIn

The Equal Ventures Insurance Index is a quarterly summary of market performance and trends in the P&C insurance sector. Our indices include relevant public equities from insurance and insurtech, from which we draw insights about key themes underlying the market over the past quarter. This post summarizes the performance of our indicies in Q2 2025. As always, our goal in this post is to help support observers of the insurance industry in identifying trends and catalysts that affect the P&C industry (and never to recommend any specific investments).

Almost from the moment it began, Q2 was an incredibly volatile quarter for markets. It would therefore be a mistake to draw too many conclusions from index price action alone during a period of such large macro-driven price swings and sector rotations. Still, commentary from earnings reports throughout the last quarter pointed to softening property rates and more challenging commercial casualty risks, areas we’ve discussed in prior iterations of this report. Follow below for our takeaways from Q2 and 1H 2025.

Q2 2025 Index Summary & Highlights:

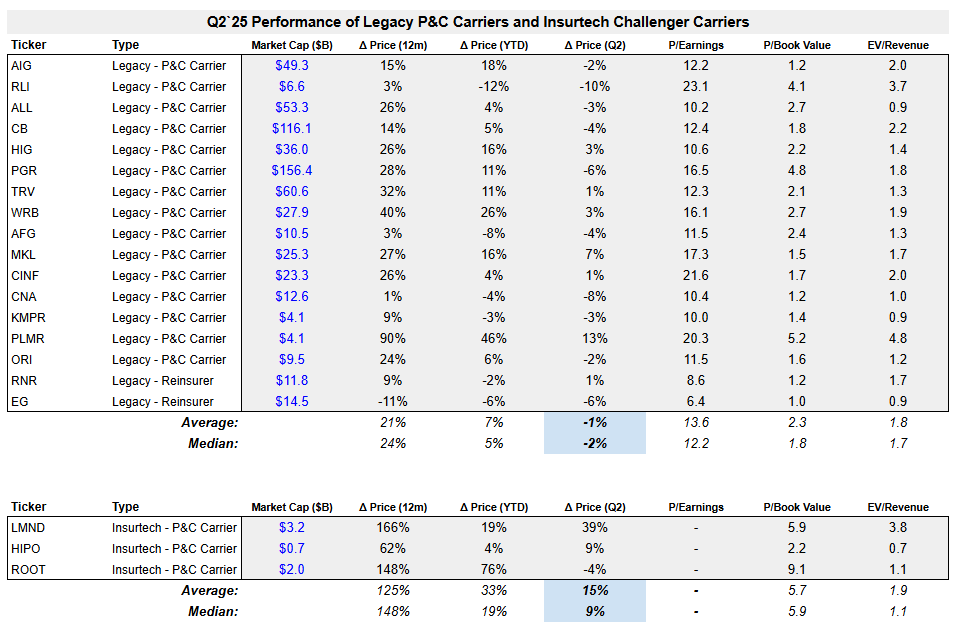

Legacy carriers closed out the quarter down small, underperforming the market (SPX +10%) amid subtantial volatility and following concerns about pricing/rate pressure. The median carrier index stock remains up ~5% through 1H, in-line with the S&P.

Insurtech carriers (once again) outperformed, this quarter led by strong growth at LMND.

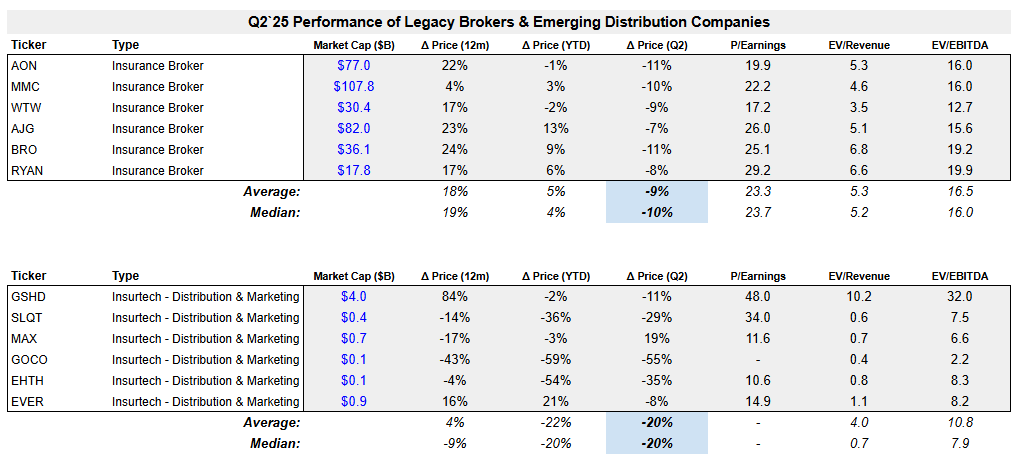

Brokers underperformed significantly, reversing their very strong price action from Q1. Our legacy carrier index fell by ~10% in Q2, and (like its legacy carrier counterpart) is now up roughly 5% YTD, in-line with the market.

Rate pressure and increasing competition was a key theme driving Q2 performance of P&C stocks in Q2. The quarter started out with a tariff-driven meltdown and inflationary fears that could weigh on carrier results in 2H, which of course could drive carriers out of the market and drive rates higher over the medium term. But by the end of the quarter, as 1Q earnings results and other indicators hit, it became clear that downward pressures on rates was the key focus of investor attention.

While there are not yet great reads on rates throughought Q2, rates trended lower at an accelerated pace during Q1 (the results of which impacted carrier announcements and earnings that hit during Q2). Marsh’s Global Insurance Market Index shows that global P&C rates fell by ~3% during the quarter, led by the property segment which fell faster, by ~6%. This is not the first quarter of property softness (which began in 2024 and which is expected after a multiyear period of large rate increases), but it is nonetheless a very different tune vs. a few years ago when property was the leading contributor to the hard market. Looking at the current pricing trend, you almost wouldn’t think natural catastrophes dominated Q1 headlines. Per Gallagher Re’s Nat Cat Report, global insured losses from natural catastrophes hit $84B in 1H, the highest since 2011. After massive losses in Q1 from the LA wildfires, losses in Q2 moderated, and as new property markets and capacity continuing to hit the market, it was enough to keep rates moving lower. Combined ratios for Q1 were hugely elevated on the back of the Q1 losses, but these are generally normalized for nat-cat events and viewed as one-time events. For example: Chubb’s Q1 results announced in April showed a 13% increase in combined ratio driven by catastrophe losses, but the overall P&C combined ratio actually improved by ~1.5ppts y/y ex-nat cat, which also remained steady in their July quarter results (which were reported before this note, but after Q2 ended).

Despite the property-driven softness, there is a continued trend toward carriers taking rate in casualty lines — a trend we wrote about in this report last month. Casualty rates increased 4% Q/Q, a standout area of rate strength consistent with the prior quarter. As we wrote about last quarter, worsening casualty claims and concerns over increasingly frequent nuclear verdicts remain an acute area of concern for carriers (which we can see both from carrier commentary in financial reports, as well as more anecdotally in conversations with industry experts in our network. We believe increasing complexity and risk in casualty claims is driving interest in claims intelligence and efficiency solutions, some of which we highlighted in our recent landscape overview of AI in insurtech.

Moderating and falling rates clearly impacted our broker index throughout Q2 and was a contributor of the sector’s underperformance. Organic growth slowed in Q1 results at the largest brokerages, and rates (which directly impact commissions revenue) were a topic of executive/analyst discussions. Aon (which traded down in Q1 on EPS/margin miss), showed strong performance in growth and retention on commercial risks, but did also corroborate a broader story about pricing pressure. When asked on their April earnings call about pricing, the CEO spoke of a “buyer friendly” market, with “property rates softening,” and softness in financial lines and cyber, despite excess casualty and auto continuing to increase.

Rising competion in property, and emerging risks/opportunities in casualty segments, peppered commenary in recent earnings calls. Kinsale (not in our carrier index, but a leader in pure-play E&S underwriting) pointed to more competition in property in their April earnings report. Notably, their COO also predicted that the casualty segment is likely to see MGAs and capacity disappear or reduce appetite over coming quarters (which would likely continue or accelerate the trend on casualty pricing). Speaking on this trend, he said:

“No risk bearer is making money at 100% loss ratio, period. And while the front end companies themselves don’t bear those loss ratios because they’re seeding away the premium, someone is bearing those loss ratios. And that someone can’t keep doing that for long.”

We heard quite similar commentary on the casualty segment from Chubb. In their July earnings report (released earlier this week, afte the end of Q2) CEO Evan Greenberg referenced the “much more competitive” market for large account and E&S property business. And earlier on their April earnings call, Greenberg called out “naive” professional/financial lines underwriters at other companies who “have no idea what’s catching up to them” and reiterated that Chubb will not “just follow people off a cliff” in their pricing. The commentary at Chubb, like at Kinsale, points to more challenging casualty underwriting and the prospect of higher rates ahead.

Outside of rate pressure in property and carrier commentary on casualty risks, we also saw a continuation of themes we’ve written about previously throughout Q2:

Insurtech values trended higher

Once again, our insurtech carrier index moved higher, up 15% in 1H and outpacing the other indices. The performance in Q2 was driven by LMND — in its May earnings report, the company surpassed $1B in in-force premium and increased 2025 guidance for both earned premium and revenue. Revenue and Book Value multiples continue to increase in this segment, as the recovering insurtechs demonstrate consistent growth and improve proftability

More broker consolidation

Marshberry stats show that after a hot start to the year in Q1, brokerage M&A cooled in early Q2 when the market was dominated by macro volatility and uncertainty. But in June, we saw the announcement of the latest mega deal: Brown & Brown’s nearly $10B acquisition of Risk Strategies, a top ten private brokerage. As brokers look for economies of scale and enhanced specialty capabilities, the push for consolidation continues— a trend that contributed to our investment in the insurance agency platform Equal Parts, which we announced last quarter.

E&S demand remains robust

E&S accounts for a record ~10% of P&C DWP and continues to grow, though at a slower pace than when rates were increasing. In their May earnings call, Ryan Specialty’s CEO Tim Turner remained positive on E&S growth, and talked about a “secular shift” in how insurance capital is positioned. Despite a “challenging comp” and although they expect proprety rates to “remain competitive in the near term,” they continue to take share on submissions and expressed bullishness on E&S longer term. Turner also pointed to ongoing brokerage consolidation as a lever for more growth in the MGU and E&S segments as more agents are part of larger platforms. By and large, we agree with this assessment: the ongoing E&S supercycle reflects long-term structual changes to risk profiles and brokerage more than short term rate trends.

Many of the key drivers of performance in Q2 like softness in property rates worsening casualty losses look set to continue into the current quarter. And despite persistently low inflation, macro and tariff-driven uncertainty remains very much on the horizon and continues to pose risks to the industry. We’ll be watching the P&C sector closely over the coming months.

If you are building something new in P&C insurance or have strong perspectives on any of the themes/challenges discussed in this post, we’d love to hear from you! You can reach Adam via email at adam@equal.vc.